L4 is used as L2, can Mobileye's next-generation solution break through?

- Get link

- X

- Other Apps

Can the secret weapon SuperVision become a new engine for Mobileye's performance growth?

The high-speed train is slowing down. Is Mobileye's growth peaking soon?

In 2019, the total car sales of global auto companies were nearly 90 million.

Mobileye achieved net income of 879 million US dollars that year, and its EyeQ series of chips shipped 17.4 million pieces throughout the year, accounting for nearly 20% of the entire market.

But in 2020, even for such a giant in the ADAS and autonomous driving industry, it will be difficult.

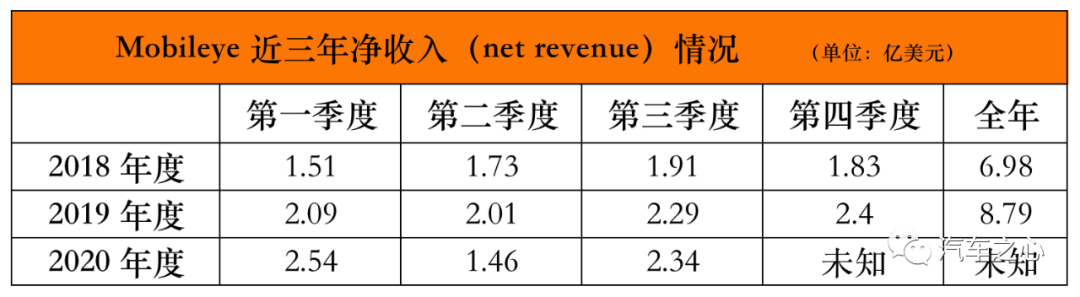

Look at the data for the first three quarters of this year:

In Q1 this year, Mobileye's net income was US$254 million, an increase of 22% over the same period last year;

But in Q2, its net income dropped by 27% from US$201 million in the same period last year to US$146 million;

In Q3 of this year, its net income rebounded only slightly by 2%, reaching US$234 million.

In terms of shipments and revenue, Mobileye may be unable to guarantee last year's results.

Where is this giant standing on the shoulders of the chip giant going next?

In the Chinese market, Geely, which just announced its alliance with it, will be Mobileye's noble person?

With EyeQ5 and the newly launched solution SuperVision, can Mobileye continue to turn stones into gold?

The high-speed train is slowing down

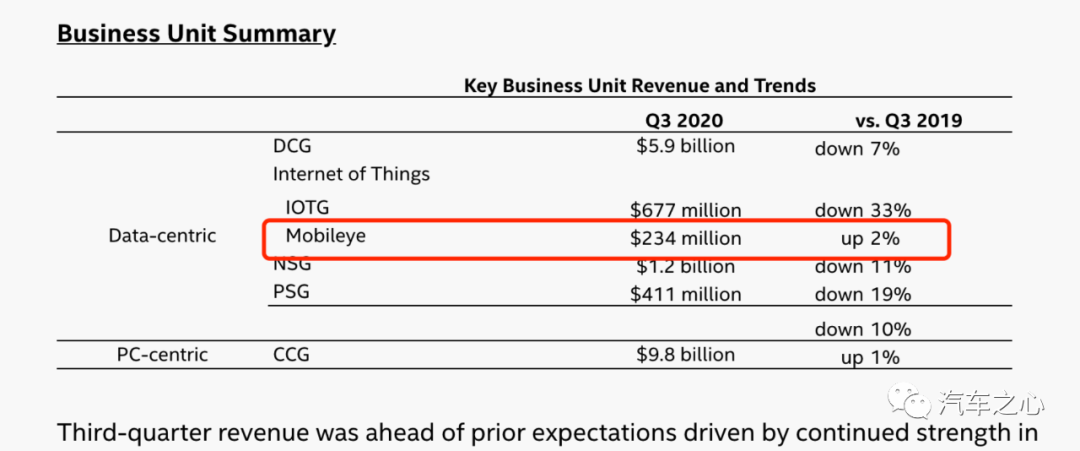

Intel’s third quarter 2020 earnings report released in October showed:

Its ADAS system and autonomous driving technology company Mobileye had a net revenue of US$234 million in this quarter, an increase of about 2% compared with the US$229 million in the same period in 2019.

If you take the time back one year, you will find that this growth rate has slowed down significantly.

Compared with the same period in 2018, Mobileye's net income in the third quarter of 2019 increased by 19.8%.

Last year was a year of rapid growth for Mobileye.

