What about being ridiculed for "cutting leek", Tesla Q3 performance has set a record

Is Tesla worth $400 billion in market value? When it released its earnings report last quarter, the market was arguing about this topic. Another quarter has passed, and people who like Tesla or hate Tesla remain the same. In the controversy, Tesla has always maintained a fierce growth momentum:

In the third quarter, Tesla's global delivery volume reached 139,000, a 44% year-on-year increase and a record high.

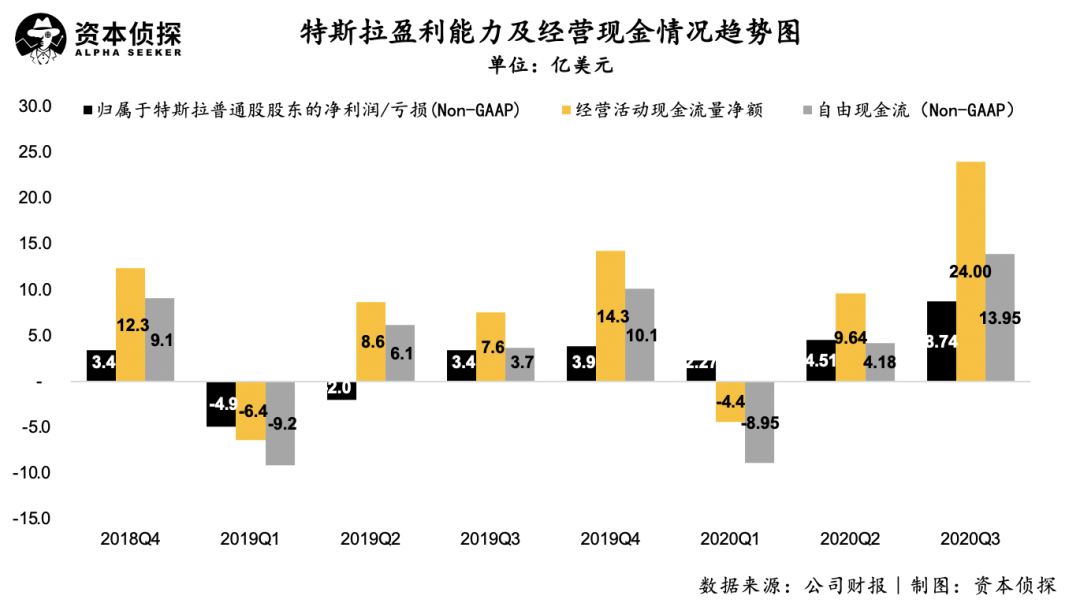

In the third quarter, Tesla achieved gross profit of US$2.06 billion, a year-on-year increase of 73%, and realized a net profit attributable to ordinary shareholders (non-GAAP) of US$870 million, a year-on-year increase of 157%, achieving profit for the fifth consecutive quarter.

At the same time, Tesla has taken a step further in autonomous driving technology. It has announced the launch of a fully automated driving test version to a small number of users on the evening of the 21st, and Musk also said on the call that Tesla is expected to launch a fully automated driving function by the end of this year.

In contrast to the dazzling performance, Tesla was caught in a whirlpool of public opinion several times in the third quarter.

In China, one of the most important markets, there are constant news about Tesla. One of the funniest ones is Sina Technology’s report that Tesla China bans employees from saying the word "leeks" and even prohibits the presence of leeks in the Shanghai super factory. Food, such as leek buns and leek dumplings.

Tesla's sensitivity to the term "leeks" stems from the dissatisfaction of old car owners caused by its frequent price cuts. This year, Tesla's best-selling series Model 3 has been conducted twice in April and October in the Chinese market this year. The price is reduced, and the price of the standard battery life version has been as low as 249,900 yuan. After the second price cut in early October, accusations of Tesla "cutting leeks" surged again.

A few days ago, there were rumors in the market that the price of Tesla Model 3 will be reduced to 199,000 yuan. Although the general manager of Tesla China quickly responded to the "outright rumor" among the car friends , consumers expressed their right Tesla is mentally prepared for possible price cuts in the future.

According to media statistics, since Tesla entered the Chinese market in December 2013, the official price range of its Model S, Model X, Model 3 and Model Y has been adjusted a total of about 59 times. Frequent price adjustments have caused Tesla to fall into a huge controversy in the Chinese market, and the label of "cut leek" is difficult to remove.

