How long can Tesla be popular?

One

Is Tesla's stock really worth so much money?

I recently saw an article on the evaluation of Tesla's future value and gave a very interesting model.

Casey Wood, the founder of Ark Investment Management, said to Barron’s:

We believe that Tesla will launch a car-hailing network to compete with Uber (UBER) and Lyft (LYFT).

As if to work, then it will be able to provide the driver with the car, the total cost of ownership and operation will be about one-third lower than the Toyota Camry.

Casey Wood described Tesla's future value as follows:

The first stage: the profit margin of electric vehicles is around 20%;

The second stage: the ride-hailing service may be around 40%;

The third stage: the profit margin of software as a service and autonomous vehicles will be around 80%.

It seems that this is a very powerful profit margin structure, far more than just manufacturing cars.

In this way, Tesla's stock price is so high, it seems to make sense.

However, similar opportunities lie in front of other electric vehicle manufacturers, and even those giants who have not yet officially entered the market?

two

Recently, electric car companies have been particularly popular.

Weilai’s share price hit a record high, and its market value broke through the $50 billion mark, surpassing BMW, surpassing General Motors, and leaving Ford far behind.

Ideal Motors and Xiaopeng Motors followed closely behind, and their stock prices were not as high as startups.

There is also a veteran player BYD, who claims to be the "Huawei in electric cars" and believes that sooner or later, it will surpass the "Apple in electric cars" Tesla.

The world is changing so fast. Just last year, people were still asking:

How long can Tesla live?

Wall Street short-selling Tesla investment tycoons have always been brooding, insisting on not leaving the market, thinking that Tesla's popularity is just a bubble.

At the end of last year, NIO’s stock price fell to the lowest value of $1.19.

It seems that in the past six months, new energy vehicles have come to a major reversal, and the stock price of Weilai Automobile has risen almost 40 times.

The popularity of BYD, Weilai, Ideal and Xiaopeng, I think there are probably (and not limited to) the following:

1. China accounts for half of the new energy vehicle market;

2. The rise of domestic brands;

3. Policy support, and capital and consumers dare to try new things;

4. Intelligent electric vehicles have become a new toy for Chinese consumers;

5. New energy vehicle companies start from scratch without burden;

6. The founder of the company is the product manager, using Internet thinking to build cars.

At first, people generally doubted that laymen would really make cars.

How do these half-way renounced guys with no technical background compete with those century-old cars?

Later, people discovered that those big automobile companies turned out to be a group of dinosaurs.

The book "Ultimate New Energy Era" makes an analysis of this:

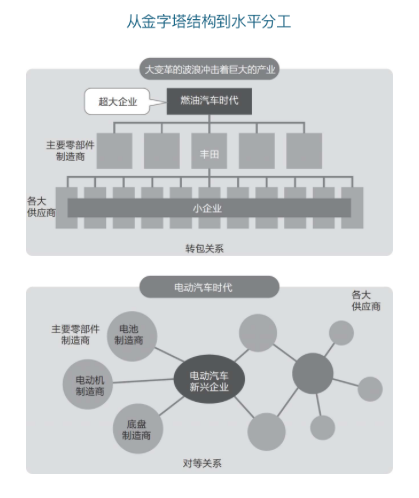

One of the reasons why Toyota is slower in electric vehicles is that it is bound by suppliers in a huge pyramid structure.

There are 800,000 people in the Japanese automobile manufacturing industry, of which 600,000 are engaged in parts manufacturing related industries.

The huge pyramid-shaped industrial structure of the automobile industry has become a heavy burden for Toyota and Honda.

Therefore, these companies seem to be hesitant in the shift from fuel-fueled vehicles to electric vehicles.

At the same time, the traditional auto industry relies on after-sales service to make money, which makes customers increasingly dissatisfied.

Why are traditional manufacturers turning so slowly? "Ultimate New Energy Era" also gives another reason:

If you want to survive the once-in-a-century era of great change, you must “think simply and act quickly”.

Looking back, Tesla’s success does not rely solely on its advanced technology. The electric motors it uses are the same as those in other factories, and the batteries are also universal products.

Tesla uses the idea of rapid iteration on the Internet, attaches importance to design, accurately benchmarks in the market, and simply focuses on making explosive models.

There is another reason. Tesla and NIO are the “indigenous people of automobiles” in the digital age. The founders also use the discourse system of the Internet, while traditional manufacturers seem a little out of place.

One of my own personal feelings is that the new generation may not be so powerful, but the old guys are too disappointed.

You use what traditional luxury car made of human hair refers to the interactive system, you will be feeling, why even a navigation guys are doing well.

three

Therefore, the title of this article "How long will Tesla be popular?" ", can also be changed to:

How long can electric cars be popular?

I remember that before the Internet bubble burst in 2000, the doubtful Buffett gave a speech. He used the analogy of the automobile industry in the early twentieth century to metaphor people's enthusiasm for the Internet.

