Charging piles, another unprofitable sunrise industry?

For charging pile companies, now is the best and worst time.

In 2018, the charging pile industry, like the P2P industry, was two deep pits in the capital market at that time. Under the stimulus of policies and subsidies, a large number of players have entered the arena to race and expand blindly for the purpose of subsidies.

Under such vicious competition, the industry soon ushered in a reshuffle. The charging pile companies were constantly thundered, and the number of closed charging pile companies exceeded 60% of the industry peak. It was like the colorful bike-sharing dispute at that time. After the hustle and bustle, stay It's just a chicken feather.

The time came to 2020, and in just two years, the spotlight of the tuyere hit the charging pile again.

The upgrade trend of the automobile industry and the new demand for green consumption have created a fire for new energy vehicles. As a charging pile that is dependent on new energy vehicles, it is also beneficial to frequently. The industry development has been pressed for acceleration.

After being included in the "new infrastructure", the senior management continued to promote the implementation of the "New Energy Automobile Industry Development Plan" to guide the orderly development of the new energy automobile industry and make up for the current major gaps in charging piles.

The spring breeze of policy has been blown to the market, and the A-share charging pile sector ushered in a big explosion. Among the 12 companies with a 20% increase on October 26, 2020, charging pile-related companies occupied 7 seats, among which the leading gainers Feite (300582.SZ) realizes three-connected boards, and Heshun Electric (300131.SZ) also realizes two-connected boards.

For this trillion-dollar sunrise industry, does the active market mean that the spring breeze of the charging pile industry has arrived and is about to enter a stage of vigorous development?

01 Industry transformation is imminent, there are still a lot of gaps

According to data released by the China Charging Alliance, as of September 2020, the members of the alliance have reported that the total number of charging piles in China is 1.418 million, and public charging piles are 606,000, of which 35 million are AC charging piles and DC There are 255,000 charging piles and 488 AC/DC integrated charging piles.

At present, the total number of gas stations in the country is 120,000. In simple terms, the number of charging piles in China is ten times that of gas stations. Unfortunately, this number is a paper tiger that cannot stand scrutiny.

Whether charging piles can meet the charging needs of new energy vehicles, there is a key indicator called the "vehicle to pile ratio". China mentioned in the plan that the vehicle to pile ratio will reach 1:1 in 2020.

As of September 2020, a total of about 4.7 million new energy vehicles have been promoted nationwide. The current ratio of vehicles to piles is about 3.3:1, which is far from the original plan.

According to the installation location of charging piles, it can be divided into private piles, public piles and special piles. The proportion of public piles is only 42%. When the number of charging piles by itself cannot meet the market demand, the proportion of public piles is relatively small, which has caused a large number of gaps in the current charging piles.

From the classification of charging pile types, it can be divided into two types of charging piles: direct current and alternating current. The characteristics of AC charging piles are simple structure and low price. The price of a single pile can be controlled at about 2,000 yuan, but the charging time is longer. Therefore, it is widely used in residential areas with low charging time requirements.

The characteristics of DC charging piles are high power and fast charging, corresponding to the high construction cost. The total price of a single pile is between 50,000 and 80,000 yuan, which does not include the corresponding expenses such as land occupation.

At present, the proportion of DC fast charging is only 25%. With the increase in the range of new energy vehicles, time-sensitive special vehicles such as taxis and online car-hailing, and the demand for improved charging efficiency for long-distance travel across cities, DC piles have always been the market The hot spot to chase.

According to the calculations given by research institutions, the total number of public DC charging piles will reach 2.1 million in 2025 and 7.5 million in 2030.

On the one hand, there are still a large number of gaps in charging piles. On the other hand, the proportion of high-efficiency DC charging piles is not high. Coupled with the continuous benefits and advancement of policies, the charging pile industry seems to have a huge market scale and extremely High market expectations.

But judging from the fundamentals of the industry, whether it can match the market situation requires a question mark.