Old car owners hung up rights protection banners

The Chinese team is very frustrated for this, but in sharp contrast, Musk on the other side of the ocean is still proud. The market value of Tesla's stock has reached an average of $250 billion in six months. As long as Q3 Tesla's revenue or profit meets a certain target, Ma Skok has the opportunity to unlock the fourth batch of option rewards.

On the one hand, there are record high performances on the one hand, and on the other hand, there are endless doubts and disputes. In this strange contradiction, Tesla still has a fierce momentum.

Record quarter

Musk once again achieved what he had said.

In September, Musk declared in an internal e-mail that the company "is expected to set a new record in car delivery in the third quarter." Facts show that Tesla has indeed ushered in another highlight in Q3. Its global delivery reached 139,000 vehicles, a year-on-year increase of 44% and a record high.

At the same time, from the perspective of sales, Tesla also performed well, with vehicle sales reaching 145,000 in the third quarter, up 51% year-on-year. This is also the best figure in history, and it also indicates that Tesla's delivery in the next quarter is also worth looking forward to under the premise of ensuring production capacity.

Regarding production capacity, the annual output of Model 3/Y in its California plant has increased to 500,000, and the annual production capacity of Model 3 in Shanghai has reached 250,000, and Model Y will be mass-produced in 2021. At the same time, the Berlin plant is also expected to start production in 2021. It is foreseeable that, with the expansion of sales volume, Tesla will have a larger increase in production capacity next year.

The main contributor to sales is still the relatively affordable Model 3 series. According to calculations, the average selling price of Tesla's bicycles is $53,000, which is lower than the first two quarters of this year. At the same time, in the Chinese market in October, the Tesla Model 3 series cut prices again, and the average selling price of bicycles may be lowered again.

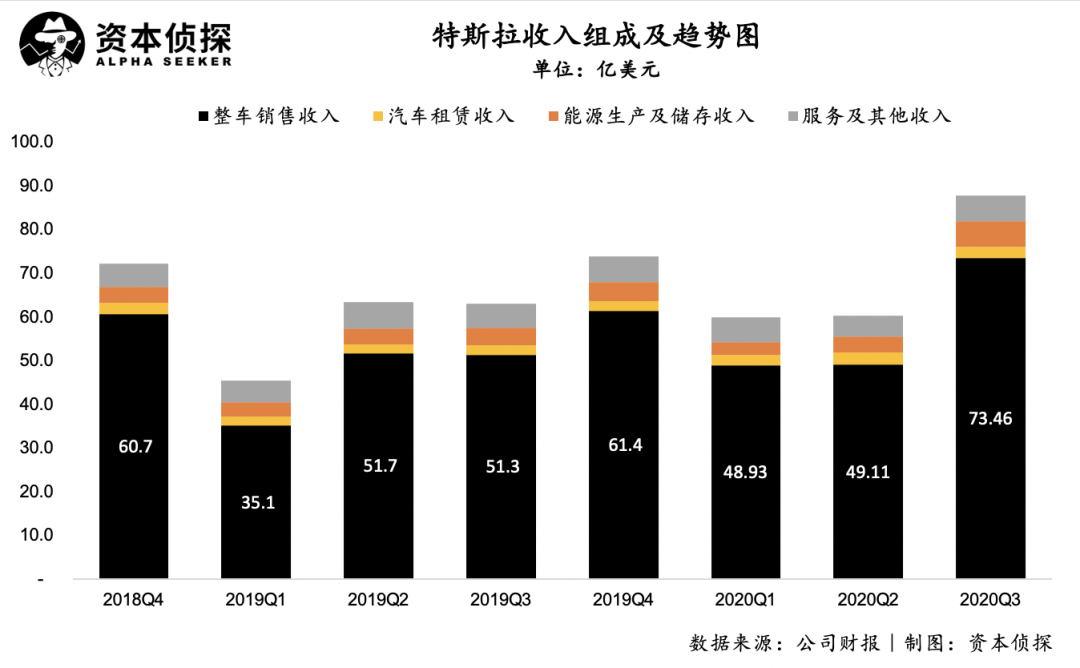

Tesla’s idea of lowering the average car unit price and expanding the scale of sales has achieved results. In the third quarter, its operating income has also achieved a substantial increase: total revenue reached 8.77 billion US dollars, an increase of 39% year-on-year; of which, vehicle sales Revenue was 7.34 billion US dollars, an increase of 43.1%.

