Demystifying the evolution of car costs: software licensing fees have triggered controversy among car companies, and Tesla's gameplay is unstoppable

- Get link

- X

- Other Apps

From the perspective of vehicle BOM, software is playing an increasingly important role in automobiles.

Software is changing the way cars are played.

Whether it is from the vehicle BOM (Bill of Material) or from the price, software is reshaping the value chain of automobiles.

Take a smart car with a cost of 200,000 yuan as an example:

The software cost included in the BOM has exceeded 1,000 yuan. And as the intelligent level of cars continues to rise, the proportion of software continues to increase.

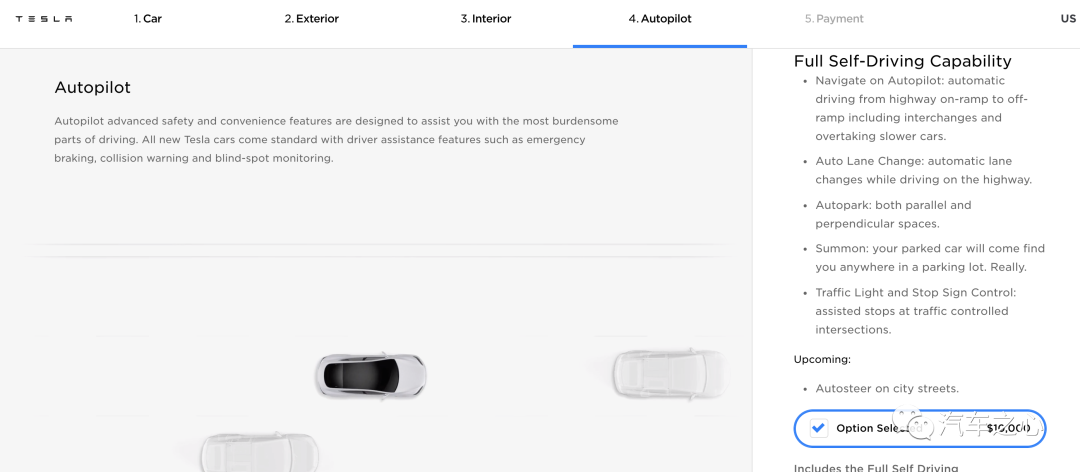

Since November, Tesla's FSD software package has risen to $10,000.

On the Model 3 with a retail price of less than US$40,000 (the cheapest standard battery life upgrade version is US$31,690), the price of "buy a package" has already accounted for a quarter of the car price.

The confusion of OEMs, how to treat software costs?

It happened at a fixed-point meeting.

I stated the final negotiated price of a domain controller, and the split explained the various costs. Unexpectedly, the last cost caused the audience to question: the license fee.

"Why do we have to charge a license for each product in addition to management costs and profits? This seems to be an additional profit!" The colleague in charge of cost accounting was very puzzled, "In particular, we have to pay for this product customized Development costs!"

I can fully understand his doubts.

Traditionally, in a car dominated by hardware, every cost is tangible.

In the long-term battle of wits and courage with suppliers, various OEMs have established complete databases and accounting methods, which makes every extra copper plate nowhere to hide.

Take a car window shaker switch as an example:

The material cost includes the resin used and the yield rate; the purchased parts cost includes the micro switch, the components and the light board on the PCBA; the manufacturing cost includes the PCBA patch, injection molding, chrome plating, assembly and testing; then consider the scrap in the process, Add direct and indirect labor, as well as machine depreciation and electricity.

In the end, a certain amount of management, sales, and four items of financial profit are given in proportion, plus the mold and special R&D expenses that are apportioned according to the quantity, which is the final purchase price.

Now that the "software-defined car" has taken root in the hearts of the people, newly emerged parts companies are beginning to claim that they are software companies instead of the traditional Tier 1.

Many of them even canceled their production bases, rented an office building in the center of the city where talents are gathered, and can start work by hiring a hundred engineers. All SMT (surface mount), injection molding and assembly, and even laboratory equipment can be outsourced.

