380 billion, is BYD worth it?

1. In the short term, the new energy auto market has rebounded, and the performance has exceeded expectations, driving BYD's share price to rise.

2. In the long run, diversified business and large room for growth make the capital particularly favor BYD.

3. Whether BYD can realize its potential in the future remains to be verified by the market.

Known as the "Golden Nine Silver Ten", the auto market finally handed in a beautiful report card in October.

On October 13, the National Riding Federation released the September automobile market data. In September, retail sales of the passenger car market reached 1.91 million units, achieving the highest growth rate in the past two years of about 8% for three consecutive months. What surprised the market even more is that the new energy auto market, which had previously slowed down to the overall auto market, finally ushered in a substantial recovery. In September, the wholesale sales of new energy passenger vehicles exceeded 125,000, a year-on-year increase of 99.6%.

The auto market is picking up, and the benefits brought by the development of sales exceeding expectations are emerging, especially in the new energy vehicle market. The rise of many stocks is a good proof of this view. Since October, the new energy sector has risen 3.4% overall, of which CATL has risen 11.5% and Guoxuan Hi-Tech has risen 14%.

As a leading company in domestic new energy vehicles, BYD's share price has been rising all the way. The latest stock price shows that as of the close of the stock market on October 26, BYD's stock price has risen to 139.96 yuan, and the market value has exceeded 380 billion yuan. Compared with the stock price of 47.63 yuan at the beginning of this year, the stock price has risen by more than 190%. Especially in the past two months, the stock price has risen significantly. .

Behind this, not only benefited from the promotion of the new energy vehicle policy, but also has a greater relationship with the market environment. New energy vehicle stocks surrounding Tesla are in an upward trend. Adding to the recent achievements of BYD in sales and performance, everything seems to be thriving. But at the same time, this also makes the outside world doubt whether BYD can support a market value of 380 billion yuan.

Yiou Auto believes that the capital market is optimistic about BYD, mainly due to its recent market performance and the deep logic of long-term development. Up to now, BYD has carried out a multi-domain business layout on its own track, and there is huge room for imagination in the future. From a long-term perspective, the capital market is still in high sentiment. If BYD can realize its potential and usher in a performance turning point, then the current market value is likely to be just the starting point.

01 Behind the continuous rise in stock prices

In December last year, the Ministry of Industry and Information Technology issued a plan pointed out that the sales of new energy vehicles will account for about 25% in 2025. According to the calculations of the Association, the compound growth rate from 2019 to 2025 will exceed 33% based on the 25% sales target. %, there is huge room for future development.

With the rise of the new energy vehicle market, BYD, as a leader in the industry, has naturally become the one popular in the capital market, which is also an important reason for its continuous growth in stock prices.