In addition to the increase in revenue and delivery, the most noteworthy point in Tesla's earnings report is the re-optimization of its profitability.

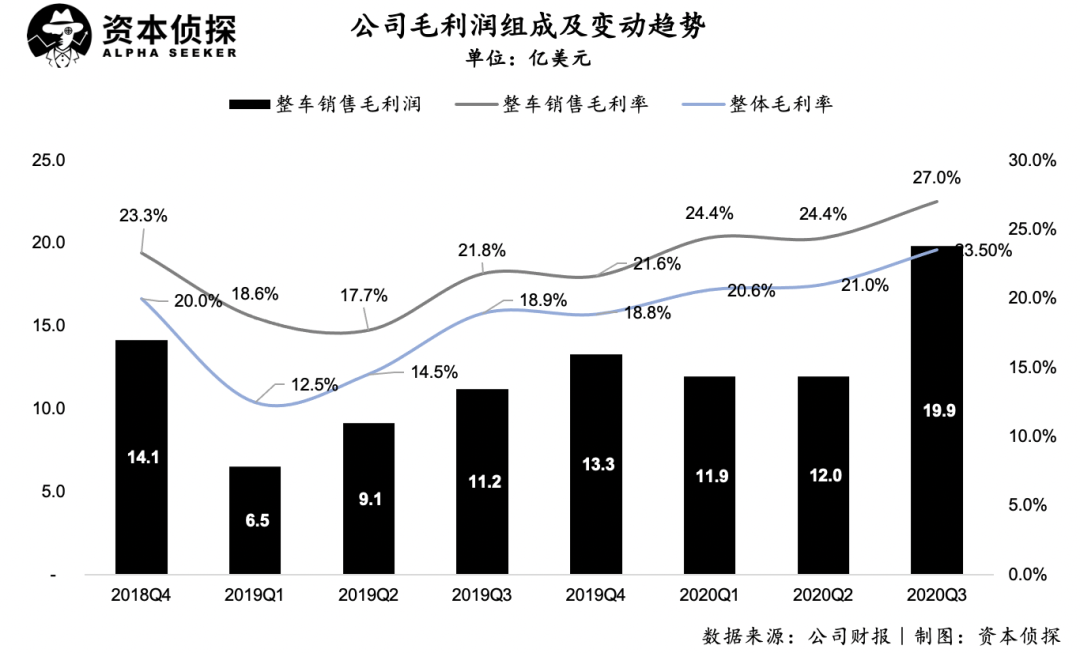

In the third quarter, Tesla achieved a gross profit of US$2.06 billion, up 73% year-on-year, and its gross profit margin increased from 18.9% in the same period last year to 23.5%. Among them, the gross profit margin of vehicle sales increased from 21.8% to 27.0%.

In the third quarter, Tesla achieved a net profit attributable to ordinary shareholders (non-GAAP) of US$870 million, a year-on-year increase of 157%, and the corresponding net profit margin increased to 10%.

The increase in sales and revenue comes more from the market's recognition of it, and Tesla's increased profitability reflected in this financial report more shows that the company's own business capabilities are gradually mature.

