Hunting the "calf"

- Get link

- X

- Other Apps

The electric two-wheeled vehicle industry has recently turned into a blue ocean market of 100 billion yuan.

There is no doubt that new energy vehicles are one of the hottest industries in 2020, but what may be overlooked by the market is the track of electric two-wheeled vehicles. The "Diaosi" industry has recently become a blue ocean market of 100 billion yuan. "The second round of electric power" has also become a powerful tool for analyzing the entire industry.

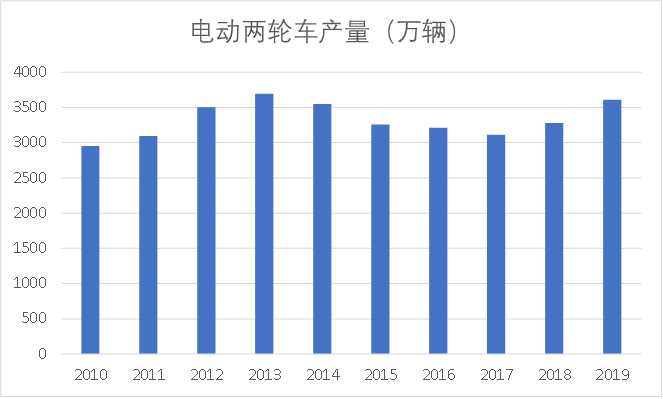

In the face of the development of the four-wheel electric vehicle industry in full swing, the two-wheel electric bicycle industry is uninterested and overshadowed. In fact, in terms of magnitude, the domestic sales of electric two-wheelers are now about 30 million vehicles per year, which is comparable to domestic four-wheelers. An order of magnitude.

Low-end manufacturing is a label that has not been removed in its development history for more than two decades. Even the industry leader Yadea Holdings (HK:01585), which has a market share of close to 20%, can only be locked at the bottom of the smile curve and become synonymous with low-end manufacturing. Yadea Holdings' gross profit margin was 13% from 2013 to 2019. -20% hovering at a low level, the net profit margin is only a terrible 3%-6%; another example is the Emma electric car, even if it is endorsed by the king of Jay Chou, it can not get rid of the gross profit margin of only 13%-17 during 2015-2018 % Dilemma.

Figure 1: Electric two-wheelers sell more than 30 million domestically each year, but they are synonymous with low-end manufacturing. Source: Wind

The forgotten electric two-wheeled vehicle has begun to be highly sought after in 2020. Funds have chosen to vote with their feet, and the electric two-wheeled vehicle market has blossomed everywhere in the A-share, Hong Kong and U.S. stock markets.

Since the beginning of 2020, the share price of Yadea Holdings, a traditional two-wheeled electric leader company, has continued to rise, with a cumulative increase of over 500%. The US-listed Mavericks Electric (NASDAQ:NIU) has increased by 310% during the year. A-share listed Xinri shares (SH: 603787) rose 170%. Bafang shares (SH: 603489) and Tianneng Power (HK: 00819) in the upper reaches of the industry chain also rose. Perhaps the only depressed person is that Emma Technology, which is still lining up for the A-share IPO, can only watch other people "get up and banquet guests."

This article, as the opening of the electric two-wheeler of the Damask Research Institute, will analyze the reasons behind the sudden popularity of two-wheelers and explore the competitive elements of the industry.

Figure 2: Yadi and Mavericks stock price trend chart during the year, source: Xueqiu

01 counter-attack Way

[1] The new national standard brings a new trend

The new national standard refers to the "E-Bike Safety Technical Specification" (GB17761-2018) promulgated on May 15, 2018. This standard was implemented on April 15, 2019 and has become the most important policy document affecting electric two-wheelers. Specifically, the key parameter limits of the new national standard are speed limit, weight limit, and battery voltage limit.

