New energy vehicles: Chips may not be banned, but batteries are banned, we can

The past year was Zhong country's new energy car changes a year, the industry is undergoing a profound change in the supply side, while the epidemic is like a baptism, stimulate market-oriented industry, the Force, and was recognized by the global capital markets .

The development of the new energy automobile industry has risen to a national strategy. On October 9th, the State Council passed the "New Energy Automobile Industry Development Plan", clearly insisting on the strategic orientation of pure electric drive; on October 27th, the Chinese Society of Automotive Engineers released new energy vehicle technology Roadmap 2.0, all fuel vehicles will be hybrid by 2035.

In the future, new energy vehicles will gradually become mainstream products. To this end, Gelonghui has launched the #新能源汽车# series to lead readers to the investment opportunities behind new energy vehicles, to better understand and place bets on new energy vehicles.

This article is the first in this series.

From 2020 to the present, the income can beat more than 90% of investors, there must be no shortage of bets on new energy vehicles. Judging from the forecasts of the third quarter reports of several major leading companies, the third quarter ushered in recovery, and the fourth quarter is generally the peak season for new energy vehicle sales. , The industry predicts that the production and sales data of new energy vehicles in the fourth quarter will usher in full force growth.

If you missed the "Apple", I hope you will never miss the "Tesla", because this is the most likely track in China for overtaking in curves.

New energy vehicles are now in a stage of rapid global expansion, with the European and Chinese markets as their prime destination. The strong downstream demand is transmitted upward to the midstream core components and upstream raw materials, and the industry also shows high growth potential.

This article is divided into two parts, briefly talk about why the new energy car is the most likely to overtake the track in the corner? Which industry chain link is the most valuable?

1 "Whoever controls oil controls all countries;

Whoever has the right to issue currency controls the world. "

Before World War II, the status of the U.S. dollar was equivalent to the production of rare gold and became the world currency in circulation. After World War II, because of the unrestrained printing of money in the United States, the value of gold was depreciated. US President Nixon announced that the U.S. dollar was decoupled from gold. in dollars, the dollar linked with oil, the dollar return to the world's cargo currency position.

No country does not need oil. As much as it depends on oil, it depends on the dollar as much. my country is the world's largest oil consuming country, and the exchange rate trend of the renminbi against the US dollar can hardly be immune to it.

In March of this year, the Fed launched the unlimited quantitative easing policy, which means that the Fed can print money without restrictions. Because the world currency is linked to the U.S. dollar, this means that other currencies have to depreciate. my country is also the largest creditor of the U.S. dollar. He asks us to borrow money. If we don’t borrow, the other party will print the money and let him The devaluation of the renminbi. Why does this mean that as long as the US prints money, the world has to pay?

Therefore, the strategic significance of diversifying the energy structure and finding alternatives to oil is not only environmental protection, but also to get rid of dependence on the dollar. Electric substitution of fuel is the general trend.

Since 2010, the state introduced a number of government policies force quite new energy, bring it into the national strategic emerging industries.

2 "From subsidizing the market to attracting wolves into the market"

Why is the country spending huge sums of money to subsidize new energy vehicles?

Take the entire automobile industry as an example. China has always lagged behind Europe and the United States. Take fuel vehicles as an example. At that time, in order to introduce foreign advanced manufacturing technology, the automobile market was opened to the outside world, and the strategy of “market for technology” was adopted.

Over the past few decades, the market has given it to others. As a result, none of the world’s well-known car brands is a Chinese car brand. New energy vehicles are the best cornering overtaking opportunities. If you don’t directly spend money on technology, you really have no chance. Soup.

In 2009, the Ministry of Finance and the Ministry of Science and Technology first proposed the "New Energy Vehicle Development Strategy", which was the first year of the development of China's new energy vehicle industry. After that, government departments successively issued a series of new energy vehicle development plans and subsidy plans.

In 2010, the government formulated specific subsidy standards for plug-in and pure electricity. The subsidy standards are determined according to the energy of the power battery pack. The financial subsidy adopts a slope-reduction mechanism, which means that every year thereafter, the slope will be reduced on the basis of the previous year. standard.

In 2015, the explosive growth of new energy vehicles, all enterprises in the industry chain shared the dividends of the rapid development of the industry.

From 2014 to 2016, the number of power battery companies increased from 81 to 155.

Subsidies stimulate development, but they also breed fraudulent subsidies. The state once again took action to regulate, lower the amount of subsidies, and adjust the pre-appropriation system to a liquidation system. The extension of the subsidy cycle and the increase in subsidy thresholds have led to the death of some new energy car companies due to the broken capital chain.

Between 2016 and 2018, the number of new energy car companies dropped sharply by more than 50.

In 2019, the state announced the abolition of local subsidies, the decline of state subsidies, and the cliff-like subsidies that caused a group of companies to close down in the automotive winter.

As a result, the subsidy policy was adjusted again. On the one hand, the subsidy method was relaxed to reduce the financial pressure of enterprises, and at the same time, the technical threshold of subsidy was raised and the amount of subsidy was reduced.