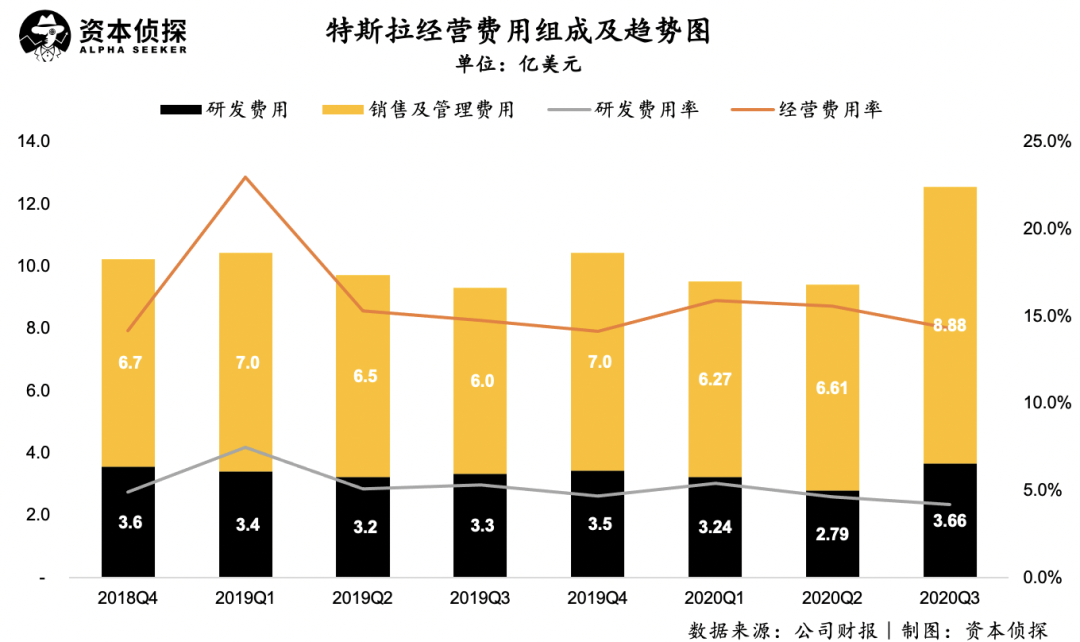

In terms of cost control, Tesla performed steadily, and its operating expense ratio dropped slightly to 14.3% from the previous two quarters. But it needs to be pointed out that part of the increase in Tesla's management expenses is used to pay Musk's incentive compensation. Since this year, the talented CEO has continuously unlocked multiple option rewards.

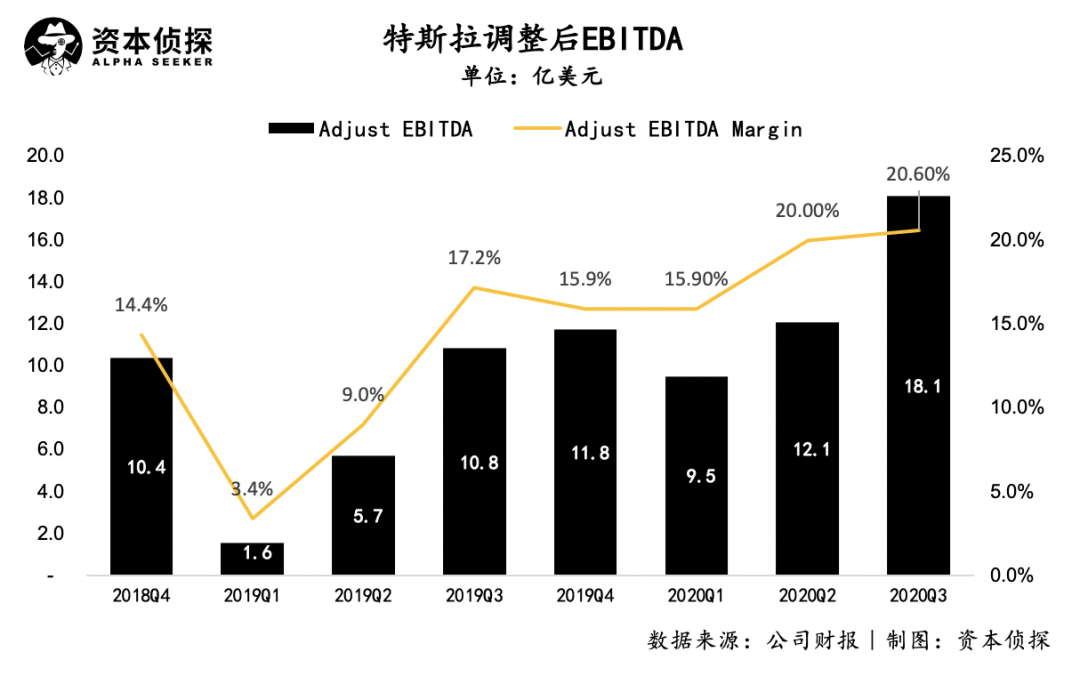

With the release of the Q3 financial report, Tesla’s adjusted EBITDA in the third quarter reached US$1.81 billion, which means that Tesla’s adjusted EBITDA for four consecutive quarters has exceeded the US$4.5 billion mark, and Musk has already obtained the unlock. The key to the fourth option may be another $3 billion in salary income.

