The IPO opened soaring 22%, but the story of MINISO is getting harder to tell

After seven years, Ye Guofu finally got his wish.

On the evening of October 15th, Beijing time, "Ten Yuan Store" MINISO was listed on the New York Stock Exchange under the stock code "MNSO". The opening price was reported at US$24.4, a 22% increase from the issue price of US$20.

While on a business project, "hey Ya Ya " There is no landing small board in 2013, but with the name of product excellence, "second pioneering" Ye Guofu listed or round dream. At the listing event, Ye Guofu said, “The listing is just a corporate milestone. MINISO will continue to strengthen the brand moat of MINISO, lead retail innovation and consumer innovation, and build a global leading retail model.”

Regarding MINISO, there are totally different opinions in public opinion. Fans regard its offline model as a standard, and believe that affordable products fit the trend of the masses' pursuit of cost-effectiveness. However, some people question its mode of small profits but quick turnover. In addition, negative labels such as "pseudo-Japanese" and "plagiarism" and MINISO's premium products almost follow suit.

With the completion of the IPO, the “king of offline cheap” that has spread all over the streets will set off a greater wave in the capital market and public opinion. Challenges and smoke, applause and controversy are coming to MINISO one after another.

The impact of the epidemic is serious, but the pace of expansion continues

In the previously disclosed prospectus, MINISO defined itself as "the world's No. 1 retailer of private-label lifestyle products." From the perspective of GMV and the number of stores, this description is not an exaggeration.

According to a report by Frost&Sullivan, an independent research institution, global private-brand comprehensive retail GMV reached US$52 billion in 2019, and MINISO accounted for US$2.7 billion (approximately RMB 19 billion) for 5.2%.

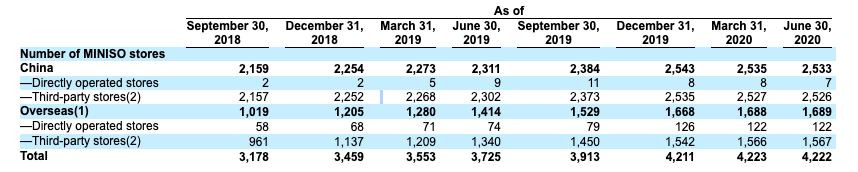

The prospectus shows that as of June 30, 2020, MINISO has built a retail network of more than 4,200 stores in more than 80 countries and regions around the world, including more than 2,500 stores in the Chinese market and 1,680 in overseas markets.

MINISO was founded in 2013, and it is amazing that it has reached such a scale in 7 years. However, if you look closely at the growth of various indicators, you will find that MINISO’s growth history is not all a story of triumphant advancement, especially in the ups and downs of 2020.

Beginning at the end of last year, the number of MINISO stores in China ended the previous growth trend, dropping from 2,543 to 2,533 at the end of June this year. A similar situation also appeared in overseas markets. In the first and second quarters of this year, MINISO’s overseas stores hardly grew.

Quarterly growth in the number of domestic and overseas stores of MINISO

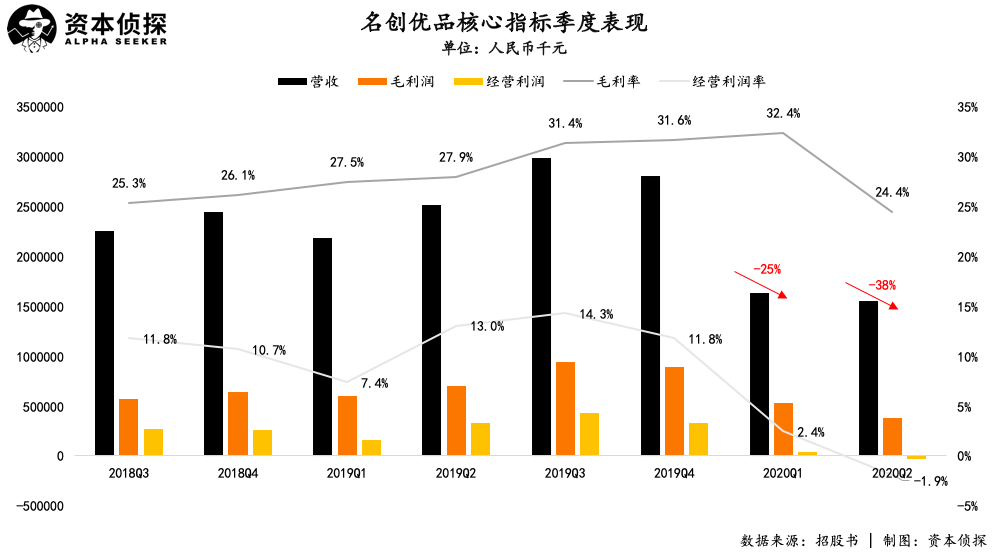

Since MINISO's business is mainly offline, the global epidemic is obviously the main reason for its development. The trouble is that the epidemic has not only slowed down the expansion of MINISO, but also seriously affected its financial performance.

