The increase is comparable to Tesla, BYD staged a shocking reversal

The new high market value is difficult to conceal and the challenges remain.

How disappointing the beginning of the year, BYD is now so beautiful.

On July 13, BYD's market value exceeded 267.1 billion yuan, surpassing SAIC to become the auto company with the highest value in the A stock market. Since then, BYD's market value has continued to rise and is currently about 130 billion yuan higher than SAIC. Compared with the lowest point in March, the share prices of BYD Hong Kong stocks and A-shares have tripled and quadrupled, respectively-an increase comparable to Tesla.

But only half a year ago, the situation facing BYD was still extremely bleak. In February, BYD's auto sales plummeted 80% due to the epidemic. The 2019 annual report released in April showed that BYD’s net profit dropped by 42%, which revealed the lack of BYD’s own hematopoietic capacity after the decline of new energy subsidies. In late March, BYD's stock price has fallen to freezing point.

Today is different from the past, and now BYD has clearly become the darling of the market.

An important factor to stimulate the market value to rise is the continuous growth of performance. On the evening of October 29, BYD delivered a Q3 financial report that exceeded market expectations:

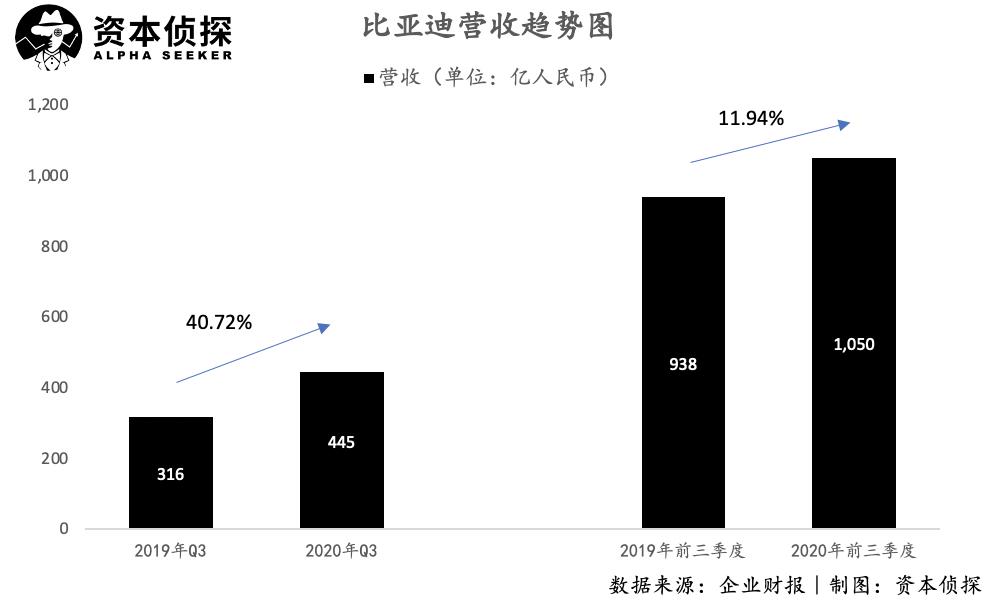

In the third quarter, BYD achieved 44.5 billion yuan in revenue, a year-on-year increase of 40.72%;