1. The maximum design speed does not exceed 25km/h;

2. The mass of a fully assembled electric two-wheeler should be less than or equal to 55kg;

3. The nominal voltage of the battery should be less than or equal to 48V.

Figure 3: Important indicators of electric two-wheelers in the new national standard, data source: "Safety Technical Specifications for Electric Bicycles"

The new national standard directly leads to the need to replace a huge stock of electric two-wheelers. There are more than 300 million two-wheeled electric vehicles in my country. According to the technical specifications of the new national standard, about 70% of them do not meet the requirements of the new national standard. With the formal implementation of the new national standard, various provinces and cities have successively introduced electric vehicle management rules to set a transition period for vehicles exceeding the standard. According to the disposal plan of local governments, the transition period will be concentrated in 2021-2023, and there will be an intensive peak of car replacement.

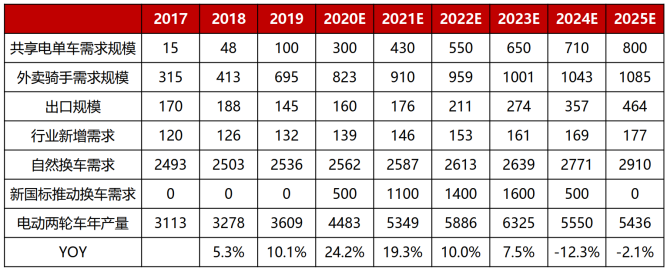

A simple estimate is that there are theoretically 210 million vehicles in stock that need to be replaced. Taking into account the implementation of strong discounts in rural urban areas, assuming that only half of them will eventually be replaced, and the vehicles will be completed in 2021-2023, then there will be 35 million replacements in the inventory every year. In 2019, the national output of two-wheel electric vehicles was only 36 million, which means that this is a doubled market.

Figure 4: Disposal plan for excessive electric bicycles by some local governments, data source: official websites of local governments

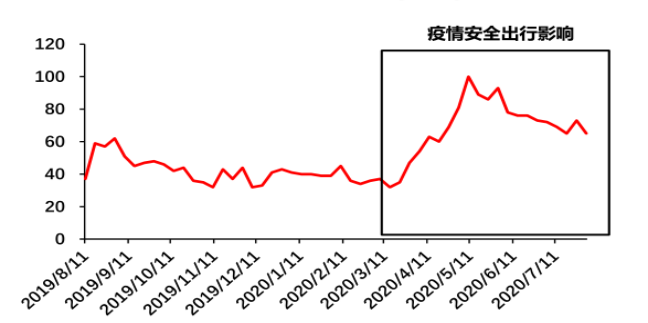

[2] The epidemic unexpectedly became a catalyst for the industry

Although the new national standard has led to a doubling of theoretical market demand, the capital market does not actually buy it. What is even more exaggerated is that from April 2019 to July 2019, the Mavericks stock price even cut in half. What really convinces the market that the logic of bullishness above is that the catalyst is the new crown epidemic beginning this year so far, and electric two-wheelers have become the beneficiaries of the epidemic.

Affected by the new crown epidemic, people who originally took public transportation for short trips began to choose to travel by bicycle. The advantages of the seemingly inconspicuous two-wheelers are highlighted:

1) Compared with taking public transportation, there is much less contact with people;

2) Riding in a well-ventilated outdoor scene can reduce the probability of infection;

3) Provide a point-to-point travel experience to minimize unnecessary stays. Especially in big cities with traffic jams, riding an electric vehicle does not have to worry about traffic jams, and there is no difficulty in parking, queuing to refuel, etc. It can be described as a tool for urban office workers to travel.

The global Google search index shows that after the outbreak, people’s attention to electric two-wheelers has increased significantly.

Figure 5: Best Electric Bike Google search popularity time trend (global), source: Google Trends, Founder Securities

Another indirect impact is that the outbreak of the epidemic has not only affected the way people travel, but has also catalyzed the transformation and upgrading of the traditional catering industry. More businesses attach importance to online development and promote the penetration of food delivery. As a result, the number of food delivery personnel has increased, and the electric vehicle market space has also been expanded. Only Meituan’s single platform, according to its released data, shows that from January to May 2020, the total number of newly registered and income riders on the platform has exceeded 1.07 million.