According to the prospectus, MINISO’s revenue in the first quarter and second quarter of this year were 1.63 billion yuan and 1.55 billion yuan (in RMB unless otherwise specified), down 25% and 38% year-on-year.

In terms of profit, MINISO’s operating profit this year has also been declining. In the first quarter, it achieved operating profit of 39.83 million yuan, and its operating profit margin plummeted from over 10% to 2.4%. In the second quarter, it turned from profit to loss. The operating loss was 29.66 million yuan, and the operating profit margin fell to -1.9%.

Regarding the impact of the epidemic, Ye Guofu, the founder of MINISO, said this year that the epidemic has actually brought opportunities. MINISO will increase its target of opening 600 new stores worldwide to 1,200 in 2020 because of the large amount of free time. Don't miss out on quality properties with good locations and low rents.

This is also one of the purposes of MINISO’s IPO. The prospectus shows that the purpose of the funds raised by MINISO this time is to expand global stores and retail networks, upgrade warehousing and logistics networks, and upgrade digital operating systems.

The business model of MINISO is the key to being so obsessed with opening stores.

In MINISO’s business model, the core links such as design, R&D, and supply chain are all controlled by itself, while franchisees are responsible for store rent and decoration. Such a “light asset” model is conducive to its rapid expansion. Regardless of whether it is directly operated or franchised, the products are distributed by MINISO. The franchisees pay MINISO mainly for authorization fees and product deposits.

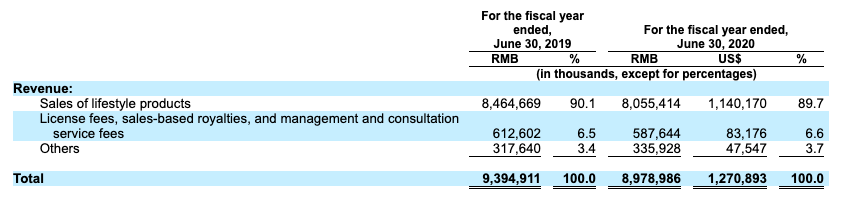

According to the prospectus, MINISO’s revenue mainly comes from product sales revenue, franchise management service fees and other three parts, of which product sales account for about 90% of total revenue. In other words, MINISO’s core means of obtaining revenue is "selling goods." If you want to grow, expansion is the most direct way, that is, the more stores you open, the higher your sales.

Revenue composition of MINISO

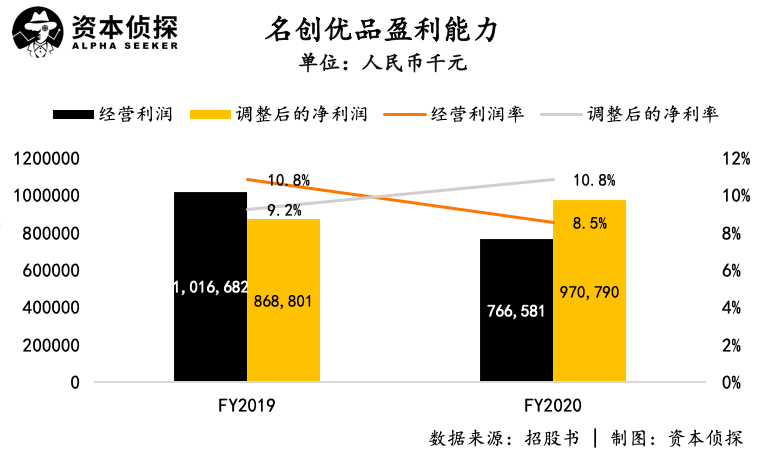

In terms of profitability, excluding the influence of factors such as changes in the fair value of preferred stocks and equity-settled share-based payments, MINISO’s adjusted net profit for fiscal year 2020 was 971 million yuan, a year-on-year increase of 11.7%, and the adjusted net profit margin was 10.8 %.