You ask what are their assets?

People are our greatest asset. All CEOs of "software companies" will say so.

In the financial report to investors, they have no capital expenditures.

If sales can meet expectations, like the pioneer Microsoft, "software companies" will become cash cows without a profit.

OEMs have encountered real confusion: how to treat software costs?

Are they a one-time expense? Or can it be included in the vehicle’s BOM just like the visible and tangible power system, chassis, interior and exterior trim, and electronics?

The most difficult thing is, can the decision makers of the car factory really accept such a pricing method?

Are today's automakers paying excess profits to software companies?

Three ways to charge for software

Currently, the software-related fees charged by vehicle companies are mainly divided into three types:

The first is to purchase a specific software package through a one-time investment to obtain the permission to use this software for development.

Take the familiar AUTOSAR as an example.

In China, AUTOSAR has multiple agents such as Vector. The automaker talks to the agent about a development package suitable for its own enterprise. It can be based on the chip platform or the entire project, and pay a one-time fee of varying amounts. Use this software.

In the A-share market , Zhongke Chuangda and ArcherMind , whose business is somewhat similar to the service agent of the chip factory's father in China.

For example, if car companies want to use Qualcomm's smart cockpit chips on their vehicle models, they will undertake services.

Customers pay a lump-sum R&D fee, and Zhongke Chuangda and ArcherMind will provide adaptive development for smart cockpits based on Qualcomm chips.

This kind of cooperation model is more flexible. Some car manufacturers can make application-layer software by themselves, and then they can hand over the middle-layer software to such a service provider instead of buying the traditional cockpit Tier 1 standard development package.

The second is the software fee (License) of the bicycle.

The CPSP (Content provider / Service provider) fees often referred to in the industry often fall into this category. For example, car music, video software, etc.

Users have long been accustomed to subscribing to this type of software on mobile phones and iPads. Software vendors develop adaptability for the vehicle environment, screen size, resolution, etc., provide API or SDK, and access the vehicle’s Android system. Users often use their own The account of the mobile phone can continue to use the member service of the weekday subscription.

In this process, automakers usually pay software vendors several dollars per vehicle.

Generally speaking, the standard SDK does not require software vendors to develop additional adaptability. If you sell one more license, you get an extra money. When encountering this type of software, there is usually a lot of room for car manufacturers to bargain prices.

The software cost of a bicycle is often To B Only.

Taking high-precision maps as an example, in order to achieve more precise lane-level positioning and to achieve functions such as pilot assisted driving, car manufacturers often need to purchase high-precision map packages from graphic vendors.

In order to overcome the problem of GPS positioning failure in the environment of tunnels, bridges, and dense buildings, sometimes relying on satellite positioning differential algorithms such as RTK to achieve this type of service also requires a large license for bicycles.

These licenses cost hundreds of dollars per vehicle per year, stimulating the fragile nerves of the purchasing and cost departments of the auto factory.

The third is a combination of the first two.

Children only make choices. We need all the one-time R&D expenses and bicycle license!

This is also the most unacceptable one for the cost department of an OEM.

If it is for the development of a unique project, isn't it that the R&D expenses have already been reported? R&D expenses include the working hours and related expenses of project follow-up personnel, software personnel, and testers.

Then, for each car, a software license is required. What's the matter?

This kind of charging method is extremely common, and it may come from a chip factory with a specific algorithm, or an emerging Tier 1 positioned as a software company.

When automakers are still not comfortable paying for pure algorithms, the combination of software and hardware is indeed a "good curative" business model.

Not only did the pre-developer costs be shared by the customers substantially, sales will rise sharply with the increase in customer sales, and the marginal cost of the software is zero. If you sell one more, you will make a profit.

It is no wonder that emerging T1s with software capabilities are more likely to gain the favor of the capital market than traditional hardware companies.

The software investment of the car factory, the software is not piled up by the crowded tactics

The software investment of the car factory itself is becoming a non-negligible part of the cost.

Volkswagen once announced in 2019 that it will integrate its software personnel within the company, establish a software team of 10,000 employees by 2025, and increase the proportion of self-written software from less than 10% to 60% by then.