[3] The icing on the cake for overseas demand

European governments continue to promote travel energy conservation and emission reduction incentives. For example, Italy, France, the Netherlands, Switzerland, and Germany have specifically provided subsidies for local residents to purchase electric vehicles, which further stimulated electric vehicle sales. In addition, European countries plan to free up more space for bicycle riding: many bicycle lanes have been added in Germany; Paris plans to launch 650 kilometers of bicycle lanes; the Scottish government allocates 10 million pounds for new bicycle lanes.

The market penetration rate of electric two-wheeled vehicles in Southeast Asian countries on "motorcycles" is much lower than that of China, and is an important export country for my country's electric two-wheeled vehicle exports. India, which has the largest motorcycle sales in the world, has issued a policy plan to support the electrification of tricycles and two-wheelers. Thailand and Indonesia have also successively introduced policies to support the electrification of motorcycles.

Supported by the above benefits, electric two-wheeled vehicles with a compound production growth rate of only 2% from 2010 to 2019 have transformed into a growth industry. According to Founder Securities, the annual output of electric two-wheeled vehicles will reach 63.25 million by 2023. The compound growth rate from 2019 to 2023 will reach 15%, and it will become a growth track that is eager for funds. The industry scale will also double from 50 billion yuan to more than 100 billion yuan. According to the calculation table, it is clear that replacement has become the main driver force.

Figure 6: Estimated demand for electric two-wheelers, data source: Founder Securities

02 small test "bull knife"

Unlike Yadea, a traditional electric two-wheeler company that has been deeply involved in the industry for decades, Mavericks can be regarded as a "new force in the field of electric two-wheelers."

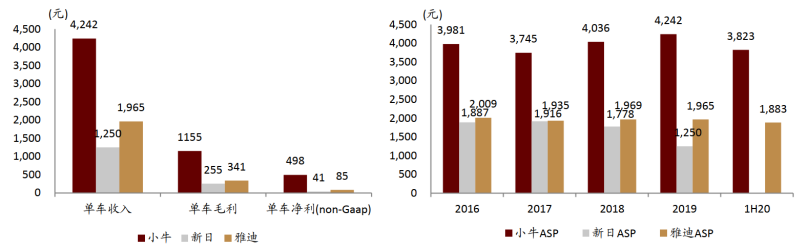

What is staggering is that the sales volume is only one-tenth of Yadi’s Mavericks, and the latest market value exceeds 15 billion yuan, while the market value of the city defender Yadi Holdings is only 33 billion yuan (the currency unit is RMB), and it is small Niu's Bicycle Value (ASP) is twice that of Yadi. Four-wheel vehicle industry is being staged in the "new forces" of the old forces roaring blaze of glory alternative, also played in the two-wheeler industry in full swing.

Figure 7: Mavericks Electric has the highest unit price, source: company announcement, CICC

[1] Intelligent positioning and implementation of the strategy of holding high

Traditional two-wheel electric vehicles are generally based on lead-acid batteries, which are heavy, have low battery life, mediocre appearance, poor body quality, and lack user experience. And most manufacturers on the market play the role of an assembly plant, and the entire industry is reduced to low-end manufacturing.

When Mavericks made its debut, it was positioned in the high-end smart field. All the company's products use lithium batteries, which weigh less than 1/3 of lead-acid batteries, and their battery life is greatly improved. While traditional brands are still fighting for prices, Mavericks dominates the field of two-wheeled electric vehicles with its aesthetic appearance and trendy interior. With the change of consumption concept and the increase of income level, people who pay attention to brand and product experience, especially the younger generation, the appearance and sense of intelligence of Mavericks become more attractive.

Picture 8: Mavericks electric promotion picture, source: company official website

【2】Introduced anti-theft function to face industry pain points

Electric vehicles and battery anti-theft have been criticized for a long time in the industry and have been plagued by users. After the purchase of the Mavericks electric car, the risk of the car being stolen is greatly reduced. Bind the frame number and SN code to the "Mavericks electric APP", and then the car will form the only connection with the APP, and you will have a unique connection. With his BID identity, he became the sole owner of this car.