Feeding the grass while spurring the whip, the subsidy policy largely determines whether the car companies' lives in the next year are satisfactory.

In 2020, affected by the epidemic, the government once again postponed the subsidy retreat policy and extended the subsidy until the end of 2022.

It can be seen that there are actually thresholds for new energy subsidies, especially technical thresholds. Thresholds are set on technical indicators such as energy consumption, cruising range, and battery system energy density, and are increasing year by year. The purpose is to force new energy car companies to accelerate technological progress and eliminate the fittest.

However, it can also be seen that it is still not enough to rely on the state to pay, and it cannot solve the pain points of cruising range and high vehicle manufacturing cost in a short time.

Another simple and rude way is to bring in better opponents.

The benchmark company for new energy vehicles is Tesla in the United States. China's introduction of Tesla not only opened up the Chinese market, but also gave tens of billions of low-interest loans and subsidies.

Even if you lead a wolf into the house, you still need to raise a wolf?

Of course it is to help solve things that subsidies cannot solve-to help China cultivate Tesla.

According to the requirements of the Chinese government, Tesla's localization rate in China will reach 30% in 2019 and 100% in 2020.

The increase in the rate of localization will inevitably drive the development of Tesla’s domestic supporting manufacturers. It is like introducing Apple in the past and cultivating batches of foundries. The leaders of the Apple industry chain will gradually support Huawei, Domestic mobile phone brands such as Xiaomi will become bigger and stronger and become the hope of localized substitution.

The introduction of Tesla is also such a path. Introducing wolves into the market is to allow companies to catch up with each other in terms of cost, performance, safety, and mileage. In the end, companies with strong technical strength and cost and scale effects will remain.

The new energy vehicle industry has gradually shifted from policy-driven to market-driven, towards a state of healthy development.

3 "If the chip is banned, we may not be able to make it up, but we can make it up if the cell is banned."

This sentence is the description of Ningde Times Chairman Zeng Yuqun's position in the global new energy market. Although he is talking about himself, it can actually represent China's position in the global new energy market.

my country's pure electric vehicle industry ranks first in the world with absolute advantages in terms of scale, and the industrial chain of power batteries, drive motors, electronic control systems and charging and replacement infrastructure has been initially established.

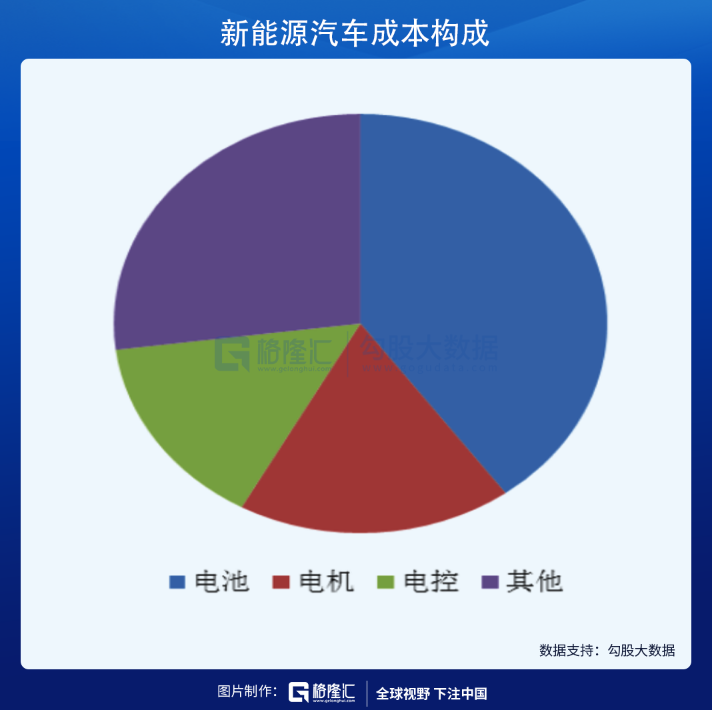

Traditional automobile structure is mainly divided into four parts: engine, body, chassis, and electrical equipment. New energy vehicles do not have an engine. Instead, they are replaced by three electrics (batteries, motors, and electronic controls). The core components of three electrics account for about 60% of the total cost. %.

As the commanding heights of electric vehicles, Sanden technology directly determines the main performance indicators of electric vehicles such as climbing, acceleration, top speed, and cruising range. According to the analysis of various brokerage analysts, the main focus of future car upgrades is also System" and the upgrade of intelligent services.

Compared with the monopolization of the core component technology of fuel vehicles by foreign manufacturers, the three-electric system of new energy vehicles has the rise of large manufacturers, which provides domestic supporting manufacturers with opportunities for overtaking in corners.

The motor drive system is the drive system in the driving process, which is equivalent to the engine of a fuel vehicle. Its performance determines the vehicle's acceleration, climbing ability and maximum speed. my country has formed a complete automotive motor industry chain, and is not far behind the international market in key indicators such as motor functional density and high-efficiency drive range.