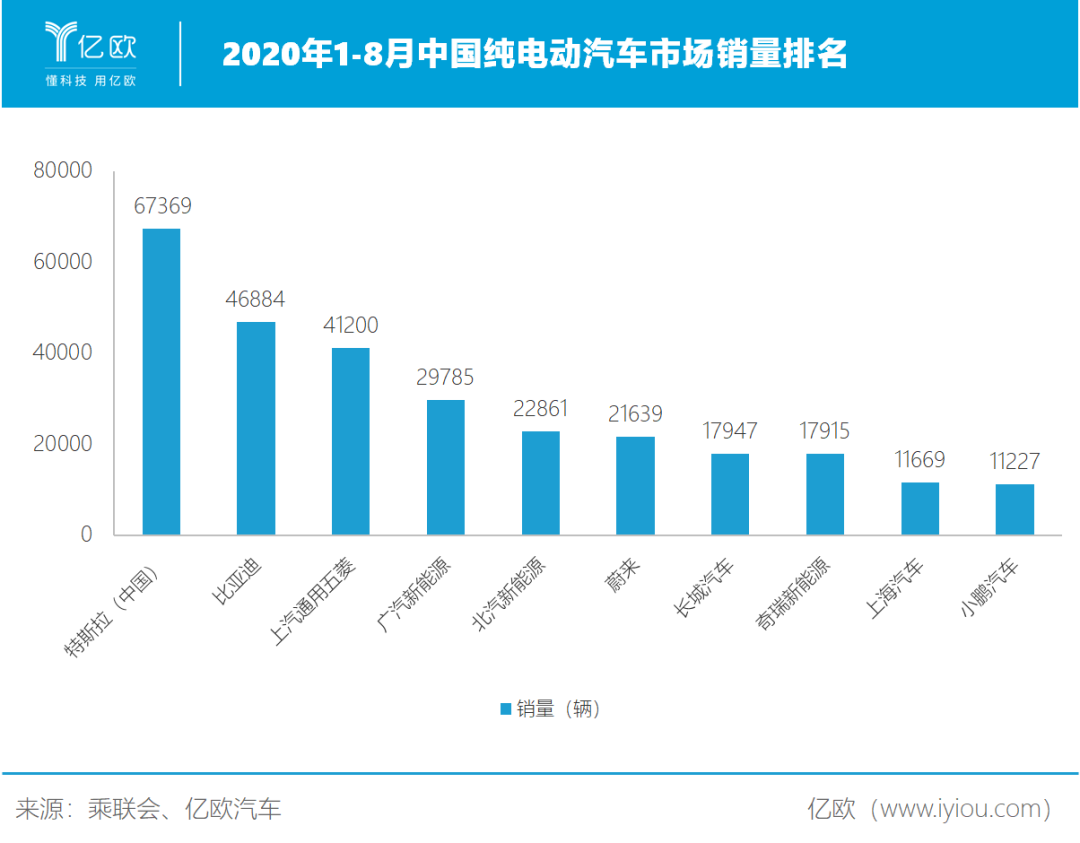

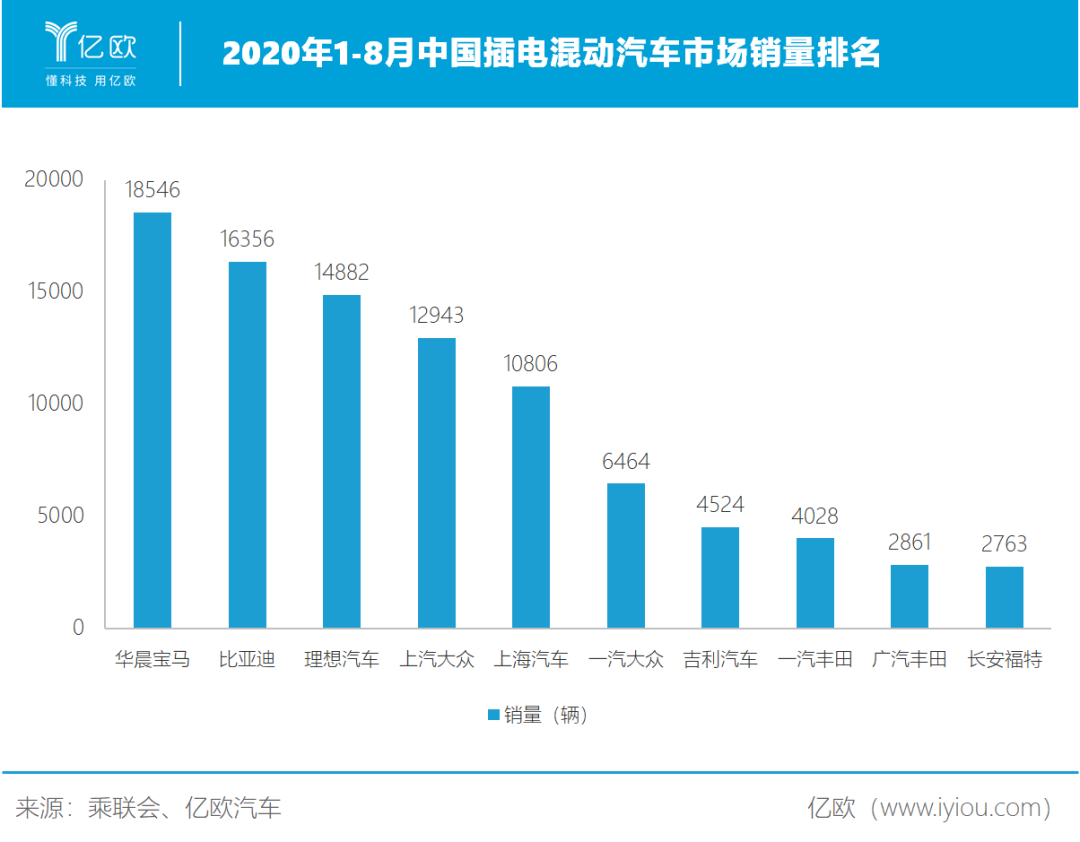

In terms of sales performance, since 2015, BYD has continuously completed four consecutive championships in the global new energy market, and it is second only to Tesla in the global sales market in 2019. Since the beginning of this year, according to the data from January-August of 2020, BYD ranks in the top two in both the pure electric market and the plug-in hybrid market, with a comprehensive market share of about 12%.

Watchmaker: Yiou Automobile Zheng Weixiong

Watchmaker: Yiou Automobile Zheng Weixiong

In terms of the development of the power battery business, BYD's blade battery has also further improved its imagination in the market.

According to data from the China Automobile Association, the national power battery sales in September were 6.9GWh, an increase of 18.6% year-on-year, of which the sales of ternary batteries were 3.5GWh, a year-on-year decrease of 17.5%; the sales of lithium iron phosphate batteries were 3.4GWh, a year-on-year increase of 121.1%. In other words, lithium iron phosphate batteries are basically evenly matched with ternary batteries, which has never happened in the past two years.