According to Intel's 2019 annual report, Mobileye's annual net income was US$879 million, an increase of US$181 million compared to 2018.

This year, the total global car sales volume was nearly 90 million units, and the single-year shipment of Mobileye EyeQ chips could reach 17.4 million units, accounting for nearly 20% of the entire market.

If we only count the models with ADAS and autonomous driving functions in this market, Mobileye's market share may reach more than 75%.

At that time, 47 cooperative projects of 26 car companies were underway, covering more than 300 models, of which 13 of the world's TOP 15 car companies chose to use Mobileye.

But in 2020, Mobileye will obviously be unable to maintain such rapid growth.

In the first three quarters of this year, Mobileye's total net income was $634 million. Due to the impact of the new crown epidemic, Mobileye's second-quarter performance fell 27%, and its net income for the quarter fell to US$146 million.

In the last quarter of this year, Mobileye needs to achieve a net income of US$245 million to ensure that its full-year performance remains the same as in 2019.

" Green and yellow not picking up ": EyeQ4 has overproduction peak, EyQ5 orders are still on the way

The slowdown in Mobileye's growth is caused by multiple factors.

Mobileye's business model is to provide ADAS and autonomous driving technology to car companies. The main way of cooperation is to provide perception algorithms and EyeQ chips for pre-installation mass production.

In the case of pre-installation and mass production, car companies will go through a series of processes such as technology selection, adaptation, testing, trial production, and mass production when developing new models. This process will take about three years.

Models equipped with the EyeQ4 chip will be available for delivery in 2018, which means that these orders have been confirmed in 2016 and 2017 and cooperation has begun.

A typical case is Weilai’s ES8, which is the world’s first mass-produced model equipped with Mobileye EyeQ4.

This model started research and development in 2016, was released in 2017, and was delivered in mid-2018. The delivery volume has grown rapidly in 2019.

This also means that around 2019, the models that Mobileye used EyeQ3 and EyeQ4 chips to hit the market have already been launched and completed the sales climb.

Therefore, it can be seen that in 2019, EyeQ chips reached a peak of mass production, achieving 17.4 million units shipped throughout the year.

In 2019, Mobileye won 13 of the world's TOP 15 car companies, and the EyeQ4 chip has also been mass-produced and put on the car.

Where does the next increase come from?

Is it to win the remaining 2 of the global TOP 15?

of course not.

Mobileye's answer is EyeQ5.

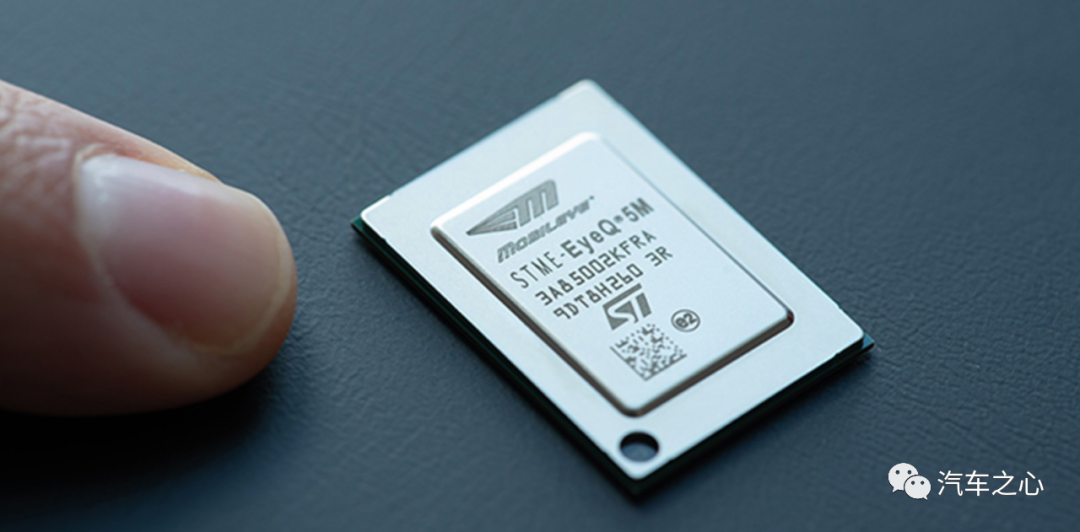

Selling higher-performance and higher-premium chips to automakers, while providing a more complete and powerful software solution than the original visual perception solution.

This software solution is SuperVision just launched.

EyeQ5+SuperVision is Mobileye's next stage of combo punches, even the core weapon.