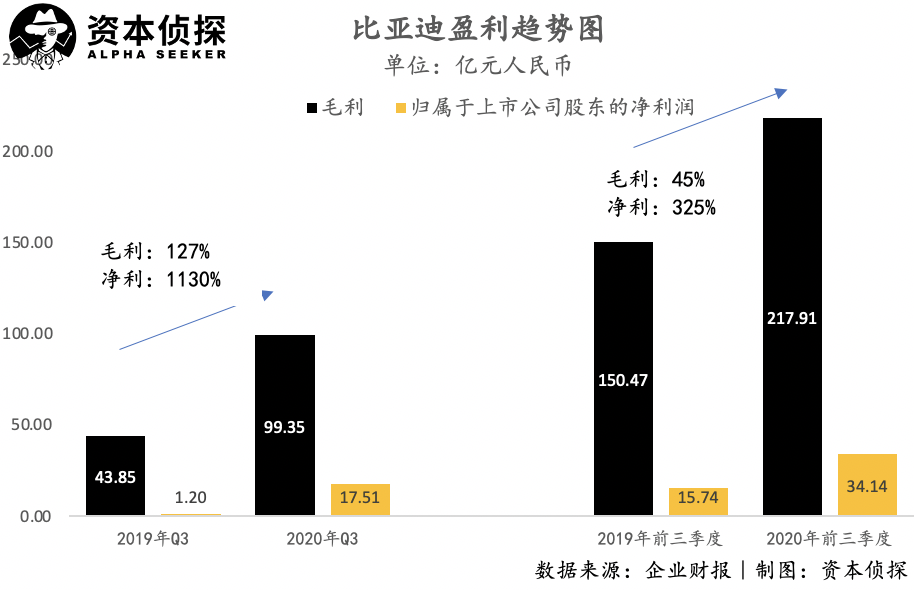

The net profit attributable to shareholders of listed companies was RMB 1.75 billion, a year-on-year increase of 1130%;

In just a few months, BYD staged a shocking reversal, but in the real market conditions, the challenges that BYD faces are still severe: in the power battery market, CATL still sits at the top spot, and the impact on BYD still exists; the field of new energy vehicles , Tesla's price butcher knife is still reaping the market without mercy.

Surrounded by rivals, BYD, as a representative of traditional new energy car companies, what is the core of supporting its market value?

Policy is improving, performance turned around

BYD has always been an auto company in its market positioning, but from the perspective of revenue composition, the auto business actually accounts for only about half.

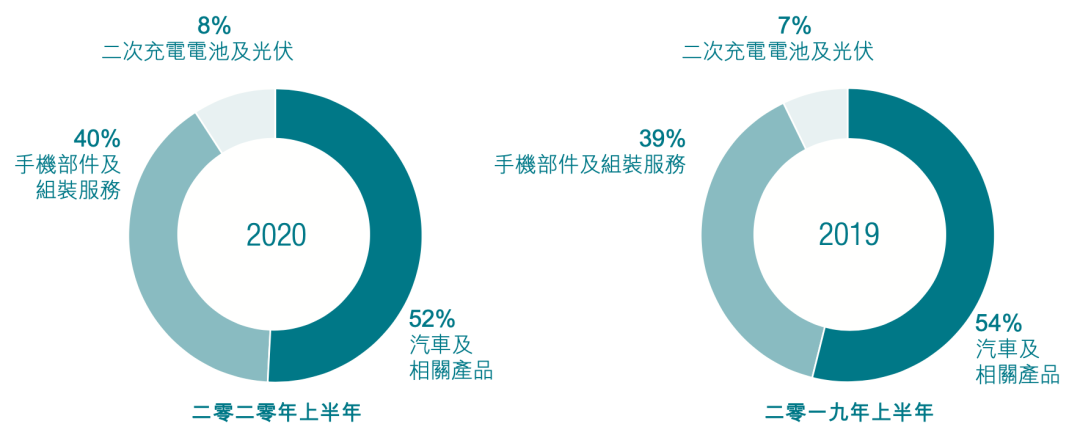

According to BYD’s 2020 semi-annual report, BYD’s automotive and related product businesses accounted for only 52% of total revenue-a slight decrease compared to the same period in 2019, which may be attributed to the significant weakness in the vehicle market under the influence of the epidemic in the first quarter. In addition, mobile phone components and assembly services accounted for 40% of BYD’s revenue, which is also one of BYD’s pillar businesses, with secondary rechargeable batteries and photovoltaics accounting for 8%.

BYD's revenue composition, source: corporate semi-annual report

Among them, although automobiles and related products account for only about 50% of revenue, they are almost the pillar supporting BYD's market value. Mobile phone components and assembly services have made outstanding contributions to revenue. However, due to the low gross profit and low imagination of the foundry business, the contribution to BYD's market value growth is limited.

The secondary rechargeable battery is BYD’s business, and the power battery business is the focus of the market, with a relatively small revenue share and extremely strategic significance. The photovoltaic business is also related to energy, but BYD's performance in the photovoltaic business is mediocre and has long been regarded as a drag on BYD's performance.

In the third quarterly report, BYD did not disclose in detail the business situation of each segment. From the perspective of overall performance, BYD's revenue and profit have increased significantly. Combined with market feedback, performance growth is closely related to the increase in BYD auto sales. Specifically:

BYD achieved revenue of 44.5 billion yuan in the third quarter, a year-on-year increase of 40.72%; in the first three quarters, it achieved revenue of 105 billion yuan, a year-on-year increase of 11.94%.