According to public information, the energy density of the blade battery developed by BYD has increased by more than 50%, which greatly improves the gap between lithium iron phosphate batteries and ternary lithium batteries in terms of endurance, while maintaining the safety and service life of lithium iron phosphate batteries. Long advantage. Today, the blade battery has been installed on BYD's flagship model "Han", and it is expected to be extended to the new Qin EV, Qin Pro EV and Song Plus in the future.

In terms of capacity expansion, BYD blade battery Verdi Chongqing plant will build 8 production lines by the end of this year to achieve the annual production capacity target of more than 20GWh. In this year and next, it plans to increase the capacity of 26Gwh blade battery to meet its own product switching. In addition, BYD plans to partially switch the original 30Gwh ternary lithium battery production capacity to blade batteries.

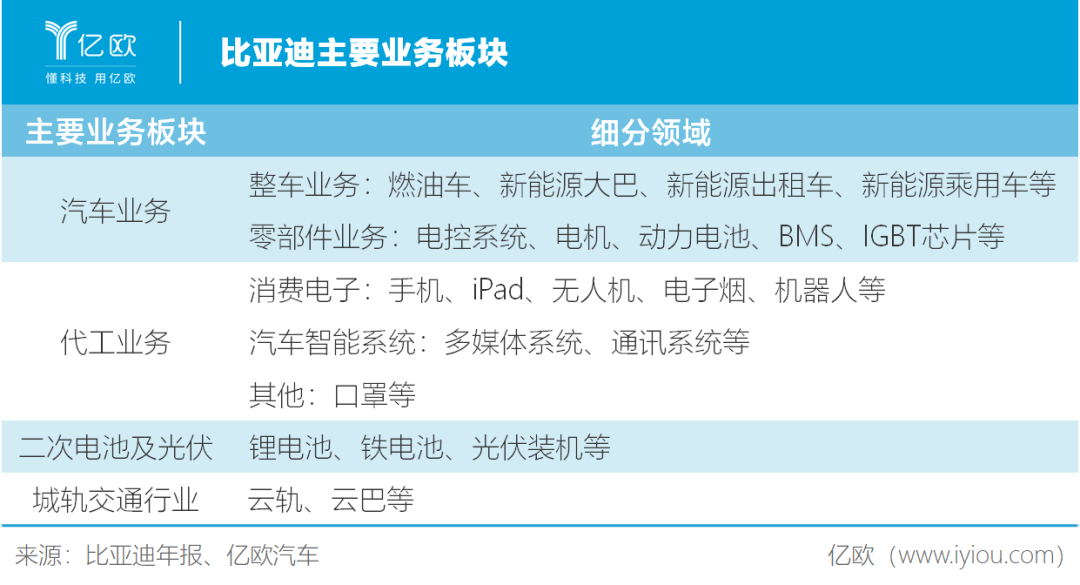

It is worth mentioning that in the automotive supply chain, BYD now has a complete "three-electric" manufacturing capacity (battery, motor, and electronic control). It is also the largest domestic manufacturer of automotive-grade IGBTs and the largest BMS manufacturer. The complete supply chain layout has strengthened BYD's cost control and risk response capabilities. In addition to the automotive business, BYD's foundry businesses such as consumer electronics manufacturing and mask processing have also been frequently released for some time in the past. They have maintained good growth during the epidemic.