02 An unprofitable sunrise industry

The industry chain of the charging pile industry is relatively short, and the whole industry can be divided into three links: equipment manufacturers, construction operators and overall solution providers.

As the hardware supplier, equipment manufacturers are located in the upstream of the industrial chain, responsible for the production of various components of charging equipment and power distribution equipment.

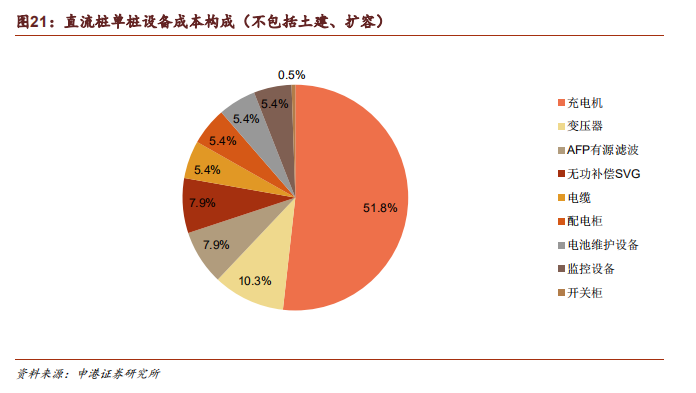

From the perspective of the cost composition of DC piles, the charger part occupies the bulk of the cost. Among them, the core IGBT component of the charger mainly relies on imports. Localized replacement is slowly progressing, which causes the high cost of DC charging piles. .

Except for IGBT components, the entry barriers for other hardware production are not high, and there are no significant technical differences in the products. The listed companies involved in the manufacturing of charging piles in the industry have many years of DC charging related technologies.

As a manufacturing industry with "to B" as its main business model, its bargaining power is relatively weak, and it relies on volume to win. Coupled with the fact that there are many competing players in the industry, the gross profit margin of each company's hardware has shown a downward trend. Although the performance is relatively stable, after all, it is not a profitable business.

As the core midstream of the industrial chain, construction operators are responsible for the investment, construction and operation of charging piles, which is a typical asset-heavy industry.

From the purchase of charging piles, site rent, power transmission expansion, operation management to subsequent parts procurement and maintenance, a large amount of capital support is required.

What does not match the large amount of investment in the previous period is the profitability of operators. At present, most of the income of operators comes from service fee income. Then the profitability of operators depends on two factors, one is charging service fee, and the other is Utilization rate of charging piles.

At present, the maximum price of charging service fees is restricted by local policies, and consumers themselves are more sensitive to price fluctuations in charging service fees, coupled with the price war launched by manufacturers to acquire users during the brutal growth of the industry.

At this stage, the national average charging service fee is between 0.5 yuan and 0.6 yuan per kilowatt-hour, and there is not much room for improvement. If market competition intensifies in the future, this figure may continue to decrease.

In the case that charging service fees cannot be increased, the utilization rate of charging piles has become a core indicator of the profitability of charging pile operators.

Judging from the current data, the average power utilization rate of my country's public charging pile industry is only about 4%. Among them, Beijing and Shanghai, where the most charging piles are laid, have only 1.8% and 1.5%.

What is the concept of an average utilization rate of 4%? Brokers have made a special profit calculation model. The model includes the full-cycle cost of depreciation, maintenance, land, and construction.

If the electricity service fee is 0.5 yuan/KW and the average power is 110KW, if the utilization rate is only 4%, the annual converted IRR is -2.8%, which means that the entire charging pile life cycle brings The return is negative.

The utilization rate needs to be increased to 6% before the IRR of the charging pile can reach 8%. For the industry at this stage, the average utilization rate of 2% may be difficult to rise to the sky.

But even if it is reached, this figure is only the government's principled requirements for bond projects, and such profitability is far from the market's expectations for the sunrise industry.