BYD’s net profit attributable to shareholders of listed companies was RMB 1.75 billion in the third quarter, a year-on-year increase of 1130%; in the first three quarters, net profit attributable to shareholders of listed companies was RMB 3.41 billion, a year-on-year increase of 325%.

BYD not only succeeded in achieving a bumper harvest of revenue and profit in the third quarter, but also completely reversed the downward trend in performance in the shadow of the epidemic in the first half of the year, and drove its annual performance growth.

Among the data of BYD's financial report, the most eye-catching is the exaggerated increase in net profit by more than 11 times, and the net profit margin has also increased from 0.38% to 3.93%.

Part of the increase in profit comes from the increase in gross profit margin. Compared with the same period last year, BYD's gross profit margin increased from 13.9% to 22.3%. According to the information in the interim report, part of the optimization of BYD's gross profit margin comes from the improvement of operating efficiency of mobile phone components and assembly services. In addition, combined with market information speculation, BYD Han series equipped with BYD's new product blade battery was officially launched in the third quarter. The advantage of blade battery cost has also made a positive contribution to the improvement of gross profit margin.

In addition, it needs to be pointed out that the changes in BYD's profitability are also related to the direction of policy.

Beginning in June last year, the New Energy Vehicle Subsidy Policy was officially implemented. Compared with the previous period, the New Deal subsidy amount has almost been cut in half. Almost all new energy vehicle companies have experienced a decline in sales, revenue, and profit. BYD said in the annual report 2019, resulting in full-year net profit to drop 42% of the cause of a positive industry and policy changes.

Since the beginning of this year, in order to boost the market and delay the subsidy decline, the new energy vehicle market has shown a good growth trend after the first quarter. Favorable policies may be an important reason for BYD's soaring net profit.

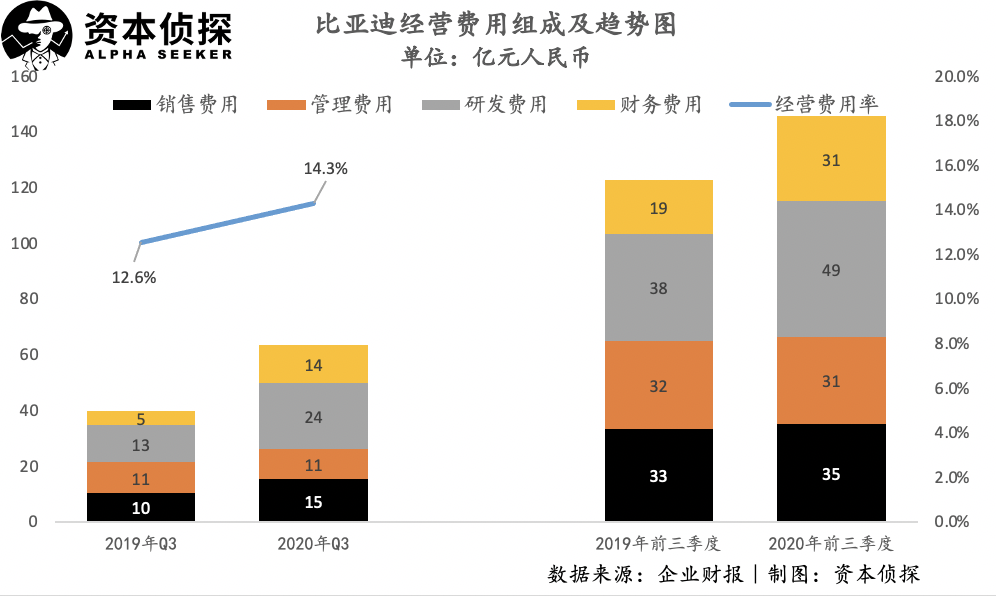

If you look at operating expenses alone, BYD’s operating expense ratio in the third quarter increased slightly compared to the same period last year, but the overall expense control performance is still satisfactory.

Unlike the substantial increase in performance, BYD's asset structure has not significantly improved compared to the same period last year. Its debt-to-asset ratio dropped slightly from 68% to 66%, and there is still room for further optimization.

In addition, BYD’s long-maligned problem of tight cash on the account still seems to exist. As of the end of the third quarter, BYD's book currency capital was 13.2 billion yuan, and its current assets totaled 107.8 billion yuan. Compared with its revenue scale, the cash flow situation really needs to be further improved.

