How long can the capital feast of new energy vehicles last?

1 capital carnival feast

Let's first look at a set of data, comparing the market value growth of major global auto listed companies this year:

The two biggest characteristics of the ranking of the rise and fall list are that the growth rate of new car-building forces has more than doubled at every turn; the second is that traditional cars have basically no rise or even declined, which is in sharp contrast with the new forces.

Tesla's market value has soared from less than 80 billion US dollars to more than 400 billion US dollars, surpassing Toyota, the world's largest car salesperson, and all of the global traditional car brands are all at once.

Weilai’s stock price has doubled 9 times a year, and its market value has surpassed GM and Ferrari; Xiaopeng and Ideal Car have doubled their market value in less than three months after being listed, surpassing GAC and FAW, and tied with Geely.

BYD’s A shares tripled, with a market value of more than 500 billion yuan, surpassing Daimler and only one step away from the international luxury car brand Audi.

Not only that, in China, the Ningde era, which is related to the automobile industry, has also risen by 1.5 times, and the market value has just exceeded 600 billion yuan. Some people have guessed that it will not take long to break through the trillion mark.

After a rough calculation, only some of the new car-making forces mentioned above have increased their market value by more than 500 billion dollars this year, which is more than half of the total market value of other mainstream traditional car companies.

It can be seen that under the mad push of capital, the current global auto stocks are showing a one-sided pattern, and new forces are killing traditional cars without any effort.

Perhaps the following picture has more contrast and impact:

On the other hand, the raging epidemic this year has caused the global economy to fall into a cold winter. The national unemployment rate in most countries has soared, and the consumption power has plummeted. For domestic purposes, the total sales of the national passenger car market in the first September was 12.925 million, a cumulative decrease of 12.5% year-on-year. ; Among them, the sales of new energy vehicles were 734,000, a year-on-year decrease of 17.7%. This is also the root cause of the decline in sales of traditional car companies.

However, although new car manufacturers and traditional car companies have also suffered headwinds in the face of sudden changes in the macro environment, in the capital market, the two are split between ice and fire.

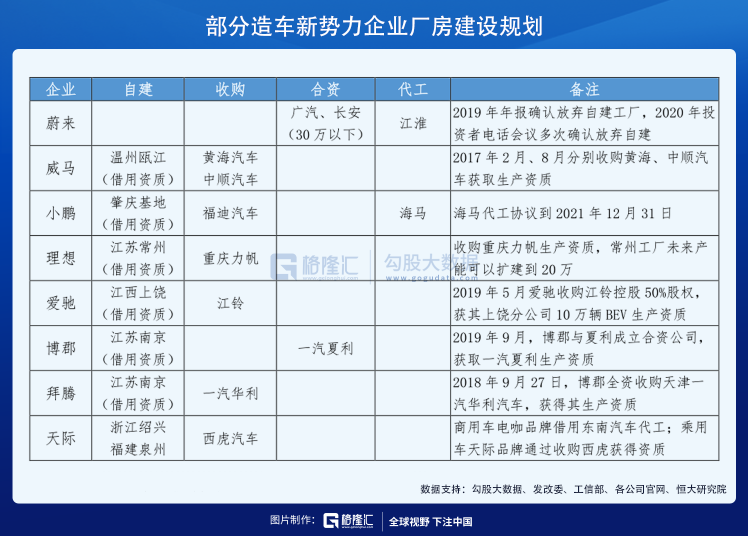

It is hard to believe that such a large number of loss-making auto companies that have just been established for a few years, and even have no workshops or workshops of their own, have so easily and quickly defeated the well-established traditional brands that have been established for a century.

How much of the restlessness and carnival given by the dividends of this era are worth the money, and how much are moisture and bubbles?

2Will history repeat itself again

In 2000, developed countries in Europe launched renewable energy development plans one after another, leading to a rapid expansion of consumer demand in the entire European photovoltaic market, and the photovoltaic industry began to quickly become the hottest emerging industry in the world at that time.

At that time, China’s photovoltaic industry was at the bottom end of the industrial chain, and the core technology front-end and market back-end with the highest yields were both in foreign countries. In order to reverse this unfavorable situation, China began to increase subsidies to guide companies to the industry. Development at both ends.

Due to considerable subsidies and policy guidance, a large number of photovoltaic companies have spread across the country overnight, and a large number of photovoltaic module manufacturing projects and polysilicon projects have sprung up.

At that time, Shi Zhengrong, a returnee from Australia, began to establish Wuxi Suntech Power Co., Ltd., which coincided with the big wind, and through rapid expansion, it quickly became the world's largest manufacturer of polysilicon battery modules.

In 2005, Suntech, which was founded only five years ago, was listed on the New York Stock Exchange. Shi Zhengrong reached the top of China's richest man with a net worth of 18.6 billion yuan.