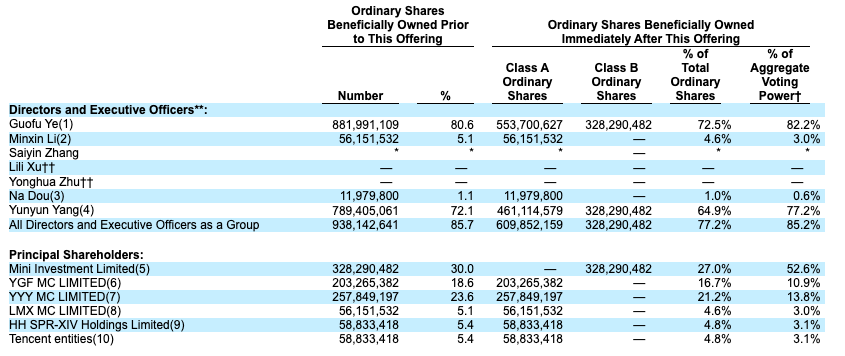

Compared with its peers in several rounds of financing, MINISO has rarely introduced external financing before. Before the IPO, founder Ye Guofu held 80.8% of the shares. The only external institutional shareholders were Tencent and Hillhouse Capital (HH SPR-XIV Holdings Limited is a fund of Hillhouse Capital), both of which held 5.4%. After the IPO, Ye Guofu holds 72.5% of the shares and 82.2% of the voting rights. Hillhouse Capital and Tencent both hold 4.8% and 3.1% of the voting rights.

The hidden worries of small profits but quick turnover

Like the company he founded, Ye Guofu himself has a considerable degree of discussion in public opinion.

Before founding MINISO, Ye Guofu was the founder of the retail chain brand "Oh Yeah". This ten-yuan store brand specializing in small accessories for young women made Ye Guofu on the rich list, but due to the rapid development of e-commerce in recent years, "Oh!" has now gradually disappeared from public view.

In 2013, Ye Guofu found a new way to get rich. In his new entrepreneurial project "MINISO", he expanded the target market from women's affordable accessories to a broader field of boutique department stores, but the business model is still obvious Traces of "Oh!": Not only is it still mainly offline, but also the previous "small profits but quick turnover" strategy.

Ye Guofu, founder of MINISO

Regarding MINISO, the most talked about by public opinion is its "cottage" attribute. In all fairness, whether it is logo or product design, MINISO has the implication of imitating Japanese brands Uniqlo and MUJI. As a new domestic brand, well-known foreign brands can obviously gain recognition faster.

MINISO’s abacus is to provide products of similar quality at a price much lower than that of its peers, while rapidly expanding the market, and doing big business with small profits but quick turnover. This idea obviously worked, though suffering from "cottage" question, but with the advantage of low prices, product excellence were very Fighter open market, stores everywhere in the country and the world,

In a 2017 sharing session, Ye Guofu summed up the breakthrough of MINISO as the "three highs and three lows", namely, high value, high quality, high efficiency and low cost, low gross profit and low price. From a disassembly point of view, the "three highs" realization path is mainly to find high-quality suppliers, and on this basis to achieve high-speed product iteration, while optimizing inventory and turnover efficiency.

In the context of the times, MINISO’s “three highs” are largely due to the domestic mature and flexible supply chain. In contrast, the "three lows" are the result of MINISO's intentional actions, and it is also the key to occupying users' minds.

The prospectus shows that more than 95% of MINISO’s products have a retail price of less than RMB 50 in China. Ye Guofu has repeatedly stated in public that only low cost and low gross profit can have a real low price, and it is called MINISO. Youpin’s gross profit margin is only 8%, while its peers are generally around 40%.

Companies take the initiative to give profits and allow consumers to use high-quality and inexpensive products. This sounds really impactful, but if the gross profit margin is really only 8%, it will be quite difficult for companies to make profits. In fact, judging from the prospectus, the gross profit margin of MINISO is not what Ye Guofu claimed.

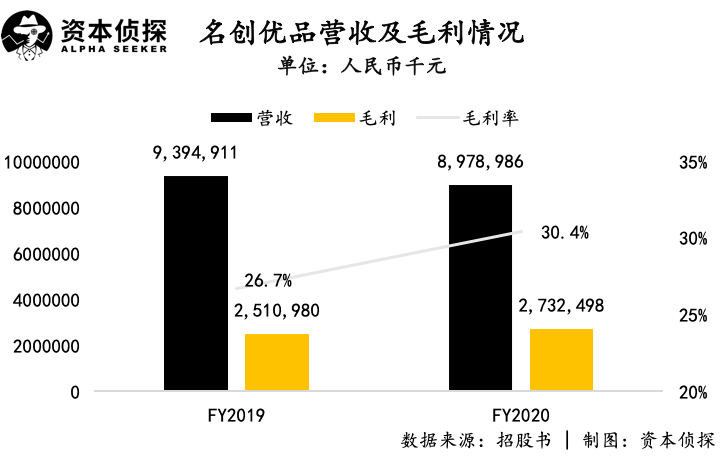

In fiscal year 2019 and fiscal year 2020, MINISO's gross profit margin was 26.7% and 30.4%, respectively, showing a gradual upward trend. The prospectus explains this that the increase in gross profit margin is due to the decline in the value-added tax rate and the promotion of high-margin joint products.