On the whole, BYD delivered an excellent third-quarter financial report, and the growth trend may continue in the next quarter: BYD said that BYD Han and the remodeled flagship model BYD Tang have accumulated a large number of backlogs and are expected to continue to promote The company's new energy vehicle sales have grown strongly, and the annual cumulative net profit is expected to be RMB 4.2-4.6 billion, a year-on-year increase of 160.15%-184.93%.

This Q3 financial report was released after the market on October 29. Before the financial report was released, the market expressed full expectations. BYD's share price reached a new high on the same day, and further secured the No. 1 market value of A-share auto companies.

The financial report did not disappoint. However, looking beyond the general background of favorable policies and rising market enthusiasm, is BYD's performance and achievements really worth 430 billion in market value?

New counterattack

July 13 was the day when BYD’s market value surpassed SAIC, and just one day before, BYD Han series models were officially launched.

BYD's stock price has continued to rise in recent months, which is closely related to BYD Han's best-selling. The reason behind this is that the new energy vehicle market of more than 200,000 yuan has been dominated by new forces such as Tesla, and Han’s hot sales means that BYD has broken through this blockade, revealing that BYD is in the high-end market. The potential and brand premium power.

BYD Han is one of the dark horses in this year's new energy car track. In May of this year, BYD officially announced that the number of orders for Han models reached 15,000. Before the official launch in July, the number of orders officially disclosed by BYD had accumulated to 30,000.

Han's success has driven the increase in the overall sales of BYD's new energy vehicles, and has also brought BYD a higher degree of market attention. One piece of news that made the market buoyant was that in September, according to data from the Federation of Passenger Transport Associations, SAIC-GM-Wuling won the sales champion of the new energy vehicle market , followed by BYD, and Tesla China ranked third. The story of Tesla China's continuous monopoly on the sales champion of new energy vehicles was ended by two traditional independent brands, GM Wuling and BYD.

But it needs to be pointed out that, compared to GM Wuling and Tesla, which have only one main model (Wuling Hongguang MINI EV, Tesla Model 3), BYD's overall sales are supported by its multiple series of models. In the TOP 10 list of new energy vehicle retail sales in September, in addition to BYD Han EV, all-new Qin EV and BYD Tang DM are on the list.

Han, Qin, and Tang all belong to the BYD dynasty family. BYD's automotive product line is mainly divided into Dynasty family and e-series. The e-series are all pure electric vehicles. The Dynasty family series models usually use pure electric, hybrid, and fuel versions.

At present, BYD's product layout is mainly based on the Dynasty series. The three series of Song, Qin and Yuan have lower prices, ranging from 60,000 to 180,000 yuan, and Tang and Han are set at more than 200,000 yuan. The number of versions of each product is different, and the number of models is different. Song has the largest number of versions. This is related to the fact that Song is in the largest SUV segment of compact SUVs. From the perspective of market performance, Qin and Han are both new energy sources each month. A frequent visitor to the TOP 10 list of auto retail sales.

In contrast, the e series released in March last year is more accurately positioned in the low-end market, and the official guide price is generally around 50,000 to 120,000 yuan.

Overall, in terms of product layout, BYD has adopted a matrix approach to expand market coverage. In addition, from BYD's release of high-end series of Han and Tang, as well as the lower-priced e-series, we can observe BYD's current strategic thinking-while consolidating its advantages in the low-end market, it gradually enters the mid- to high-end market.

Competitors of the e-series and the mid- and low-end series in Dynasty mainly come from traditional car companies, such as the Aion S under Guangzhou Automobile, one of the benchmark targets, which is priced at 146,800 and is a popular model in the new energy market in recent months. The Han and Tang series currently being promoted by BYD need to face the fight with Tesla Model 3 and new domestic car manufacturers.

Han is a model that was born against the Tesla Model 3. The official price is 230,000-280,000 yuan, which is in the same price range as the Model 3 that has just been reduced in price. It also has the same price as the Xiaopeng P7, which is also against the Model 3. Stronger competitive relationship.

From the perspective of car performance, Han's working condition cruising range is 550km-605km, while the Tesla long-endurance version can reach 668km working condition endurance, and the Xiaopeng P7 ultra-long-endurance smart version can reach 706km endurance, which is currently domestic The longest endurance electric car. In terms of acceleration to 100 kilometers, the speed range of the three Han EV models is 3.9-7.9s, while that of Tesla Model 3 is 3.4-5.6s and Xiaopeng P7 is 4.3-6.7s.