Shi Zhengrong's great success has also stimulated countless ambitious capital to accelerate into the photovoltaic industry. By 2007, China had more than 10 polysilicon companies, more than 60 silicon wafer companies, more than 60 battery companies, and more than 330 module companies. The output of solar cells had increased by more than 600 times in six years, accounting for a share of the world's total output. 30%.

Soon more than a dozen photovoltaic companies began to go public in the United States, and the richest man in provinces and cities began to be born: Peng Xiaofeng, 32 years old, with a net worth of 40 billion yuan, became the youngest man in Jiangxi and the richest man in new energy; Yingli Miao Liansheng became the richest man in Hebei; Li Hejun of Hanergy , with a wealth of more than 160 billion yuan at his peak, once became the richest man in China. . .

However, when the European debt crisis broke out in 2009, the photovoltaic plans strongly supported by European countries were unsustainable. At the same time, in order to protect the domestic photovoltaic industry, European and American countries began to impose huge anti-dumping duties on Chinese photovoltaic products. The industry ushered in an instant disaster. Almost instantly, all photovoltaic companies fell into huge losses, and 90% of polysilicon companies were forced to suspend production.

By 2013, 99% of the global PV listed companies' market value had evaporated, more than 350 Chinese companies had gone bankrupt in the industry chain, and 11 leading companies had a total debt of nearly 150 billion. Shi Zhengrong’s assets were “zeroed” and left the market, Hanergy Li Hejun was 100 billion. Wealth was in vain, and Saiweipeng Xiaofeng fled because of a large amount of unpaid debts and became a wanted criminal.

The buzzing photovoltaic bubble was punctured at an alarming rate, leaving a whole lot of devastation. Only a few lucky people survived.

From a historical perspective, how similar is the global new energy vehicle replacement plan to the photovoltaic energy plan of the year?

It is also a global new energy plan. It is also a large number of companies around the world who have entered the market. It is also a stimulus and support under the macro background of the economic crisis. It is also a myth of mad wealth creation. Is it possible that the same ending will happen in the future?

Today, although global car sales continue to decline following economic growth, all companies, whether it is Tesla, BYD, or new car manufacturers, are eagerly working hard to launch new production capacity, for fear of being too slow to be robbed by others. It doesn’t matter whether consumers’ wallets and traditional brands agree or not.

Since the country initiated the new energy vehicle subsidy policy, the number of new energy vehicle registered companies in China has been soaring, with an increase of nearly four times in five years, and it is the industry with the fastest growth in the number of companies above designated size.

In the history of human automobile business, there is no period in which tens of billions of dollars can be raised through a PPT, and then a whole car can be burned out in just a few years through exaggerated burning of money.

There is not even a period when you can burn a brand without even having its own complete technology and factory, only through acquisition or foundry, and then successfully go public, with a market value that surpasses most traditional car companies, and it goes all at once. The height reached after decades of hard work by others.

Among these, how much is rational expansion, and how much is gambling-style recklessness?

3 More cruel elimination has not been staged

Unlike photovoltaics, this time is not the emergence of a new industry, but from a global new energy vehicle industry that has been based on hundreds of years and the competitive landscape has been rock solid.

A very realistic data-with the global economic downturn, the overall global car sales have continued to decline since 2017. Even in China, where high expectations are given, overall car sales have continued to decline, indicating the new forces The increase in sales is a cake robbed of old companies.

So this is a global market stock competition that is fighting for speed, capital, and technology, and it is a reshuffle of either you die or I live.

Whether you like it or not, no car company can stay aloof.

For the new car-building forces, they are not only facing the difficulties in the development of their own technologies and routes, but also facing challenges from other new forces.

Although the prospects for the development of new energy vehicles are very bright, the vast majority of players who have no strength can only become cannon fodder to accompany them.

At the beginning of this month, the Yangtze River Automobile , which has a background supported by Hong Kong's wealthy businessman Li Ka-shing, was ruled for liquidation. This is one of the earliest new forces in China's electric vehicle field. Now it is forced to go bankrupt as the capital chain is broken. "Yicuo" will always stay in the PPT stage.

Yangtze River Automobile is just a microcosm of many cannon fodder. In the past year, AIWAYS Automobile and Weimar Automobile announced the cancellation of year-end bonuses and other benefits, and Bojun Automobile was exposed to allow some employees to leave their jobs without pay. . . More electric car companies are struggling with the impact of the epidemic and industry competition.

The subsidy decline and the impact of the epidemic have accelerated the survival of the fittest in the industry. Previously, more than 300 new car manufacturers in China have eliminated a large number of players from forming teams, looking for financing, issuing PPT, and finding factories to make cars and deliver them. It can continue today. The number of models released is less than ten.

At this stage, PPT cars have been eliminated after rounds of competition, and only a few have got the finalist tickets. We have not seen more powerful new players enter the game, but the next competition between new forces and traditional old overlords is the real climax .