According to "Automobiles and Accessories" reports, independent brands have always occupied an absolute share of my country's new energy vehicle electrical suppliers. In 2018, my country's independent supporting ratio of drive motors reached more than 95%, and new energy buses, pure electric trucks, pure electric logistics vehicles and other fields have all achieved localization.

The electronic control system includes three parts: vehicle controller, motor controller and battery controller (BMS). Among them, the new energy vehicle controller and BMS are relatively mature, and the motor controller technology is relatively backward, mainly because of the core component IGBT 90 More than% rely on imports.

The power battery of the new energy vehicle provides direct current, while the drive motor needs alternating current. The IGBT is a transfer switch, which determines the efficiency of electrical energy conversion. It accounts for about 1/3 of the cost of the motor controller, and 15% to 20% of the overall cost of the motor. At present, most of the core technology of IGBT is controlled by European, American and Japanese manufacturers, and our country is almost entirely dependent on imports.

The number one IGBT in China is Star Semiconductor. In 2018, its IGBT products ranked first in the global market share, but the market share was only 2.2%.

The localization of automotive-grade IGBT technology has been given high expectations for breaking the international technology blockade.

Among the three electricity, the battery is the most important. Power batteries can basically account for 30% to 50% of the vehicle cost. The high cost ratio has largely restricted the popularity of electric vehicles. Take the three electrics of Tesla Model 3 as an example, batteries, motors, and electronic controls account for approximately 38%, 6%, and 6% of the total production costs respectively.

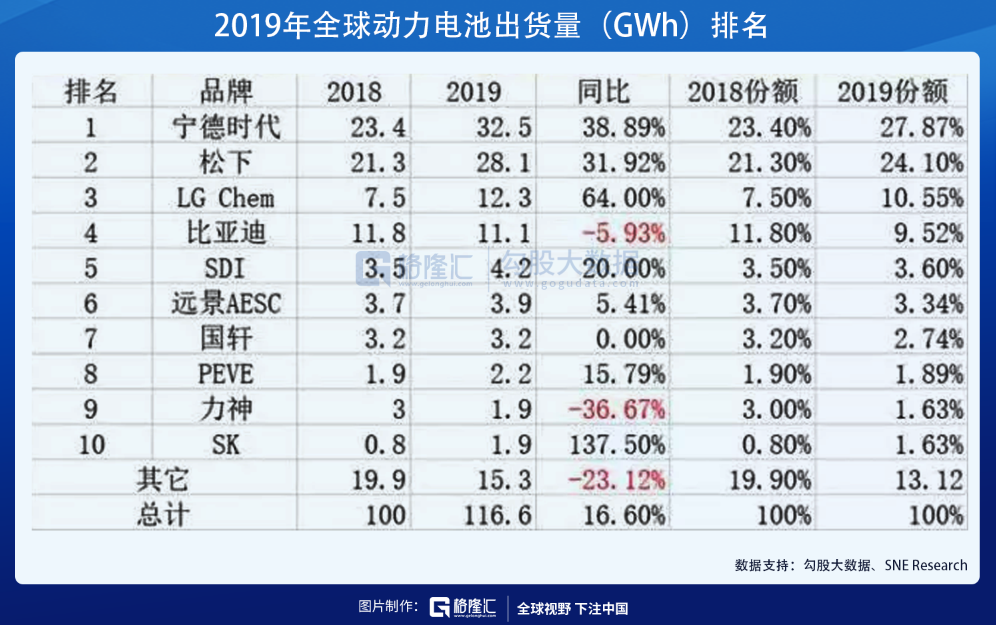

In the battery field, the global competition pattern is monopolized by China, Japan and South Korea. From the perspective of global power battery shipments in 2019, among the top ten power battery companies, China is one of the most powerful companies. Entering the TOP1 are Ningde Times, BYD, AESC (acquired by Envision), Guoxuan, and Lishen. , A total of 5 companies, occupying half of the seats, with a market share of 45.1%, which has changed the past pattern of “strong west and weak east” in the auto industry.

Among them, the world's largest power battery in recent years, either BYD or Ningde era.

In the field of three powers, BYD is the domestic enterprise that carries out the layout of the entire industrial chain, not only for batteries, but also for electric drives and electronic control systems, and it also overcomes the difficult design and manufacture of IGBTs.

In the domestic market, BYD has the second domestic battery market, the first electric motor control, the first BMS, and the second IGBT (Star Semiconductor first).

In terms of new energy vehicles, BYD's new energy vehicle shipments rank first in China, and its "Han" is even comparable to Tesla's M3. According to a report from the Head Leopard Research Institute, from a comprehensive analysis of the cost-effectiveness, battery technology, electric drive system technology, autonomous driving functions, suppliers and other aspects of the new energy vehicle, BYD Han compares with Tesla M3 and Xiaopeng P7. BYDhan ranks first in comprehensive competitiveness.

As the most beautiful young man in domestic new energy vehicles, BYD has a market expectation that "it is expected to overtake in a curve and compete with Tesla."

Compared with the currently controlled chips, the semiconductor market is weak, but it is not unreasonable that the new energy car market has been detonated.

Comments

Post a Comment