After Tesla handed over "the best quarterly report in history", what cards are in Musk's hand?

"23W Model 3, the number is limited, know how to come soon."

As soon as this circle of friends of Tesla selling Hu Jun was sent out, more than 10 potential customers sent private messages. "Tesla has cut prices again?" "Wait for the party" to question again.

This is actually a batch of “quasi-two-handed cars” returned by Tesla’s “Confidence Guarantee Program”—according to the previous policy, they can be returned for no reason within 7 days. Many car owners returned before even the license plates were issued. Because there is a certain number of kilometers, the official will reduce the price of the car by 13,000 to 18,000 and then sell it.

The recent large number of “quasi-two-handed cars” that have been added are largely due to Tesla’s price reduction strategy, and the “cut” owners choose to return the products. It is estimated that it cannot withstand the pressure, Tesla announced that it will cancel the confidence guarantee plan on October 16.

Amidst various disturbances, Tesla released an unaudited third quarter 2020 financial report on October 22.

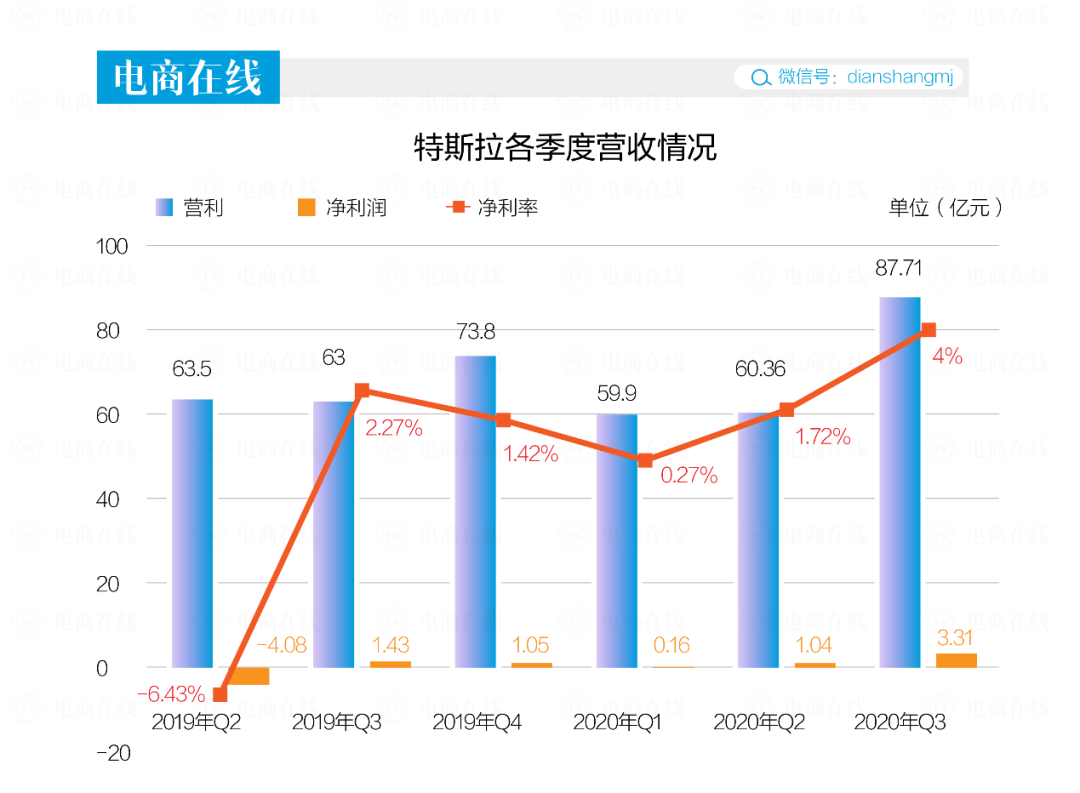

Earnings for the fifth consecutive quarter, revenue of $8.771 billion far exceeded market expectations, and net profit of $331 million was the sum of the previous four quarters. The once-constrained production capacity, cash and other problems are being solved step by step. Every new car is almost immediately taken away from the factory. Unmanned driving technology is also in the future.