In terms of vehicle performance, the performance parameters of Tesla, BYD Han, and Xiaopeng P4 are not large. BYD Han is slightly inferior, but they are all in the first echelon of new energy models in the Chinese market.

However, in the process of intelligentization, BYD, as a traditional car company, still has a gap with new forces such as Tesla and Xiaopeng. Han EV has realized the L2 level autopilot system, but Tesla's fully autopilot FSD will be launched at the end of the year, and Xiaopeng P7 has also realized XPILOT 2.5+/3.0.

From the perspective of brand effect, BYD has a high brand awareness and recognition in the Chinese market after more than ten years of hard work, which helps BYD's new models to quickly open the market when they are launched. However, BYD is also facing the problem of brand aging and low-end image. Especially for the younger generation of consumers, Tesla's brand appeal is far better than BYD.

Compared with competing products, a highlight of Han is that it is the first model equipped with a blade battery. This battery, launched by BYD in March, features high safety as a selling point and supports Han's considerable cruising range.

In view of market performance, BYD Han has been recognized by the market after its listing. Compared with domestic new energy vehicles at the same price, it has achieved good results, but it is not enough to compete with Tesla Model 3. In September, the sales of Tesla Model 3 in China ranked second (11,329), BYD Han EV ranked sixth (3624), and Xiaopeng P7 was not on the list.

In this competitive landscape, Tesla is still further seizing the market space. In October, the Model 3 standard battery life version has been reduced to 249,900. With the advantages of better performance and stronger brand effect, Model 3 once again picked up the price butcher knife to harvest the market. In addition, as Model Y will be officially delivered in the Chinese market next year, BYD's product line advantages will be further eliminated.

However, Han's performance to some extent proves the feasibility of BYD's entry into the high-end market. Chinese self-owned brands have long been confined to the low-end market, and BYD Han, a mid-to-high-end model, has not fallen behind in the competition with new domestic forces.

In addition to entering the mid-to-high-end market and competing head-on with Tesla and new powers, BYD's other major development trend is to "de-fuel vehicles."

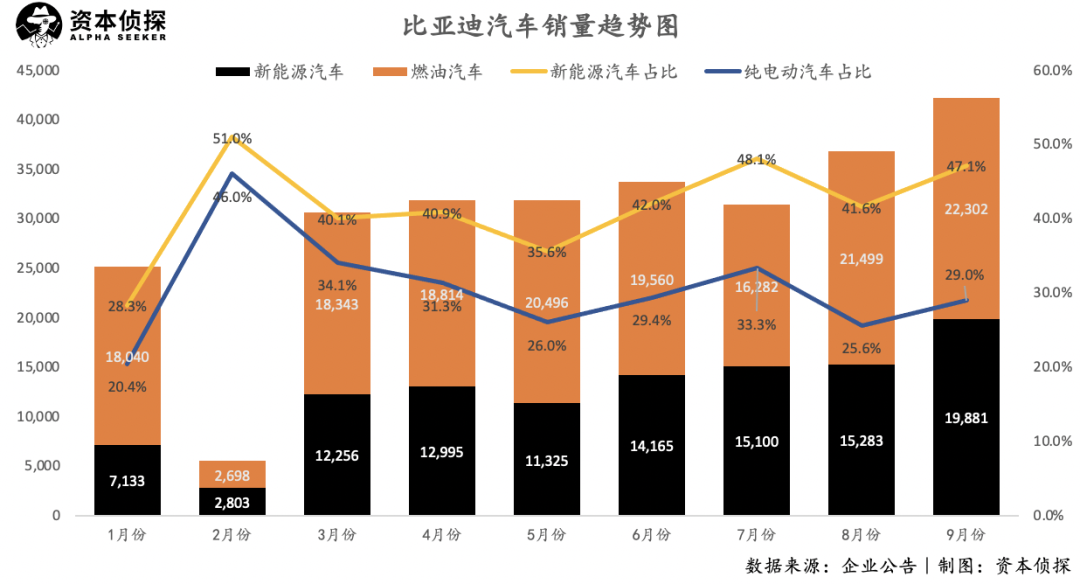

From the perspective of the composition of automobile sales, the proportion of BYD's new energy vehicles is increasing, and the gap with the sales of fuel vehicles is gradually disappearing. Moreover, BYD has not given up its ambition to "eliminate fuel vehicles." It stated at the investor exchange meeting in April this year that BYD’s fourth-generation plug-in hybrid power system DMi will become its core technology platform for the next three years. It is expected to be replaced on BYD’s full plug-in hybrid vehicles in 2021. BYD's fuel vehicles will all be converted into plug-in hybrids.