Companies such as Audi, BMW and Daimler have also made similar statements.

In the past, the collaboration model of distributed ECUs provided by different suppliers to OEMs has created inestimable difficulty for today's traditional car companies' OTA.

As early as 2016, Tesla pushed through OTA to enable Model X to perform Christmas dance music with Eagle Wing Door and light show.

In traditional car companies, such a festive OTA push to improve the theme of suspension, ambient lights, and cockpit interaction involves several suppliers writing code and joint debugging and testing, making cost and construction period uncontrollable factors.

It is precisely because of this that OEMs are increasingly eager to merge the major ECUs, allowing the internal software department to write the middle layer and APP layer code to meet the terminal market OTA requirements and to please users.

It's a pity that software is not piled up by crowds of tactics.

The status of the Volkswagen ID.3 parking lot with thousands of people flashing the machine is not alarmist.

An outstanding programmer is often better than the productivity of a hundred mediocre programmers.

On the road of software-defined cars, traditional car companies will have to go through additional detours and incur huge costs.

Are these personnel included in this year’s expenditure as R&D expenses? What about next year?

Regarding the investment of a certain platform, such as the internal research and development expenses on autonomous driving visual parking, whether to include the BOM cost, it does test the financial staff.

When visual parking can be additionally packaged into a software package and sold to users, it is particularly wise to allocate R&D costs to the BOM.

In the past, when we talked about the cost of automobile BOM, it basically referred to the engines, gearboxes, steering, brakes, interior and exterior trim, body-in-white, and electronic appliances.

Today, the proportion of software in the BOM cost is constantly rising.

Taking a smart car with a cost of 200,000 yuan as an example, the software cost included in the BOM has exceeded 1,000 yuan. And as the intelligent level of vehicles continues to rise, the proportion of software is still rising.

Software has become a cost component that cannot be ignored for the entire vehicle.

Very similar to the pre-installed Windows system and Office in the notebook computer industry.

Maybe car manufacturers can choose not to use QNX or Classic AUTOSAR for development, but the AEB algorithm, HD navigation map, 360 surround view stitching or visual parking algorithm on the Mobileye EyeQ series chip, DMS recognition algorithm, front-end sound source positioning, noise reduction and Recognition, ASR and natural semantic understanding in the voice cloud, QQ music or NetEase cloud music , Himalaya App or car "get"...

As long as it is a smart car, there is always a software that will make your BOM nowhere to escape.

Software tomorrow, from cost center to profit center

Fortunately, the software does not blindly increase the pressure on the BOM of the car factory.

People can hope for tomorrow-in the near future, software will be transformed from a cost center to a profit center.

Going back 20 years, in Shanzhai MP3 and the years where you can download music everywhere, buying genuine music on iTune is a fool's behavior.

The popular Thunder and BT, eDonkey, which is also nowhere to hide movie resources, tens of dollars to spend big in the cinema "support genuine", it is a luxury.

Passage of time, we have been accustomed to in the QQ music and iQIYI recharge every month on the purchase of Kindle unlimited read permissions.

In order to play on the glory of the king, we spend incredible prices to buy equipment and skins; in order to increase the speed of uploading and downloading, we purchase VIP members of Baidu Netdisk...

The purchase of software is undoubtedly a major advancement in consumer concepts, and the positive business cycle that it has promoted has encouraged new research and development and pushed the Internet industry forward.

With the saturation of users, various APP vendors are aiming at the smart car market, which may become the Internet giants, the next battleground for warriors.

Tesla announced its 2020 Q3 financial report, with cumulative software revenue exceeding $1 billion.

Of the 367,800 vehicles delivered by Tesla this year, 57% of the owners purchased the optional autopilot package.

Starting from the Autopilot system of $2,500 in 2015, Tesla's autopilot optional package has been upgraded to FSD Beta all the way, and the unit price has also risen to $10,000.