Elon Musk described this as Tesla's "best quarterly report in history." After the earnings report was released, Tesla's US stocks rose more than 4% before the market.

But behind the excellent results is the delivery pressure hanging over Tesla. It is still 181,500 vehicles away from the KPI of 500,000 vehicles delivered by the end of the year. The Shanghai factory has already met the demand on the production side, and more efforts are still on the sales side, but the new car-making forces are still growing, and Wuling Hongguang has entered the market with a high profile under the banner of "People's Electric Vehicle".

Before the end of the year, what more cards Tesla can play is worth looking forward to.

Best performance in history

The source of this quarter's performance is the best delivery volume in history.

(Image source: Tesla official website)

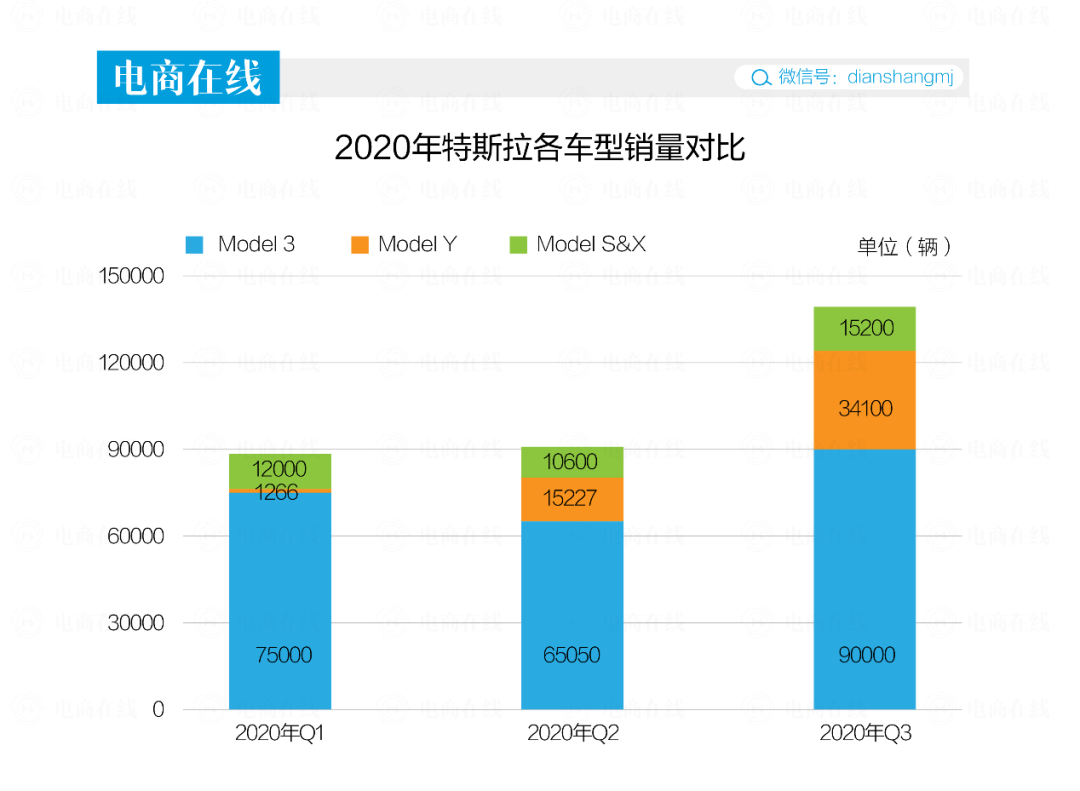

Tesla announced the delivery of 139,300 vehicles in the third quarter of 2020, which broke the record of 112,000 deliveries set in the fourth quarter of 2019.

For Tesla, the number of delivered vehicles is an extremely critical indicator. Different from the traditional physical store model, Tesla’s car purchase process is roughly as follows: store test drive → official website reservation, deposit payment → factory order, custom production → Pay the balance and deliver the vehicle.