By expanding the product line layout and replacing fuel vehicles with hybrids, BYD is all in new energy, and constantly refreshes the market’s inherent impression of traditional brands, and seizes the user group that originally belonged to Tesla and new domestic forces. BYD Han is an important step in its transformation. Judging from the feedback from the capital market, BYD’s strategy has been initially recognized.

In addition to breakthroughs in new energy vehicles, another major reason for BYD's market expectations is that its power battery business, which has experienced ups and downs, has also shown signs of recovery this year.

Overall competitiveness

BYD Han can only win such a high degree of market attention, partly because this is BYD's first model with a blade battery.

The blade battery was launched in March this year. BYD has high hopes for this battery. Wang Chuanfu said: “BYD blade battery should correct the current development of the industry, and at the same time, it will redefine the safety of new energy vehicles and let new energy vehicles enter the fast lane of healthy development. , And more importantly, this will change the role and division of labor of Chinese auto companies in the world's new energy field."

In addition, on the safety of the blade battery and the ternary lithium battery of the Ningde era, the two sides also had a big battle and conducted several public "acupuncture experiments." This series of gimmicks makes the blade battery one of the most eye-catching new products in the power battery market this year.

A positive trend for BYD is that with the gradual exposure of the safety instability of ternary lithium batteries, the market is showing a trend of returning from ternary lithium batteries to lithium iron phosphate batteries, and lithium iron phosphate batteries are BYD’s Advantage areas. At the same time, the blade battery, which overcomes battery life and safety issues, is indeed competitive in terms of performance.

In terms of cost, the reason why blade batteries attract investors’ interest is that their cost advantages help to improve gross profit margins. Moreover, BYD blade batteries have begun to supply externally, and it is very likely to win orders from Daimler. Will help BYD release greater commercial value.

It can be observed that after the introduction of blade batteries, the power battery business has once again become the engine of BYD's market value increase.

Wang Chuanfu at the blade battery press conference

Power batteries used to be the soul of BYD's new energy business. Wang Chuanfu once believed that the core technology of new energy vehicles is power batteries, and the core key for BYD's new energy vehicles to maintain a leading edge in the market is to maintain the extremely high technology and process threshold of power batteries. Therefore, BYD, as the first domestic enterprise to independently develop and produce power batteries, only vertically supplies its own new energy vehicles. This helped BYD establish business barriers in the early stage, but it also made BYD miss the market opportunity of rapid growth of power batteries. .

In 2017, this situation was completely broken. In the absence of rivals for domestic power batteries, a Ningde era emerged halfway, and BYD took the top market share. In 2017, CATL’s installed vehicle volume was 10.4 GWH, surpassing BYD for the first time and becoming the battery supplier with the largest shipment volume in the power battery market. The ternary lithium battery represented by the Ningde era has become the darling of the market due to its greater energy density, while the lithium iron phosphate battery represented by BYD has been gradually abandoned.

This year's market trend has changed, and BYD has gained the opportunity to regain a city with blade batteries. And BYD, which has learned a lesson, has tried hard to become more "open" in the past two years.

However, looking at the power battery market alone, but limited by the capacity constraints brought about by the vertical supply system and the external competitive environment, BYD still has not made any significant breakthroughs in external supply, which is not as good as CATL’s market share. There is a big gap. However, BYD's breakthrough in power batteries has made a significant contribution to enhancing the prospects and market value of BYD's new energy vehicles.

Therefore, in terms of revenue and profit, the current contribution of power batteries is limited, but the synergy between the battery business and the new energy vehicle business is obvious, and it has an effect on the company's valuation increase.

New energy vehicles and power batteries are the main market perception of BYD, and they are also the engine of BYD's value growth. However, it is worth noting that BYD's revenue and profit growth cannot be equated with the performance of the new energy business.

Among BYD’s various businesses, the importance of mobile phone components and assembly services may have been overlooked for a long time. In fact, this part of the business’s revenue accounted for as much as 40%, which is the guarantee for the stability of BYD’s development.