02 380 billion, is it worth it?

Although a forward-looking layout has been carried out in the business, the imagination is huge, but the market value of 380 billion yuan still makes the industry believe that BYD is at risk of being overvalued. According to the current market value, BYD's market value has surpassed the combined market value of SAIC and GAC, and also surpassed the combined market value of the new car maker Weilai Enterprise and Ideal Auto , the new car maker whose share price has skyrocketed .

Such worries are not unreasonable. Obviously, compared with the traditional auto industry, BYD has not relied on the traditional auto business logic to increase the market value space. It has been included in the technology camp to gain the attention of the capital market. It can be seen from Tesla's strong valuation that it surpasses Toyota Group, which also opens the valuation ceiling of new energy car companies.

New car-making forces such as Weilai, Xiaopeng Motors, and Weimar Motors have been favored by the secondary market with the attribute of intelligent network connection, and the valuation of BYD, which is biased towards traditional car companies, obviously tells another story. As a leading company in the new energy automobile industry, BYD occupies a special position. It has a layout in the fields of complete vehicles, parts, consumer electronics, batteries and photovoltaics, and urban rail transit, which makes its imaginable space larger.

Watchmaker: Yiou Automobile Zheng Weixiong

But how big is this kind of imagination? Will also be marked with a big question mark.

From the perspective of its revenue composition, BYD's main business revenue in 2017 accounted for 54% of the automobile business, 38% of the mobile phone components and assembly business, and 8% of the secondary rechargeable battery and photovoltaic business. In 2018, the proportions of these three parts were 58.44%, 32.47%, and 6.88%, and the proportions in 2019 were 49.53%, 41.79%, and 8.22%. Judging from the performance of its three-year main revenue composition, BYD's revenue composition is relatively stable.

However, based on its 2019 data, it can be judged that the decline in its revenue is mainly caused by the automotive business. Its revenue related to automobiles and products decreased by 16.76% year-on-year. Data show that in 2019, BYD's total sales of cars were 461,000, a year-on-year decline of 11.39%. From January to September 2020, BYD's car sales fell by 19.9% year-on-year. This means that there are still big challenges before the end of 2020.