To put it bluntly, only when the consumer gets the car, Tesla can complete the closed loop of sales revenue.

High delivery volume drove high revenue. The financial report showed that Tesla’s Q3 quarter revenue was US$8.771 billion, a year-on-year increase of 39.2%; net profit was US$331 million, which is almost the sum of Tesla’s net profit in the first four quarters. An increase of 131%.

From the data point of view, Model 3 with the lowest gross profit margin has supported the bulk of sales, but ASP (average selling price of cars) has risen. The average selling price of Tesla last quarter was 52,271 (USD), and the average selling price this quarter was close to 55,000. , Thanks to Model Y.

Since the price of Model Y is higher than Model 3, the more Model Y sells, the greater its contribution to ASP, and the better Tesla's revenue performance will be.

From the perspective of the company's gross profit margin, the gross profit margin for this quarter was 23.5%, an increase from the same period last year. In the eyes of the outside world, this is Tesla's cost control effect.

When it comes to cost control, Musk is definitely a strong one. From the previous rumors that employees brought their own toilet paper to the recent cancellation of the marketing and public relations department, his ins became the company's only external channel, saving a lot of marketing expenses each time, not to mention other cost control.

In fact, for Tesla's 5 consecutive quarters of profitability, in addition to the boost in car sales, the sale of carbon credits is an important part of its corner overtaking. Selling carbon credits is actually Tesla selling its carbon emission quotas to gasoline car companies. This "windfall" is very considerable. In 2019, Tesla earned $594 million by selling carbon credits.

In a conference call after this quarter’s earnings report, Tesla’s CFO Zachary Kirkhorn said that this year’s carbon credits more than doubled from last year.

Financial report data shows that Tesla's operating cash flow and free cash flow have both risen sharply.

Free cash flow is the remaining cash flow generated by the enterprise after the reinvestment needs are met. For a high-quality company, the abundant free cash flow shows its strong ability to obtain cash, and it has the opportunity to do more.

Tesla can cut prices

This generous cash flow will not be held for long. According to Tesla's plan, it will enter the cost cycle next.

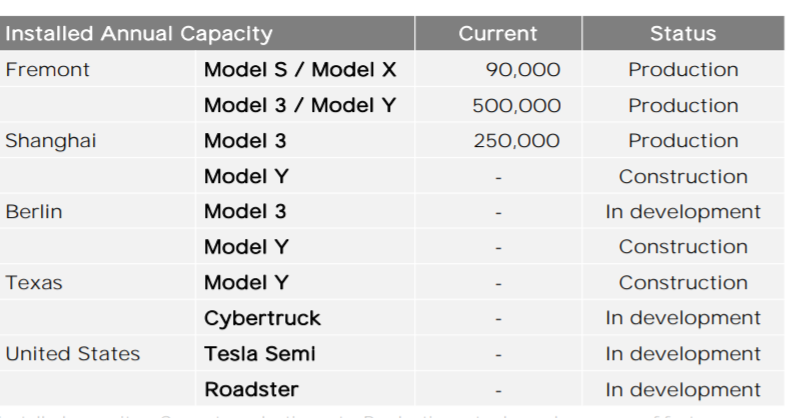

Tesla's Berlin super factory is still under construction, and the next super factory will be built near Austin, Texas. This new factory will be mainly responsible for the production of Cybertruck pickups and Semi semi-trailers. At the same time, Tesla plans to start production of Model Y at its super factory in Shanghai before the end of the year.

According to the financial report data, the annual production capacity of the Fremont plant has been increased to 590,000. The Shanghai Super Factory currently only produces Model 3 models, and the annual production capacity has reached 250,000. If the Model Y is put into production at the end of the year, the annual output will be 100 Wan's goal is just around the corner.

These million vehicles are both the supply-side capacity and the demand-side power. For Tesla, both aspects must rely on the Chinese market.

From the supply side, the Shanghai factory has increased its third shift of production at present, with an annual production capacity of 250,000 vehicles, compared with 150,000 vehicles in the same period last year. Compared with the 500,000 vehicles delivered annually, it is equivalent to a single factory in China. Contributed half of the production capacity in 2020.