Combined with the observation of BYD's performance this year, in the first half of the year, the automobile business showed a downward trend, while the revenue of the mobile phone components and assembly business was the same as the same period last year. In addition, benefiting from the increase in the share of major customers, the increase in shipments of high-end smart products, and the doubling of shipments of glass and ceramic products, the profitability of mobile phone components and assembly business improved, which drove BYD's Q2 overall gross profit margin to increase by 2.87 month-on-month % To 20.53%.

It can be seen from this data that in the first half of the year, BYD was able to maintain its revenue scale despite the impact of the epidemic in its automobile business, and achieved a 119.88% year-on-year increase in net profit attributable to its parent in the second quarter, of which the mobile phone components and assembly business contributed. No.

In addition to the above-mentioned core businesses, BYD also has multiple identities:

BYD Semiconductor Co., Ltd. raised funds twice in May and June, with a valuation of 10.2 billion U.S. dollars, and has launched a spin-off and listing plan.

A few days ago, BYD launched a nationwide notebook, promoted from an electronic equipment OEM to a terminal manufacturer.

It has entered the photovoltaic business since 2007, and is still increasing its share of related companies this year.

The cloud rail business is benchmarked against CRRC. In the first half of the year, two major projects in Bishan, Chongqing and Pingshan, Shenzhen have made positive progress.

In the first half of the year, BYD quickly integrated resources to assist in the production of masks during the epidemic and quickly became the world's largest mask manufacturer.

Few companies can span many fields and business lines like BYD. BYD's continuous expansion of its business scope has indeed helped it tell many new stories, and it has a very positive attitude in diversifying risks and looking for new growth points. Moreover, this fully confirms BYD's strong supply chain capabilities.

However, operating many businesses at the same time tests BYD's ability to integrate and balance resources. In terms of actual performance, some of BYD's businesses have been dragging down the overall performance.

For example, in the photovoltaic business, BYD merged the photovoltaic business with the battery business in the financial report, and did not disclose specific revenue figures. In fact, its continuous loss has become an indisputable fact; for the cloud rail business, BYD’s Hengyang project was once started by the National Development and Reform Commission. Stop, this business that requires huge investment in the early stage has a strong uncertainty; in addition, for the latest notebooks launched by BYD, it has to compete with manufacturers that have established brand recognition such as Apple, Lenovo, and Huawei. Competitive pressure is not small.

From battery to foundry to car building, to such a complex and expansive business scope, BYD is indeed a legend. BYD has no shortage of supporters, such as Buffett is a loyal supporter of BYD. Now, after nearly a decade of stable market value, BYD has finally taken off.

However, in the process of simultaneous advancement of many of its businesses, there are still gaps in relevant capacity dimensions. Revenue mainly depends on the automobile business and mobile phone foundry business, of which the mobile phone foundry business has a low gross profit margin and limited contribution to valuation. For the rest of the photovoltaic business, semiconductor business, cloud rail business, etc., BYD is not deeply rooted as a crossover, and it is not competitive compared with senior players in the track, and these tracks happen to have huge investment, long return period, and The characteristic of extremely high uncertainty due to policy influence.

The iceberg under the water is worth noting. In addition to auto-related businesses, BYD’s many high-investment, long-cycle branch businesses have always been diluting the value generated by the auto business.

Considering BYD’s new energy business alone, BYD has taken a big step forward this year in terms of power batteries, new energy vehicles, brand image, etc.-for new domestic forces, especially products that are highly similar. For Xiaopeng, the counterattack from BYD, a traditional car company, should not be underestimated.

However, the forward-looking demonstrated by BYD still lags behind the new forces, and the technological progress in intelligence and Internet is not outstanding. When the reform of the "four modernizations" of the automobile goes further, BYD's disadvantages compared to the new powers will be more obvious, which will also restrict BYD's further exploration of higher-end markets.

At present, BYD is transforming from the low-end market through Han, but the prices of the two high-end series models of Han and Tang are only comparable to Tesla Model 3, the most affordable model in its product line. If BYD wants to complete the counterattack against new forces, further development of high-end lines is a necessary step. Under the long-standing brand image restrictions, it is difficult for BYD to enter the luxury market of more than 300,000 yuan and even higher prices.

In any case, BYD’s performance has given the traditional car companies that have been under pressure this year some confidence, but with the title of "China’s No. 1 Car Company by Market Value", BYD needs to be more calm-whether it is BYD or a new domestic car manufacturer, It is still a long way to catch up with Tesla.

Comments

Post a Comment