For Model 3 with a retail price of less than US$40,000 (the cheapest standard battery life upgraded version of the bare car is US$31,690), the price of "buy a package" has already accounted for 1/4 of the car price.

This is just the beginning.

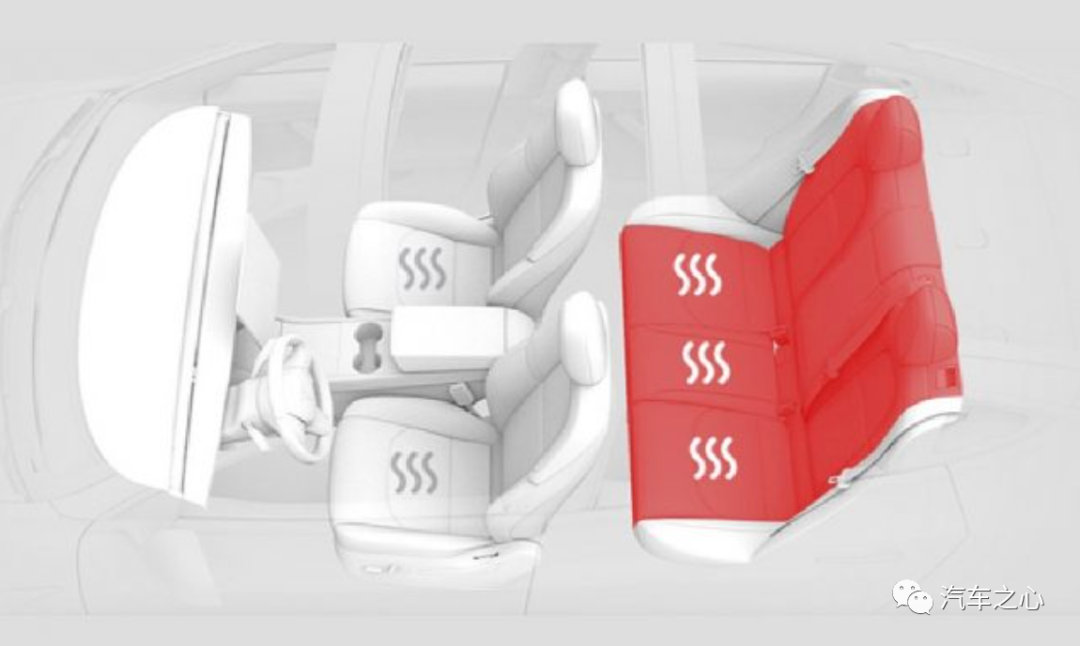

A wide variety of software has already targeted Tesla users' wallets.

An OTA acceleration package is $2,000, and an OTA seat heating is $300.

Battery life upgrades, games, streaming video, karaoke... There are a lot of software packages sold, a car, with more than a dozen software optional packages.

There is no difference in production, software OTA. Isn't it much more fragrant than traditional car hardware distribution that is difficult to control?

The new forces have also kept up.

NIO Pilot optional package is 15,000, if you want to upgrade to NOP, it is 40,000.

The NGP supported by Xiaopeng’s Xavier has not yet been upped by OTA, but it is said that the selection rate exceeds 50% of sales, which is really awesome.

In a word, people who buy these new things have completely different thinking.

What they want is better user software. Although it may be the "most expensive bag" bought in this life, this group of users feel that it is worth it.

Such people will become the main consumer in the world. no doubt.

If this doesn't make the comrades who calculate the cost of the auto factory feel happy, I don't know how to comfort it.

Tomorrow that is visible to the naked eye, the BOM cost paid by the car factory to the software company, plus the software R&D expenses invested by the car factory itself, will most likely be transformed into one after another software product for car owners and users, and become the engine of profit for the automotive industry.

At that time, software will surpass steel, plastic, leather and PCBA boards and occupy an extremely important position in the BOM.

I still haven't been able to fully explain what kind of cost a software license is. My colleagues still believe that today's software companies charge high profits.

But we are all very clear, willing or not, the era of software has arrived.

- Get link

- X

- Other Apps

Comments

Post a Comment