The performance of EyeQ5 is about 10 times that of EyeQ4, exceeding 20 TOPS, but it has not yet been mass-produced.

BMW iNext will be the first mass-produced model equipped with EyeQ5, which will be launched in March 2021 at the earliest.

Therefore, EyeQ5 revenue has not yet come, and EyeQ4 revenue has gradually reached the top, which is one of the reasons why Mobileye's growth rate has slowed in the third quarter of 2020.

It can be said that Mobileye's business is in an awkward period of "no answer".

In addition to the changes in car companies' orders caused by product replacement and the epidemic, the slowdown in Mobileye's performance growth is also due to external competitors.

At present, in the computing hardware of intelligent driving, Nvidia's Drive AGX series chips are becoming the replacement of EyeQ series chips, and Xiaopeng, the ideal of China's new car forces, has chosen the Nvidia camp.

In the Chinese market, a number of smart driving chip suppliers have also emerged, such as Horizon and Black Sesame Intelligent Technology, all of which are grabbing orders from Mobileye. Huawei is also entering the hinterland of Mobileye.

In overseas markets, Qualcomm also launched the autonomous driving computing platform Snapdragon Ride.

The news that the heart of the car has learned is that there are already new Chinese car manufacturers testing the Snapdragon Ride platform.

The rise of this group of emerging suppliers will inevitably divide Mobileye's share.

Order growth has slowed, rivals are eyeing, Mobileye's current situation is not optimistic.

Mobileye CEO Amnon Shashua obviously can't sit back and watch this situation. He must come up with more competitive products to meet the challenge.

And this hit product is the newly launched SuperVision ADAS system.

Acquire key customer Geely, Mobileye’s secret weapon SuperVision

On September 24 this year, Mobileye and Geely announced that they have reached an in-depth strategic cooperation in the field of ADAS and autonomous driving.

In Mobileye's official text, it attaches great importance to this cooperation.

Amnon Shashua wrote a special blog to explain the importance of this cooperation, the title is:

"Why the Geely Auto Group Win is a Game Changer".

He mentioned in the article: This fixed-point project with Geely is "very impressive" in terms of the scale of the project, the range of models covered by the project, and the time period of project cooperation.

Mobileye's secret weapon for winning this key Geely project is SuperVision.

What exactly is this SuperVision system?

In fact, at the beginning of this year, Mobileye released a video of its own L4 self-driving test car in the downtown area of Jerusalem.

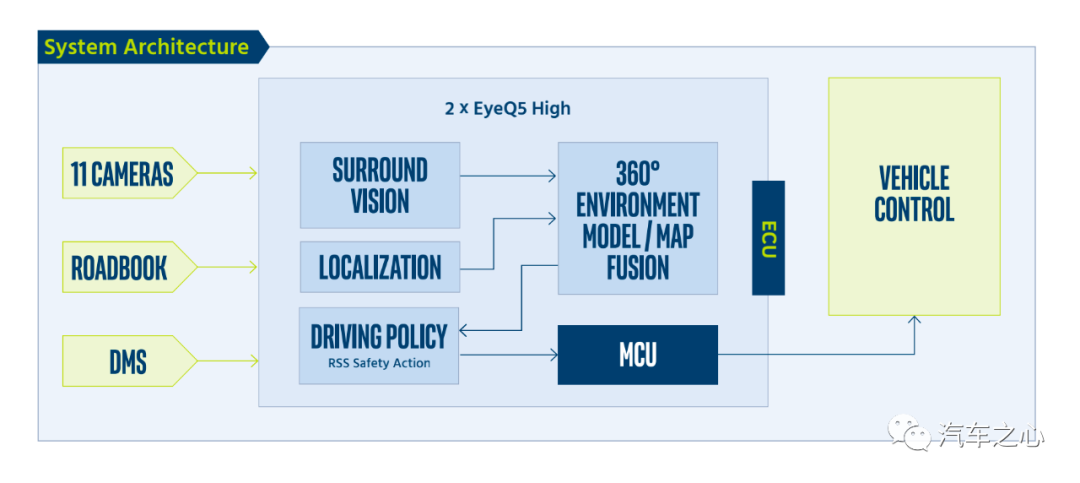

At that time, the vehicle was equipped with 2 EyeQ5 chips and a 360° camera sensing solution around the body. SuperVision was the solution at that time.

It can be said that SuperVision is a system with L4 level autopilot capability, but it is now being delegated to be used as an L2+ autopilot system in consideration of mass production as soon as possible.