At the same time, Mavericks Electric has installed a lot of smart sensors on the body to record riding information, and constantly monitor vehicle position and vehicle condition information, as well as battery life. Through these technological innovations, not only the pain points of vehicle theft are solved, but also a better riding experience is brought to users.

Figure 9: Mavericks electric APP interface, source: Mavericks electric APP

[3] Play the same traffic and circle fans

Like the NIO strategy established in the same year, the Mavericks also have their own circle economy and fan culture, and even the name "butter" was born.

"Butter" is the collective term for Mavericks electric users and fans. Mavericks Electric pioneered the electric car brand community, leading the fan culture of the electric car industry. The company's APP has strong social attributes, and users can interact and share with car friends on the APP . Not only has it improved the brand loyalty of old users, but also relied on the word-of-mouth communication value of fans to attract many new users. According to consumer surveys conducted in June 2018 in China Investment Corporation (CIC), Gu Mavericks electric two-wheeled electric car brand in customer satisfaction ranked first degree, 81% of users are interested in purchasing again.

03 hunting calves

The scale of the industry has doubled to hundreds of billions, and electric two-wheeled vehicles are also pursuing intelligence and high-end. The capital market realized that this track is good. Even taking into account the absence of any new benefits, the industry will continue to grow rapidly for 2-3 years. From an expected point of view, two-wheeler companies will still enjoy a bubble feast. For those who do business, they naturally salivate over this piece of fat.

In fact, we use several dimensions of industry research to carefully analyze Mavericks Electric, and it is really difficult to conclude that this company has core competitiveness.

The three major killers of the Mavericks discussed in the previous chapter are basically the "product power" analysis centered on the attributes of consumption, but the electric two-wheeler is a manufacturing industry after all, and the Mavericks as an assembly company can actually hardly escape the low-end vicious circle. ; And this is actually not obvious in the new power industry of four-wheeled vehicles, at least Tesla also has BMS, thermal management system, Autopolit and so on that car fans talk about.

The market is now very hot. In the period of rapid growth, everyone will naturally say that as the leading advantages become more prominent, manufacturing problems will gradually be digested. But in fact, the biggest problem facing this industry is: under the scenario of few manufacturing barriers, this The industry is likely to enter the Spring and Autumn Period and the Warring States Period; since the Mavericks can emerge suddenly, what about other players?

[1] Counterattack of traditional leading cars

Traditional electric vehicle leaders such as Yadi and Emma also launched products equipped with high-performance motors and lithium batteries such as Yadi Z3 and Emma U1S-Z after the introduction of the new national standard. Suppliers’ bargaining power and economies of scale, combined with their mature dealer system, will have an impact on Mavericks’ leading position in lithium batteries.

Yadea Holdings and Emma Technology both sold more than 5 million vehicles in 2019, far surpassing other players. This year, they will continue to widen the gap with latecomers. Compared with industry leaders, Mavericks' annual sales volume is only hundreds of thousands. Vehicles. Traditional players who choose high-end breakthroughs are not necessarily bad in brand recognition and product power. In particular, Mavericks’ innovations are obviously easy to "imitate". The supply chain is basically a public product, and the big deal is to buy parts. , Digging engineers.

[2] Other "new forces" enter the game

The low barrier to entry in this industry is most typically reflected in the light asset model. As of 2020, Mavericks Electric’s fixed assets are only 160 million yuan. Basically, if you sell a villa in a first-tier city, you have the funds to participate in the game. Once qualified, companies in other industries that want to extend their entry will naturally look at them.

In October of this year, Xiaomi Eco-Chain Enterprise No. 9 (SH: 689009) was listed on the Science and Technology Innovation Board. Currently, the company has launched E and C series products, mainly for benchmarking Mavericks.