He made a 70-page list that included all 2,000 automobile companies in the United States.

The automobile was the most important invention of the first half of the 20th century. It has a huge impact on people's lives.

If you witnessed how the country developed because of cars in the era when the first cars were born, you might say, "This is an area where I have to invest."

However, out of more than 2,000 auto companies a few decades ago, only 3 companies survived.

Buffett’s view is:

Although the automobile has had a huge positive impact on the United States, it has had an opposite impact on investors.

Munger’s attitude towards the Internet is:

The Internet is extremely good for society, but it is purely a disaster for capitalists.

The Internet can improve efficiency, but there are many things that improve efficiency but reduce profits.

Therefore, the Internet will allow American companies to make less money instead of more money.

However, for investors who are gamblers, Buffett's "old-school conservative" investment thinking is not applicable.

New energy, autopilot, shared network network, such a good theme, so much imagination, so sexy in the future, such a good bargaining chip, how can you ignore it?

Maybe no one can see which companies can run out in the end, then "buy the entire track".

Back then, even "shared bicycles" could bet. Of course, smart people felt that they would not be the last.

Human beings need a super business theme in any era, and bubbles have never been a problem.

What we want is imagination and chips.

four

So, what kind of company came out in the end?

The article begins with an investor’s expected profit model for Tesla:

The price of physical goods + the profit of services + the profit of network and AI services.

The last company of this type should be Apple, with a market value of over two trillion.

Apple mobile phones are expensive, and service profits are still growing rapidly.

Almost all the largest companies in the world are "cloud service" companies.

a. The customer side of cloud services is a subscription service.

Similar to Microsoft's Office365, Netflix's monthly fee includes the monthly fee for the battery of NIO and the monthly fee for the envisaged Tesla self-driving service.

b. The technical side of cloud services is artificial intelligence.

However, no matter how good the model is, it must return to the essence of business.

Important companies must have pricing power, that is, have some form of monopoly.

From the current point of view, the "monopoly" of electric vehicles is still very vague.

If you take the analogy of a smart phone, an electric car is a system + hardware, AI-based autonomous driving, and one more thing: the density of vehicles in the shared network.

If Tesla is Apple, will Google’s Waymo become the Android system in the field of autonomous driving?

Is BYD really the Huawei of new energy vehicles?

What about after Huawei personally enters the market?

How will companies like Didi that have a shared car network counterattack?

When will the Apple electric car be available?

It is foreseeable that there will be few winners in the market, and oligopoly will be more severe than in the era of fuel vehicles.

Fives

Now electric vehicle to earn money, part of the industry transfer of wealth, is part of the future imagined wealth.

The fierce wealth transfer is reminiscent of the "disruptive innovation" proposed by Harvard Business School Professor Clayton Christensen.

Christensen systematically studied "why big companies fail" in the book "The Innovator's Dilemma."

He proposed the new concept of "disruptive innovation" and came to a conclusion:

The more well-managed a company, the harder it is to get out of trouble when the moment of "disruptive innovation" arrives.

Super large companies are defeated by humble small companies. This scene appears in almost all industries, from department stores, finance, computer hardware to the Internet.

Today, in the field of electric vehicles, "disruptive innovation" is even more cruel.

This may explain why the electric car company, which was established a few years ago, has a market value far exceeding that of the established auto companies.

As practitioners and beneficiaries of "disruptive innovation", Bezos and Musk have repeatedly emphasized the "Day1" and "entrepreneurial spirit" of the organization. The company itself is also "self-destructing" and continuously accelerating evolution.

We will also notice that the founders of leading companies are "product managers + commercial traders" and benefit from the Internet's monopoly on communication effects.

to sum up

Finally, sum up 10 points:

1. The money made by "disruptive innovation" first comes from the transfer of wealth, rather than reinventing the wheel.

2. From hardware to service, from network to AI, business profit models are undergoing tremendous changes.

3. Upstart companies will use the existing infrastructure to make money, but they are predators and destroyers in value.

4. The value of the physical world and the value of the digital world are not only fusion, but also the struggle for control and the alternation of power.

5. Commodities are like flying knives. After the merchandise is sold by the merchant, it begins to create value for the company, not just the value of its hardware price.

6. The goods in the physical world will get better and cheaper, but it does not constitute a monopoly in itself, but to constitute a network effect "after the knife is shot".

7. Monopoly appears either in the human brain network, in the digital network, or in the time network.

8. The "subscription business model" based on cloud services and AI will be ubiquitous.

9. This is an era in which "belief" and "doubt" are difficult to distinguish. You can't believe in Musk, nor can you forget Buffett.

10. We must find a way to keep up with the wave and not be abandoned, but also beware of being swallowed up by the bubbles in the wave.

Comments

Post a Comment