Watchmaker: Yiou Automobile Zheng Weixiong

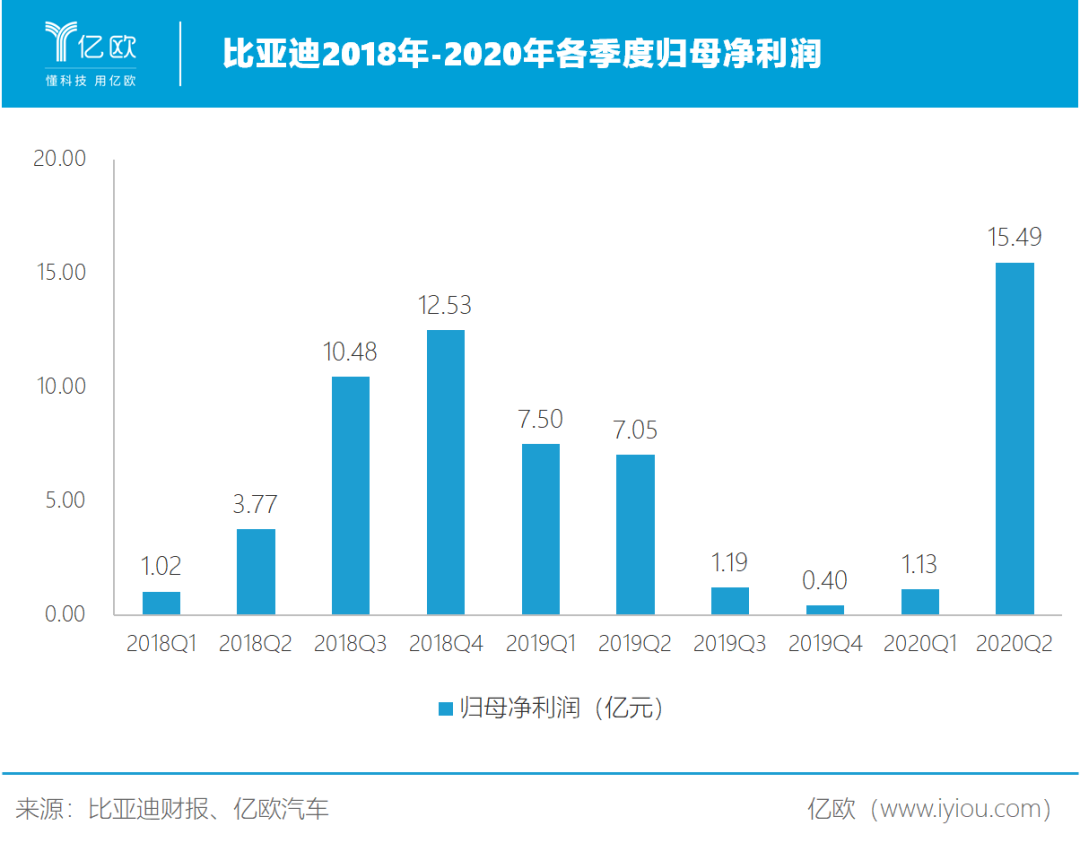

According to the financial report, BYD’s net profit attributable to its parent for 2017-2019 was RMB 4.066 billion, 2.78 billion, and 1.614 billion, respectively. The net profit continued to decline. It must be mentioned that a large part of the net profit came from government subsidies. The data shows that the government subsidy for BYD in 2017 was 1.275 billion yuan, and in 2018 this figure was 2.073 billion yuan. In 2019, BYD’s government subsidies included in the current profit and loss were 1.483 billion yuan. After excluding government subsidies, BYD's earnings performance is even worse.

Behind the data is a true portrayal of BYD's development. From the perspective of the competitive environment of the new energy market, the domestic new energy market has now entered the midfield battle. Although in September this year, BYD’s flagship model BYD "Han" successfully entered the high-end sedan market and its sales have increased significantly, but now there is Tesla. Under the impulse of price cuts, there are new forces such as Xiaopeng Motors, a new car-making force that has emerged. In this context, people have to worry about whether BYD, which has subsidized in the future, can continue to maintain its previous leading position.

The power battery business, which BYD is proud of, is still a catcher. Data show that in the first half of 2020, China's power battery market share CATL won 48.7% by an absolute advantage, and BYD ranked third with a market share of 14.2%. Looking at the world, BYD's 6% market share also lags behind Panasonic, CATL and LG Chem. This is both an opportunity and a challenge for BYD.

But judging from a longer-term perspective, Yiou Automobile believes that BYD’s imagination in the field of three electric power will become a key area for its establishment of a moat.

In the past, BYD has achieved independent self-control on batteries, motors, and electronic control, but the supply of parts and components is basically internal, and there is still a lot of room for growth. At this stage, with the strategic transformation of BYD’s open supply chain and the increase in production capacity, power batteries The offer will begin to enter the cash-out period. Domestically, the company has already provided support to car companies such as Changan and Xiaokang, and has entered the BAIC New Energy announcement; for overseas customers, it has been designated by Toyota and is expected to supply world-renowned car companies such as Ford and Audi. With technological breakthroughs in blade batteries, BYD is expected to enhance its position in the global power battery supply chain.

Yiou Automobile believes that BYD, which has been deeply involved in the new energy field for many years, has come to fruition, which has attracted a turning point in performance. In the future, BYD, with its diversified and open business, is expected to become a supplier of new energy solutions, greatly enhancing the company's value.

Is BYD worth 380 billion? In fact, the capital market is a big bet, and BYD, which has high hopes, has not yet settled down, whether it can realize its potential will reshape the market’s confidence in BYD.

Comments

Post a Comment