Different from Mavericks’s initial online channels, No.9 Company adopted omni-channel marketing combining online and offline from the beginning to increase the penetration of product sales. The No. 9 electric car has now entered mainstream e-commerce platforms such as Xiaomi Mall , Tmall, JD.com, and Suning.com; in terms of offline channels, the company's products are launched on the Xiaomi home platform. In August 2020, Robot No. 9 released the No. 9 electric B-series electric car, priced at RMB 2,599. Consumer groups have also expanded from first- and second-tier cities to third, fourth, and fifth-tier cities.

Intelligent configuration: EABS energy recovery brake system, mobile phone sensor unlocking, constant speed cruise, triple intelligent positioning system (GPS + Beidou + base station), OTA upgrade and other functions are both compelling and practical. Many advanced technologies are not inferior to Mavericks, and Compared with mainstream similar products, it still maintains a super high cost performance.

[3] Shared motorcycles may not only be the demand side

On November 2, the first batch of "Shared Motorcycle Series Group Standards" was officially released. The standard for shared electric bicycles was released, with unified implementation standards and a basis for supervision, and shared electric bicycles became a regular army. Previously, the market was chaotic and the development of limited shared motorcycles will usher in a new outbreak period. According to iiMedia Consulting's data, in 2019, the scale of China's shared motorcycles reached 1 million, a year-on-year increase of 52%. It is estimated that the number of shared motorcycles will exceed 8 million in 2025.

In April of this year, Meituan placed orders for millions of shared motorcycles from Fujitec, Xinri and other companies. In August, Didi Qingju, which received financing, also launched two motorcycles, highlighting the importance of Internet giants on the motorcycle business. Remember that when shared bicycles were first launched, bicycle manufacturers suffered a strong market impact. Now that the army of shared motorcycles is surging, will the Mavericks' vitality be greatly injured when their strength is upgraded?

[4] Power battery giants dimensionality reduction strikes

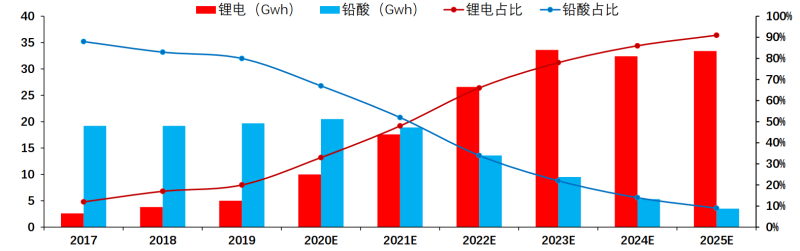

With the introduction of the new national standard, power lithium battery companies have begun to pay attention to this blue ocean market. The five domestic power battery giants: Ningde Times, Guoxuan Hi-Tech, Yiwei Lithium Energy, Lishen Battery, and BYD have successively entered the electric vehicle two-wheeler market. According to the research report "CAR OF FUTURE v4.0" released by Citi, it is expected that the compound annual growth rate of the lithium battery two-wheel electric vehicle market will accelerate to 62% in the next three years. Lithium batteries are expected to replace lead-acid batteries in large quantities. Niu Electric's first-mover advantage in lithium batteries is gradually disappearing.

Different from the four-wheeler market, lithium battery companies and vehicle companies in the four-wheeler market are basically developing simultaneously. Panasonic’s cylindrical ternary battery is becoming more and more mature with the support of Tesla. The domestic giant Ningde era is also tied Certain downstream auto companies have gained scale advantages.

Except for BYD's own ecology, basically all mainstream battery companies in the world will not get involved in the manufacture of complete vehicles. In the two-wheeled vehicle market, the value chain itself is basically in the hands of power battery companies. As the industry switches from lead-acid to lithium batteries, power battery companies that have been fighting fiercely in four-wheeled vehicles for many years will most likely become The two-wheeler industry chain's dimensionality reduction blow is not only for Mavericks, but also two-wheeler suppliers such as Xingheng Power , Tianneng Power (0819.HK), and Narada Power (SZ: 300068). .

- Get link

- X

- Other Apps

Comments

Post a Comment