NIO has reached the European gold track, but can't escape the dissatisfaction?

- Get link

- X

- Other Apps

The three major issues of localization, brand power, and epidemic need to be solved, and NIO’s going overseas is not optimistic

NIO, whose stock price has repeatedly hit record highs, has once again become the focus of the capital market because of its "going to sea".

On November 2, 2020, according to multiple media reports, NIO is preparing to build an overseas business unit. The internal code is tentatively designated as the "Marco Polo Project". Its models will be sold in Europe and the first stop may land in Copenhagen, Denmark .

This rumor has yet to be verified, but its willingness to go to sea has long been made public.

Li Bin, the founder of NIO, said in August 2020 that the first stop of going overseas will be the European market: "We hope to enter some countries that welcome electric vehicles in the second half of 2021."

Public data shows that Weilai delivered 5,055 vehicles in October 2020, an increase of 100.1% year-on-year.

Why did Weilai lock the first stop of the sea to Europe? Why is the European new energy vehicle market unique? Moment Zhong country's new energy automobile enterprises to sea What are the challenges?

The sea card game has already started

At this stage, China's traditional fuel vehicle exports are showing a shrinking trend, while new energy vehicle exports are booming.

According to public data, China exported 36,900 new energy vehicles in the first half of 2020, a year-on-year increase of 140.7%; the export value was US$1.102 billion, an increase of 271.6% year-on-year; the export of pure electric vehicles was 21,500, an increase of 136%; the export value was 3.63 Billion US dollars, a surge of 1122.9% year-on-year.

Among them, the European market has become a battleground for the export of new energy vehicles.

An anonymous worker at an international investment bank told Zinc Scale last month that Europe believed that the future of new energy lies in biodiesel rather than electrification. In 2015, Volkswagen entered a crisis of confidence in the biodiesel route due to fraudulent emissions data from some diesel vehicles. The European Union has promulgated quite a radical carbon emission control target. In order to meet the standard, Europe has started the electrification rush. Therefore, the European new energy vehicle market will be strong in 2020, and sales will exceed the Chinese market.

In other words, Europe will become the main battlefield alongside China.

In this context, it is not surprising that NIO will lock the first stop in the sea to Europe. If it successfully enters the European market, it will not only obtain a second point of strength, but also prove its brand power.

In fact, the position war for Chinese new energy car companies to deploy in the European market has already begun.

In 2013, the Netherlands issued the first order for pure electric buses in Europe, and all the traditional fuel buses on Sismonnik were replaced by BYD pure electric buses.

After that, new energy commercial vehicles from China continued to be exported to Europe. An auto analyst told Zinc Scale: “Electric commercial vehicles have a good momentum, entering more than 100 cities in more than 20 European countries, and even taking the lead in some countries and cities. status."

Such as Yutong Group in 2019 to 33 pure electric buses delivered Finland, Finland now become the only a positive electric buses in operation, such as SAIC Chase again from 2019 to the European market output EV80 pure electric vehicles logistics, so far, 707 new cars Complete registration.

Compared with the B-side, the development of the C-side is quite slow.

For example, new car manufacturers such as Xiaopeng and Ai Chi are the first to test the water. In June 2020, Xiaopeng Motors cooperated with the Norwegian dealer ZEM to enter the Norwegian new energy vehicle market. There are currently 100 G3i vehicles on the way..... Although many car companies are advancing into the European market, there are not many achievements.

In the first three quarters of 2020, a total of 4,024 MG EZS pure electric vehicles were sold in the UK, ranking among the top five British pure electric vehicle brands. This is a rare record in the industry.

Preference for cars in the European market?

Many car companies have gone abroad to Europe, and the results are not big from the current point of view. So what will NIO's road to sea? I am afraid it will not be smooth sailing. After all, the European new energy market is unique and quite different from the Chinese local market.

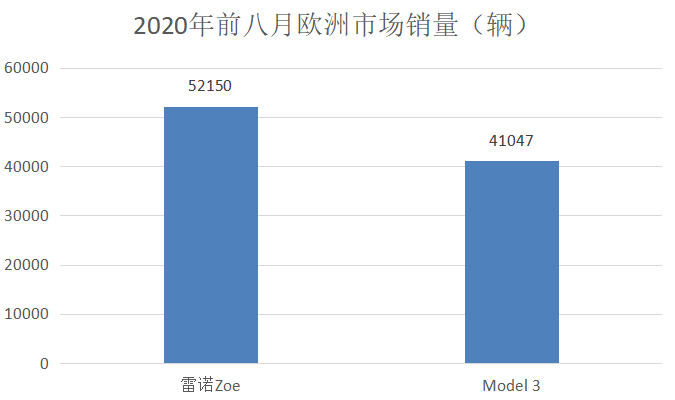

Although Tesla is the world's largest new energy car company, it is not the best-selling in the European market. According to Teslaati data, in the first eight months of 2020, Renault Zoe sold 52,150 vehicles, with a market share of 9%, while Model 3 sales were 41047 vehicles, with a market share of 7%.