Because of sufficient testing on the L4 autonomous driving test vehicle, the maturity of the SuperVision system has been very high, which will greatly shorten the system's mass production time.

According to Amnon Shashua, this system only takes about 1 year to get on the car.

The first model equipped with the Mobileye SuperVision system will be the Zero Concept model of the Lynk & Co brand under Geely Holdings, which is expected to be mass-produced and launched in the fall of 2021.

Specifically, SuperVision uses 2 EyeQ5 high-performance version chips as the basis for computing power, with 11 cameras (7 long-range cameras and 4 close-range cameras) on the body to achieve 360-degree surround view perception.

Among them, two EyeQ5 high-performance version chips will provide computational redundancy for the autonomous driving system:

The main system chip will contain a complete technology stack;

The other chip provides redundant backup and plays a role when the main system fails.

In addition, Mobileye also introduced its self-developed high-precision map REM and RSS security drive strategy into the system.

Another very important point is that it is different from the previous Mobileye's EyeQ4, which only provided perception algorithms + chips.

SuperVision also includes vehicle planning and control algorithms. This is also Mobileye's first attempt to launch a full-stack autonomous driving solution.

It can be said that with this system, car companies can greatly reduce the energy and investment in algorithm self-research.

From the Geely perspective, a very interesting related signal is that Liu Weiguo, the chief engineer in charge of intelligent driving and safety technology development at Geely Automobile , has resigned this year. In August, he joined the National Automobile Zhilian as the assistant to the general manager and the head of the vehicle business department.

For Mobileye, the combination of SuperVision+EyeQ5 has stronger computing power and more comprehensive software than the previous EyeQ4-based solutions, and the license fee will inevitably be higher.

In addition to the REM system, SuperVision also includes a driver monitoring system (DMS), which is also the first time that the DMS system appears in Mobileye's solution.

According to the official statement, SuperVision can achieve:

Automated highway driving with hands free: including automatic lane change, navigation between different highways, automatic on/off ramps, and assisted driving on urban roads;

Automatic parking

Standard ADAS functions: including AEB, ACC and LKA, etc.

Moreover, this system supports OTA updates.

Judging from the above function description, SuperVision is actually a set of automatic driving assistance system that aggregates many advanced functions currently on the market. Its free-hand highway automatic driving function is similar to the NOA and Weilai launched by Tesla. The NOP launched and the NGP launched by Xiaopeng.

The closest set of solutions to it should be Huawei's high-end autonomous driving solution ADS.

Hu Zhengnan, Dean of Geely Automobile Research Institute, also stated in an interview that in 2021 their models will introduce functions similar to automatic lane change, automatic on-ramp and NoA (Navigate on Autopilot), and these functions will Rely on Mobileye's SuperVision system to achieve.

But having said that, if SuperVision wants to achieve a function similar to Tesla NoA, it cannot do without the support of high-precision maps.

How can REM land in China?

This is an important issue that Mobileye and Geely have to face for their cooperation and subsequent SuperVision mass production in China.

There may be two solutions to this problem:

First, Mobileye borrowed domestic partners to collect high-precision map data;

Second, the car companies themselves choose the corresponding map providers. For example, Geely has invested in the high-precision map manufacturer YiTutong's holding company Luokung Technology, and it is entirely possible to adopt Yitutong's high-precision map solution.

In a blog post, Amnon Shashua directly called SuperVision "the most advanced ADAS system in the world."

One year later, we can actually experience the localized version of SuperVision system. Whether this system is worthy of such praise, it will only be clear by then.

Can SuperVision + EyeQ5 carry the banner of growth?

Mobileye, which has been deeply involved in the field of visual ADAS and autonomous driving technology for many years, has been following a two-line strategy:

Stand firmly in the field of visual ADAS with one leg, and firmly grasp the leading or even monopoly position in the market;

The other leg is stepping into the research and development of higher-level autonomous driving technology, and Robotaxi operation services will be launched in the future.

Nowadays, the L4 technology that cannot be commercialized in the short term is decentralized to the L2+ system, and mass-produced on the road as soon as possible. After the road is on the road, data is used to promote the improvement of L4. This is the "modern" commercialization path chosen by Mobileye.

Mass production of advanced technologies that have invested a lot of energy and resources in research and development and provide consumers with use value may be the focus of the entire autonomous driving industry. Mobileye has now found a research and commercialization of autonomous driving technology. Combination point.

Next, it will take time to verify whether the SuperVision system can carry the banner of Mobileye's next rapid growth in performance.

- Get link

- X

- Other Apps

Comments

Post a Comment