No matter from which point of view, this is a financial report sufficient to satisfy the market. Since Tesla surpassed Toyota to reach the top of the global auto companies' market value list, there have been discussions about whether it is not worthy of its name, and the growth potential and growthability reflected in Tesla's financial reports have repeatedly disappointed short sellers. Up.

Sales are king

Behind the continued good performance this year is Tesla's series of radical measures against the market.

The performance of the third quarter revealed the uniqueness of Tesla as a company. Even though it has been caught in public opinion storms several times, there are many doubters and short sellers, but the market always favors Tesla.

At the beginning of this year, Tesla had set the goal of delivering 500,000 vehicles a year. Under the influence of the epidemic, the global vehicle market as a whole shrinks, but Tesla still maintains a good growth momentum. Musk said in an internal company email in early October that the company's vehicle production this year is still expected to reach 500,000 vehicles.

To achieve this goal, it means that Tesla needs to deliver 182,000 vehicles in the fourth quarter. "It all comes down to the fourth quarter. Please take any imaginable steps to increase production (while improving quality)."

Under this goal, Tesla has lowered prices in North America, Europe, and China this year. Under the surface of its aggressive pursuit of sales, its deeper strategic appeal is hidden.

First of all, the market share of electric vehicles is still very low compared with fuel vehicles, and there is still a gap between the scale of new power car companies such as Tesla and traditional car companies.

With the transformation of the automobile industry, although Tesla has already become the world's largest auto company by market value, the actual sales and delivery data do not match the stock price performance. In this context, one of Tesla's current priorities, which is burdened by investors' expectations, is to accelerate the electrification of the vehicle market and narrow the gap with traditional car companies.

Therefore, Tesla has repeatedly adjusted the prices of its models, especially the low-priced Model 3, squeezing the living space of electric vehicles and even fuel vehicles in the same price range, grabbing market share, and consolidating its current dominant position.

Secondly, expanding auto hardware shipments can also provide a basis for Tesla to expand its software revenue.

Judging from Tesla's current product layout, the software sales business has become increasingly strong. Tesla said it is expected to launch Fully Autonomous Driving (FSD) by the end of this year. The US version of this software is priced at US$8,000 and the price in China is 64,000 yuan-equivalent to about 1/4 of the price of the Model 3 standard battery life version. . Moreover, Musk also said that the price of FSD will become more and more expensive in the future, because there will be more functions added.

It is conceivable that with the introduction and gradual popularization of FSD and more software products, software revenue will become an important part of Tesla's revenue, and the gross profit margin brought by software will be much higher than vehicle sales. The prerequisite for the promotion of software is that the automotive products equipped with the software have a large enough scale.

This idea of Tesla is similar to that of Apple. In recent years, Apple has continuously increased its investment in software and online services, focusing on the creation of a software ecosystem. Tesla's investment in software is also a testament to the fact that Tesla is different from traditional car companies and has the attributes of a technology company.

In addition, in the Chinese market, Model 3 price cuts may also need to be attributed to its automotive product line layout.

The domestically produced Model Y will be launched in 2021. This is an SUV that is between the price of the luxury sedan Model S and the affordable sedan Model 3. In terms of product line layout, Tesla’s various models are clearly aimed at different levels of consumer groups. Therefore, Model 3 is one step ahead of the price drop, so that different models will open the gap at different price points, thinking that the upcoming domestic Model Y will create more Large market space.

Tesla car product line

For the above reasons, Tesla's frequent price cuts are not difficult to understand. Although its aggressive promotion strategy has caused a wave of ridicule, at least from the perspective of the realization of the financial report, Tesla has received positive market feedback.

Genius and lunatic are two common labels on Musk. Tesla's hurricane advances in recent years have confirmed Musk's ability and courage, but under a radical strategy, Tesla is not without any hidden worries.

Tesla's confidence and arrogance

Behind Tesla's frequent price cuts, there are more and more doubts, but sales are also increasing.

Taking the Chinese market as an example, after Tesla’s first price cut in April, its revenue in the Chinese market in the second quarter reached US$1.4 billion, a year-on-year increase of 102.9%. Tesla’s results after the second price cut in October still have to wait for four. quarter earnings data, said Ming, but from the point of view of existing achievements and feedback is not too bad, a staff post, said on social media, Model 3 orders flood of employees almost no time to eat or talk with customers.