From the demand side, with the weak recovery of the United States, Europe is struggling in the second round of the epidemic, and the Chinese market has high hopes. Tesla did not announce regional sales, but data from the China Automobile Industry Association and China Passenger Car Association (CPCA) showed that Tesla sold about 34,100 Shanghai-made Model 3s in the third quarter.

China's new energy market itself is very strong consumer demand, Industry and Information Technology Ministry spokesman Huang Libin said that my country's new energy automobile volume for five consecutive years, ranking first in the world to promote the cumulative amount of more than 4.8 million, accounting for the world More than half.

"Golden Nine and Silver Ten" is also applicable to the automobile industry in addition to real estate. September to October is an important node for auto brands to sell and launch new products. In September this year, the momentum of new domestic forces was good, with sales of Ideal, Weilai and Xiaopeng basically around 4,000 vehicles.

Although this number is not as small as Tesla's, the entire new energy market is still in its infancy, and any threats should not be underestimated, not to mention that the new energy camp may kill "barbarians" at any time.

In September, Hongguang MINIEV launched by Wuling squeezed Tesla out of the sales throne. With a monthly sales of 20,000 vehicles, it is the first domestic brand to exceed 10,000 in a single month. The total amount is almost equal to Model3 + BYD Han + Ideal ONE + Wei Come to ES6.

(People's electric vehicles also penetrate into the young market)

BYD's new Han is also a rival that cannot be underestimated. Its price is similar to Model 3, but it is higher than Model 3 in terms of interior and interior space. Judging from various reviews, the reputation is good.

Compared with gasoline vehicles, new energy vehicles have greater price incentives, as can be seen from the example of Wuling Rongguang. In Tesla's sales strategy, price cuts have always been an inevitable topic.

In the past three years, Tesla's four models Model X, Model S, Model 3 and Model Y have all adjusted their prices more than 10 times. Among them, the most frequent price changes in 2019, the four models have been adjusted for about 15 times. Since May this year, the price range of the four models has been adjusted approximately 9 times, of which 7 were price cuts.

In early October, the subsidized price of the upgraded version of the domestic Model3 standard battery life dropped from 270,000 yuan to 249,900 yuan, and the price of ModelS was also reduced in three days, from US$74,990 to US$69,420.

In the eyes of many people, Tesla can still cut prices in China. The reason is that there is still a sales target of 180,000 cars before the end of the year.

Another reason is that when combing the financial report, "e-commerce online" found that Tesla's overall gross profit margin was 23.5%, and the vehicle gross profit margin was as high as 27.7%, which means that there is enough profit space to reduce prices.

The manufacturing cost of the Shanghai plant also has room for compression. Estimates from Bohai Securities believe that the cost of localized parts for Tesla in China is 10%-20% lower than that of foreign parts. For example, the room for this price reduction comes from Tesla's replacement of ternary batteries with lithium iron phosphate batteries, which can reduce the cost by about 20%. However, with large-scale production and increased yield, costs are still expected to continue to decline.

The data shows that the current localization rate of Model 3 is close to 70%. According to Ping An Securities' calculations, assuming that the localization of parts and components in the future will advance to 100% while maintaining a gross profit margin of 25%, the price of Model 3 can drop by about 20,000-30,000.

What else except the price cut

To be sure, Model3 will not drop to a bottom line. According to Musk's setting, in the future, he will launch an electric car that can be purchased for 20,000 to 30,000 dollars.

Now that there is a Tesla version of the "people's electric car", expectations for Model 3 are not so high. Apart from price cuts, where is Tesla's next card?

In the earnings report, Tesla direct indication achieve the goal of 500,000 production capacity depends on the Model Y production, growth of Shanghai's super factory to transitive flow and delivery to further improve efficiency.

The cost advantage of the Shanghai factory has already begun to play to its global advantage. The Chinese-made Model 3 recently confirmed that it will be exported to the European and Australian markets. In view of the current price advantage of the Chinese-made Model 3, it is considered to be a weapon for Tesla to expand its market share in the European market. It has once again proved that the Shanghai factory is in An important position in Tesla's strategic goals.