MINISO is already familiar with finding big IP joint names . Since its establishment, MINISO has successively cooperated with world-renowned IP such as HelloKitty, Bare Bear, Pink Panther, Marvel, and Mickey. The significance of the joint name is to obtain the premium brought by IP, thereby improving the company's profit performance under the mode of small profits but quick turnover.

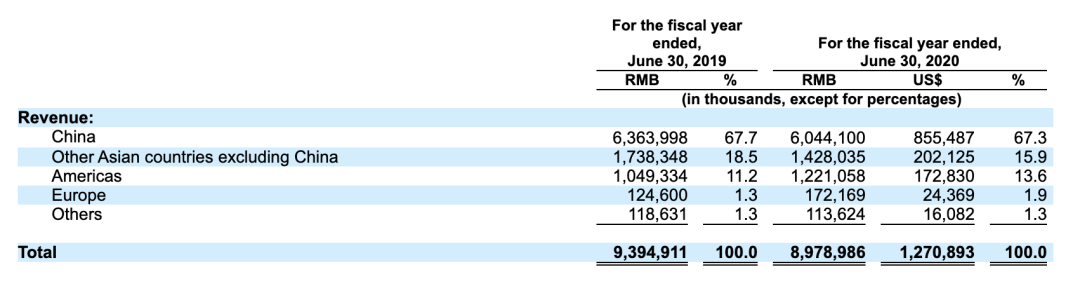

In addition to working with big IPs extensively, another feature of MINISO is its globalization. According to the prospectus, revenue from overseas markets has accounted for 30% of MINISO’s total revenue in fiscal year 2019 and 2020. the above.

Global revenue distribution of MINISO

In Ye Guofu, globalization is a way to spread the risk, because "eggs in one basket is very easy to destroy mission, to avoid the risk of globalization is the most easy to handle law."

But apart from that, MINISO’s active promotion of globalization may have financial considerations.

According to "Capital Detective", MINISO prefers locations with high traffic and high-end positioning. The former is a factor that all offline stores will consider, while the latter is the key to the rise of MINISO. When choosing high-end locations, MINISO has two main intentions:

The first is to use the added value of the location/commercial area itself to enhance the brand value of MINISO, so as to avoid the "feeling of price drop" brought about by the strategy of small profits but quick turnover;

The second is to contrast with surrounding shops, strengthen its own price advantage, and attract consumers who have the ability to consume but pay attention to the price-performance ratio.

This is a smart way to take advantage of strength. The problem is that the domestic high-quality spots that meet the requirements are limited after all. If the benefit of a single store is not well calculated, the more expansion will become a burden. In this context, it is imperative to focus on the broader global market. However, as the global epidemic has not cleared, MINISO’s expansion path will still face uncertainty.

In addition to the need to find more high-quality points, the mode of small profits but quick turnover has brought other problems.

Compared with the hot online wave of the retail industry, MINISO has always relied more on offline. This is not only related to the founder’s insistence on offline entities, but also has practical considerations-cooperation with e-commerce platforms means the need Pay additional advertising and marketing expenses and logistics expenses, and profits will be further diluted.

However, after being hit by the epidemic, MINISO actively embraced online, and it launched the social e-commerce platform "MINISO Employee In-App Purchase", and also cooperated with Ele.me, Meituan, SF and other cities for delivery in the same city. Over the live broadcast boom. In the prospectus, MINISO also explained its future strategic thinking. It stated that it would further develop its own e-commerce channels, strengthen cooperation with third-party e-commerce platforms at home and abroad, and use social media to increase brand influence.

Looking back on the development along the way, with its outstanding cost-effective advantages and radical expansion, MINISO quickly expanded its business and became the "world's most terrible rival" in the eyes of MUJI and Watsons. However, under the rapid growth, the mode of small profits but quick turnover It also brought constraints to MINISO. In addition to the launch of Alibaba’s "1 yuan store", major e-commerce platforms have heated up competition in the low-price market. MINISO needs to pay more attention to more than the business model itself. .

Both internal and external are facing new challenges. How to obtain new growth on the existing basis will be the key to MINISO after its listing.

I found your blog very informative. Thanks for sharing your knowledge.

ReplyDeletelic ipo date