Tesla does have the confidence to "cut leek".

In terms of cost, Tesla’s gross profit margin for vehicle sales reached 27% in the third quarter. This data supports Tesla’s expansion of sales at the expense of margins. If you only look at the Model 3 series, as early as 2018, a team of experts composed of German automakers had dismantled the car and concluded that the Model 3 cost was about 28,000 US dollars (about 186,000 yuan). With the Shanghai factory put into production and cooperation with the domestic battery manufacturer Ningde Times, the cost of domestic Tesla will only be lower than this figure, which provides Tesla with enough room for price reduction.

In addition, in terms of technology and brand, Tesla, as a well-deserved benchmark in the new energy market, is regarded as the auto company that best represents the future. The fully automated driving test version it just launched is another technological breakthrough ahead of the times. For consumers in the new era, Tesla's brand charm under the label of "future", "technology" and "trend" is an important reason why consumers are willing to be "leeks".

Brand influence consumer car purchase one of the key factors in the decision to buy. This has been further amplified in the Chinese market. For domestic consumers, automobiles are "asset products" second only to real estate, and consumers have extremely high demands for brands. Under this objective consumption concept, foreign brand cars have inherent advantages, not to mention Tesla, which is added to the concepts of "the world's first car company by market value" and "future car".

Price reduction is Tesla's means to expand its scale and improve its product structure, but the drawbacks that it may cause consumer rebound are also very obvious. At a time when the "leek theory" is becoming more and more popular, what Tesla needs to realize is that in the repeated harm to consumers, the brand advantage may also be wiped out.

Tesla's unwillingness to bow his head to please the market's style is extremely consistent with Musk's personal characteristics. No one will deny that Musk is a genius. Tesla can have a large number of followers and admirers, thanks in part to Musk's personal charm. Musk's high-profile and aggressive style of action is part of his charm, but after this temperament is integrated with the company, to gain general market recognition, it also needs to integrate more sophisticated and friendly consumer operating strategies.

As market penetration continues to deepen, Tesla must face consumers who are relatively unfamiliar with it, and how to win over these consumers determines Tesla's next stage of competition. From the current point of view, Tesla's frequent price cuts have caused a certain negative impact on its brand, which has even become a breakthrough point for some friends.

And Musk does not seem to realize the problem. In early October, Tesla has announced the dissolution of the North American public relations team, which means that Tesla refused to communicate with the media in depth, and corporate news will only be released through official accounts or Musk’s personal Twitter accounts. Tesla believes that the public relations team in the new media era no longer has the need to exist. From this move, Musk's advanced business philosophy can also be seen.

In the Chinese market, Tesla fell into a brand crisis several times last quarter due to price cuts and disputes with Pinduoduo. Most of Tesla’s official responses were posted on Weibo through Tao Lin, its vice president of external affairs . This is exactly the same as Musk's personal Twitter as Tesla's official speaking window. In addition, in addition to a large number of official statements on Weibo, Tesla Model S continues to cut prices, and only released a three-month confidence guarantee plan to go offline, which shows that Tesla does not seem to pay enough attention to external disputes. .

With Tesla’s existing technology and brand advantages, market suspicions and disputes have not actually caused Tesla any harm. However, as new domestic car-making forces continue to catch up in technology, it remains to be seen how much consumers can tolerate Tesla's arrogant attitude. In sharp contrast with Tesla, the domestic new car representative company NIO, happens to be characterized by high-quality car owner services.

The importance of the Chinese market to Tesla is rising. In addition to taking responsibility for sales growth, Tesla has announced that it will start exporting China-made Model 3 electric vehicles to more than ten European countries including Germany, France, Italy, and Switzerland. The Chinese market has become a major center of Tesla’s production and sales. Therefore, the brand crisis faced by Tesla in the Chinese market will further magnify the threat to Tesla.

With the financial report being made public, Musk, who is very likely to get another huge sum of money, should probably focus more on the other side of the ocean. As an outsider, in this country where humility is a courtesy, an arrogant attitude that disregards the wishes of consumers is not the best way for a company to survive.

Comments

Post a Comment