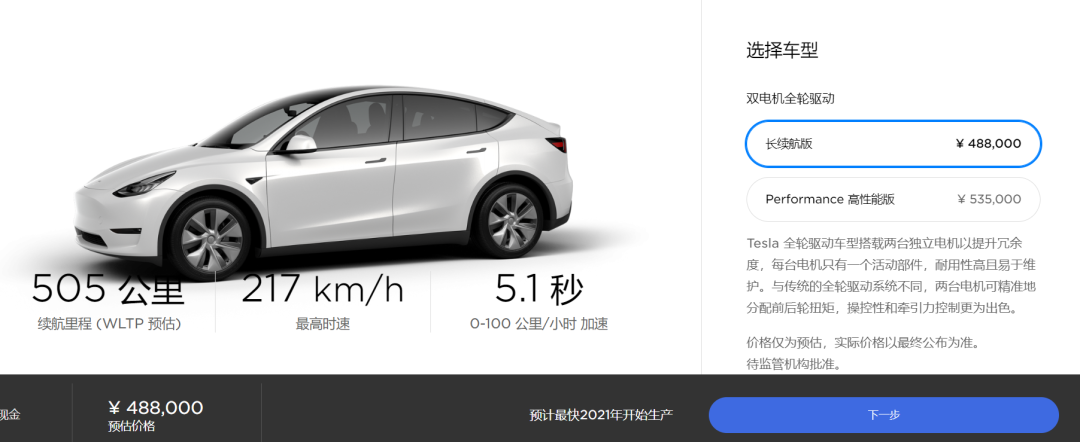

Model Y is a compact SUV developed by Tesla. It is also the fifth model currently launched by Tesla. It was released in March 2019 and delivered the first batch of cars in March this year. From the data point of view, the delivery of Model Y has been increasing, so before the end of the year, Model Y will also be an important indicator of KPI.

"E-commerce Online" found from the official website that Model Y has opened an order, launching two models of long-life all-wheel drive version and Performance version. The pre-sale price of the two cars is 48.80 and 535,000 yuan.

At present, the price of 480,000 yuan is quite controversial. On the one hand, many people think that Model Y and Model 3 are actually the same batch of production lines, "the two vehicles share up to 75% of the parts". It is more of a difference in appearance, which is not enough. Open up such a big price difference.

On the other hand, although Tesla has always advertised that its opponents are BBA (Mercedes-Benz, BMW, Audi) rather than those new car-building forces, the price of Model 3 250,000 and Model S more than 700,000 are actually not true. Competing with BBA, but ModelY's pricing does cut into the hinterland of BBA, and Weilai EC6 is eyeing the eye. In this way, how much competitive advantage there is may be unknown.

However, at this financial report meeting, Tesla's CFO also mentioned that the production cost of Model Y will still fall in the future, which will be similar to Model 3. Of course, it may be hinting that Model Y will start a price reduction cycle.

After Model Y, Tesla has two other models already on the schedule, the Semi-trailer electric truck and the Cybertruck electric pickup. Facts have proved that Musk's cards can be played for a while.

In the Chinese market, Tesla has made more attempts in sales channels. In April of this year, Tesla opened an official flagship store on Tmall and built a second online channel outside the official website. Although it does not sell cars directly, it can make appointments for test drives and purchase auto parts.

(Tesla participates in Double 11)

Behind this is actually Tesla’s “pre-emptive” move to control costs. Tesla’s customer acquisition costs are very high in the direct mode, and the best way to control costs at the sales end is undoubtedly to find a capable “small” in the Chinese market. "Partner", Taobao and Tmall's 800 million monthly active users have naturally become Tesla's potential customers, and the digital marketing capabilities of the e-commerce platform can more accurately reach core consumers.

On the recent "Battery Day", Musk released his bold ambitions to achieve the goal of selling 20 million cars per year by 2030. If you want to achieve this goal, I am afraid it is more than doubling sales.

Comments

Post a Comment