The profitability is under the constraints of many parties, and the life of the operators is not easy. Leading operators Terios Germany (300001.SZ) 's special call six years a total investment of nearly 60 billion in R & D investment over one billion, Tak Cheung chairman in 2019 before announcing the special call profitable.

The key to profitability lies in the fact that Tideruy itself controls the cost for hardware manufacturers, and the utilization rate of its own charging piles has reached 9%, which makes Tideruy the first profitable charging pile operator company. .

In terms of hardware, there is a lack of core technology and marginal profits; in terms of operation, the profit model is single and the utilization rate is low. Most companies need to rely on policies and funds to maintain their livelihoods.

Such fundamentals seem to be insufficient to support the prospects for the future development of charging piles, but capital is always chasing the trend, and the giants have accelerated their entry. This time, are they betting right again?

03 The second half of the charging pile

Since 2020, giants in various industries have accelerated their entry into the charging pile industry. On March 6, the power battery leader Ningde Times (300750.SZ) and Fujian Baicheng New Energy jointly established a new business company-Shanghai Kuaibu New Energy, which is mainly engaged in charging piles. Fast charge service;

March 31, ants gold dress wholly owned subsidiary of Shanghai Venture Capital Co., Ltd. Xin Yun shares a simple charge (Hangzhou) Co., Ltd., with 33.33% stake to become the second largest shareholder simple charge;

On April 23, Huawei announced the new generation of DC charging module Hi Charger, and signed a "Comprehensive Cooperation Agreement" with Telecom to promote the construction of pile networking and the development of smart charging business;

On July 10, Energy Chain Group, the parent company of the fast-moving platform, received 900 million yuan in financing, with CICC Capital as the leader, and Xiaomi Group and Weilai Capital as somersaults.

Prior to this, Didi and AutoNavi entered the market from the perspective of charging pile aggregation; Tesla and Weilai, as complete vehicle manufacturers of new energy vehicles, charging is a part of service and even sales. layout.

From the perspective of the giants entering the market, it can be roughly divided into the New Energy Department and the Internet Department. Although the industry is different and the purpose is different, there is one thing in common. They are all "big rich men".

Take charge of the majority of Internet giant cut pile operations industry, the current user demand for charging pile is first of all not have the charging electric pile can be used, followed by charging pile is good or bad. In this way, the barriers of the operating industry are the differences in scale and refined operations.

Terad CEO Yu Dexiang said that if others want to do this, they must first lose 500 million, otherwise they will never want to do it. For big wealthy people, if only paying 500 million can get the ideal market share, then this transaction is too cost-effective.

Compared with shared bicycles in the same asset-heavy industry, first grabbing market share and then performing refined operations to seek diversification of profit models is the beginning of the war.

For bike-sharing companies, money is the most important issue, but for Internet giants entering the market, money is the least important thing, as is the current charging pile operation industry.

Internet giants hold a large amount of funds. For them, short-term non-profitability is not a problem. Certain scenarios are more meaningful than making profits. What's more, they operate on the basis of big data analysis and refined operations. It is even more handy.

The spring breeze of the industry has blown, but the small and medium enterprises in the industry feel even colder. The core operator industry itself is highly concentrated, with the top eight companies occupying more than 88% of the market.

The accelerated entry of capital has also accelerated the occurrence of the Matthew effect. Under the effect of scale, leading companies can concentrate resources to achieve profitability or obtain financing. Small and medium-sized enterprises experience capital trampling in the absence of hematopoietic capacity. The probabilities are more bad than good.

The charging pile industry has experienced barbaric growth and elimination and shuffling. With the promotion of policies and the entry of giants from all walks of life, industry competition has entered the second half.

The trump card in the second half has also changed from "funding" to "operation". Whether it is to open up the industry chain for vehicle-stake collaboration or combine scene big data to develop diversified business models, it can become a breaking point for this industry reshuffle.

The charging pile industry in the future may become an infinite war between giants just like the current shared bicycles. For companies in the industry, the current stage of shuffling and competition may be their best chance to become famous.

Comments

Post a Comment