GM, Toyota, Ford, Audi, BMW, Mercedes-Benz, Ferrari, etc., traditional global super brands, have accumulated technology and huge capital and channel advantages over hundreds of years, and the deep-rooted brand power is by no means only a few years old. The new forces that have not built up can despise it.

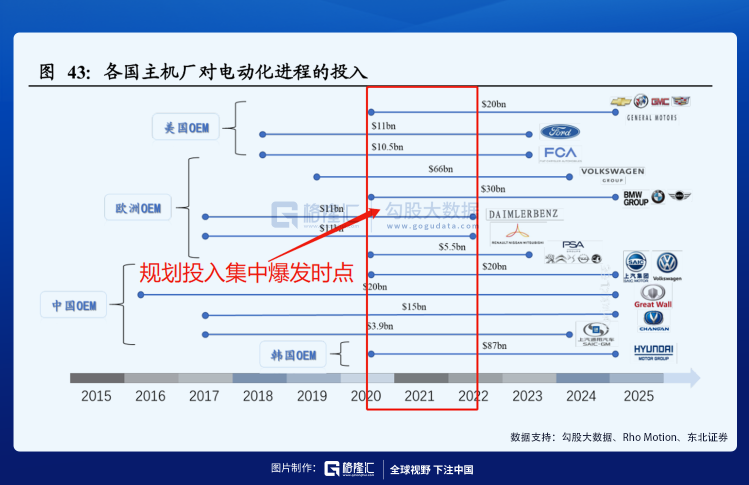

The current era full of traditional vehicles ball Pa main not likely to sit still. There was no big move before, and it was more just because the ship was too big to turn around, and it was necessary to judge the situation and then move, but once it was shot, it was likely to be thunderous and powerful:

Volkswagen: It has planned to invest 60 billion euros in electric mobility and digitalization. By 2025, the proportion of pure electric vehicles will be 20%. After 2025, at least 80 new energy models will be launched, corresponding to the BEV sales target of 2.5 million vehicles, of which 2025 There are approximately 1.1 million and 1.4 million vehicles in Europe and China respectively.

BMW: It is planned that 25% of electric vehicles will be electric vehicles in 2021, and at least 25 electric vehicles will be launched before 023. In 2025, sales of electric vehicles will increase by more than 30% every year, and 7 million electric vehicles will be sold within 10 years of 2030.

Daimler: By 2022, all models will provide electric models, and it is expected that there will be more than 20 models. In 2025, pure electric models will account for 25%; in 2030, the electrification rate of EV and PHEV passenger cars will reach 50%.

Toyota: It plans to complete more than 1 million electric vehicles in 2025, and sales of electric vehicles in 2030 will exceed 5.5 million.

and many more. . . . . .

Compared with the 100,000-level sales volume planned by the new domestic car-making forces in the next year or two, the actions of the above-mentioned traditional overlords can be described as "crushing", and they are not players of the same level.

Of course, Tesla, a big boss in the electric vehicle field, will have a million-level capacity in the future with the construction of several large factories around the world.

Even more frightening is that according to the production plans of each manufacturer, whether it is the super luxury car camp or the ordinary civil car brand, the next two years will usher in the concentrated release of production capacity. At that time, the global electric vehicle production will be The doubling type concentrated outbreak.

However, it is unlikely that explosive growth will occur from the consumer side, especially in an environment where there is still great uncertainty in the restoration of the global economy.

At that time, how will the huge output released at once be digested? Is it the new forces that are more attractive, or the traditional big brands are more popular with consumers.

In the future, when the traditional big brands are also electrified, how many people will fall into the difficulty of choosing BMW, Mercedes-Benz or NIO Tesla for the same price of more than 300,000 electric vehicles?

Although the current new car-making forces seem to be flying in line with their performance and valuation, and their growth momentum is the same, in fact, except for Tesla, most of them are very weak, and the model also has many problems that require time verification. For traditional old brands, apart from running for a while, they don't actually have much advantage.

It is foreseeable that the future of new energy vehicles will inevitably be a more cruel elimination and reshuffle.

4 epilogue

All emerging technology industries have similar technology industry maturity curves. Judging from the current trend, the current new energy automobile industry is still in a period of expected expansion, and it is far from the peak of expansion.

But it is undeniable that there must be a bubble in this. And the larger the market size of the new technology, the larger the bubble.

In terms of macro trends, the new energy vehicle plan is undoubtedly an epochal reform, and the resulting market is tens of trillions of scale, which is enough to nurture and carry many legendary deeds similar to Tesla.

Now is an era of capital turmoil. Under the catalysis of capital, many new car-making forces have grown out of nothing in just a few years, quickly catalyzed one new brand after another, and then sought to go public and realize it. The industry accumulated over a century of technology and experience has been transformed into a workshop and assembly line operation as simple as magic.

How many of these catalytic growth models can stand the test of competition and time and become new legends? How much will become the cannon fodder to be eliminated when the mature curve turns back?

Comments

Post a Comment