Public information shows that the early version of Renault Zoe has a battery life of only 150 kilometers, and the actual range of the new version is 300 kilometers after being fully charged; it can be fully charged in 7 hours and 30 minutes with a 7-kilowatt charger, and 2 hours with a 22-kilowatt charger Full in 40 minutes.

In fact, among the five best-selling new energy vehicles in the European market, only Model 3 is a medium-sized car, Renault Zoe and Hyundai Kona EV are small cars, Ford Kuga PHEV and Mercedes-Benz A250e are compact cars, which also reflects a feature : Europeans seem to prefer cars.

According to several market participants, there are three reasons for this.

First, urban planning is different. European cities were planned earlier, mostly taking into account the future traffic conditions, so the distance between houses is smaller, there are fewer wide roads, more winding roads, and there is a strong awareness of maintaining old buildings and historical buildings. , The road is more difficult to widen, so the European road network is more suitable for sensitive cars.

A student studying abroad in France told Zinc Scale that small cars are common in daily life in Paris: "The road conditions in the city are complicated. It is more convenient for cars to pass through the streets and alleys, and they can stop when they encounter narrow parking spaces!"

Second, the travel needs are different. Chinese people need to consider all aspects when buying a car, such as the old and the small, the length of travel, and the passability. However, the European car penetration rate is high, the terrain is flat, and the personal preference is more focused. Therefore, the travel demand is relatively simple, and the car is enough Meet the basic needs.

In fact, the current red-hot Wuling Hongguang Mini EV has similarities with Renault Zoe: good parking, good travel, and relatively cheap prices. The original price of Renault Zoe is 32,000 euros, and the subsidy is 23,000 euros, while Model 3 is different. The country’s original price varies, with a minimum of 53,500 Euros.

It should be noted that Tesla is building a factory near Berlin, Germany, once it is put into production, it can lower the price.

Third, the car culture is different. For a long time, the price of gasoline in Europe is higher than that in the United States, making small cars, small displacements and manual transmissions the symbols of European cars. The culture of rational consumption is deeply rooted in the consciousness of Europeans, and this culture also extends to new energy. The automobile market is difficult to change in a short time.

Localization, brand power, and epidemic are the three major obstacles

Looking at it this way, if Chinese new energy car companies want to gain a foothold after going overseas, they must face three major challenges.

First of all, localization needs to be improved.

It is undeniable that the overseas acceptance of Chinese new energy car companies is still low: on the one hand, the localized design for overseas markets is insufficient. For example, NIO’s is either a medium-sized car or a medium-large car, which does not account for the size of the model. Advantages, whether to win the favor of the locals is a big question mark; on the other hand, due to the small holdings and insufficient after-sales business outlets, the after-sales maintenance costs are increased, the user experience is affected, and some consumers are discouraged.

Secondly, brand power still needs to be improved.

There are many strong players in the global new energy vehicle market. There are not only “net celebrities” like Tesla, but also established international car companies such as Mercedes-Benz, BMW, and Audi who are seeking transformation. There are also “ground snakes” like Renault. Most Chinese new energy car companies Brands overseas are weak, and how to use them positively is a thorny issue.

A related person told Zinc Scale that behind the weak brand power is that there is still a certain gap between independent innovation and international standards, and there is still a need to make up for shortcomings in the future. Most of the current overseas trips are mainly based on military training. "Weilai, Xiaopeng, etc. go overseas, The best strategy is to clenched your fists and cultivate a country deeply. Don't rush for success in the short term. Don't pursue sales. Slowly accumulating experience is the right way."

Third, the overseas epidemic reduces consumer desire.

The overseas epidemic has become more and more serious, casting a shadow over the export of new energy vehicles.

For example, "In 2030, we will use electric power for all motor vehicles" India has been hit hard by the epidemic. In April 2020, the Indian auto market sold zero vehicles, and there was no vehicle production in India.

Today, although the Indian car market has resumed sales, the epidemic continues to ferment, and car sales are showing a sluggish trend. Public data shows that in the first eight months of 2020, Indian car sales were 1.4 million units, a year-on-year decrease of 44.4%. This means that SAIC, Great Wall, Haima and others are eager to share the vision of the rapid growth of India's new energy market, which may fail.

From this point of view, NIO is not optimistic about going overseas. How to improve localized operation capabilities, increase brand power, and then expand territory, tests the wisdom of the management.

- Get link

- X

- Other Apps

Comments

Post a Comment