Prelude to change: "Nokia Moment" for fuel vehicles

- Get link

- X

- Other Apps

Leading to the tipping point of the next era.

Carefully study country's new energy vehicle industry, you will find an interesting phenomenon: "Four Little King" are standing behind each one interconnected network giants: Wei to be behind Tencent, Xiaopeng behind Ali, the ideal is behind US group, Behind Weimar is Baidu . These Internet New money are like nouveau riche, and they are generous.

For example, Li Wei to car Bin record when industry, Lei Jun said, [19] readily, "when you pull the trigger, directly to me on the line." And when went to Liu Qiang East even more happy, and tea sister later vividly restored The whole process: "At that time, Li Bin spent 15 minutes talking about the concept of NIO. My husband said YES in 10 seconds."

Although the new energy car companies took a lot of money, the industry still suffered a cold winter due to mass production and other issues in early 2019. A large number of companies were tight in cash flow. The ideal car that was established the latest was also the latest to raise funds. It was quite under pressure. passive. Even some investment circles chiefs put down relentless, "new forces no one worthy of investment capital."

But New money didn't believe in evil, so he turned around and gave money to the new forces. Beginning in August 2019, Meituan Wang Xing successively invested 1 billion U.S. dollars in ideal cars and pushed them to the hot Nasdaq. Wang Xing's shareholding ratio has reached 23%, becoming the largest shareholder of Ideal Auto. He also frequently promoted his ideals on Fanfou and was named the "Best Car Reviewer of 2020".

Automobiles are known as the king of industry. They emphasize capital, technology, and talents. The probability of success in building cars is extremely low. In the past 100 years, there have been few successful startups in the world. However, in a plastic sisters tyranny today, why the Internet bigwigs saw made vehicles brothers in trouble, really would dare?

In fact, this is not pure friendship, but pure business logic: these New Money people are all people who have enjoyed the "Nokia Moment" bonus.

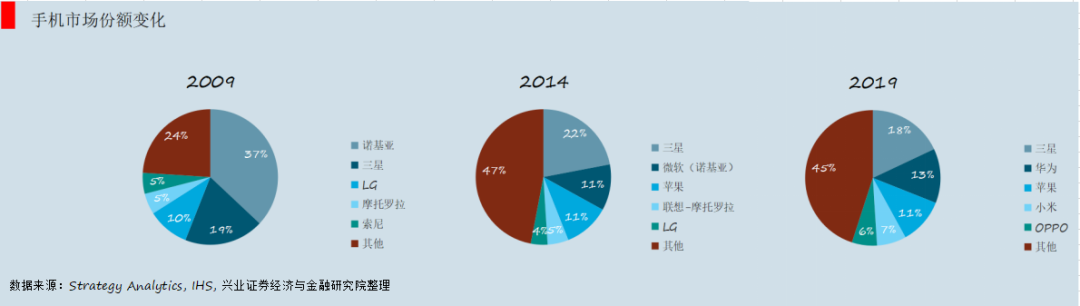

In 2009, Nokia ranked first in the world with a market share of 39%, enjoying the highest profits and premiums in the industry. Apple’s biggest competitor was BlackBerry. A year later, the smartphone broke out with the appearance of iPhone4, and the "Nokia Moment" came quietly.

In 2011, Stephen Elop, the new CEO who dropped from Microsoft to Nokia, said that through cooperation with Microsoft, Nokia will "stand together with iOS and Android." Just one year later, Elop's argument became "Samsung Apple duopoly will be broken."

Elop's prediction was half right. The duopoly pattern was indeed broken, but it was not Nokia that broke it. In 2014, while the Xiaomi model sparked great industry discussions, Nokia also secured its position as "others". From full ball Pa master to the stack of paper, Nokia only 5 years.

Once the industry hegemon meets the new regulations of high-dimensional rise, a "Nokia Moment" will be formed. Obviously, regardless of Lei Jun's Xiaomi, Tencent's WeChat, Liu Qiangdong's JD e-commerce, Wang Xing's Meituan, these Internet upstarts are all enjoyers and even producers of Nokia's moment bonus.

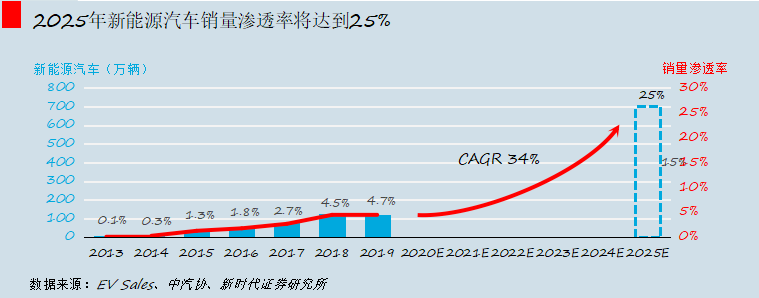

In recent years, the penetration rate of new energy vehicles has begun to follow the path of subversion of smart phones. Since 2010, the penetration rate of electric vehicles in the automotive industry has increased year by year. The global penetration rate exceeded 2.3% in 2019, and the Chinese passenger car market reached 4.9%.

4.9% is not much, but you must know that the penetration rate of domestic smartphones in 2010 was only 8%. Just two years later, it jumped to 36%, and it has soared year after year. As Tesla's stock price rises and a new round of industrial policies is about to emerge, there is only one question left for new energy vehicles: Has the "Nokia Moment" come?

The formula and key elements that form the "Nokia Moment" are the decision-making support of Internet upstarts such as Lei Jun. This article will explore and discuss through the following four aspects:

1. Race track: from linear to nonlinear

2. Leader: Must be super able to play

3. Ecology: forming new interest groups

4. Waiting: a decisive battle against three moats

Race track: from linear to nonlinear

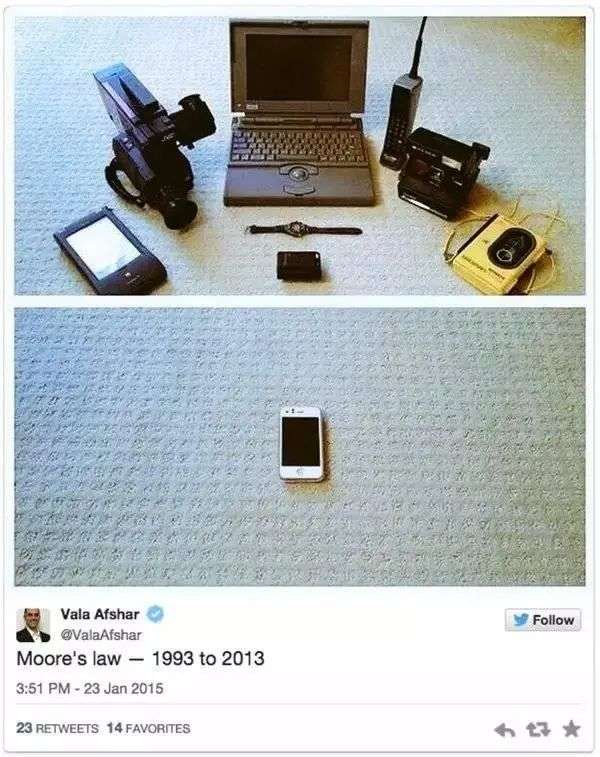

For a new industry to quickly form a trend of "single prairie fire" from "a single spark", the key is to choose the right track and find a track that can achieve "non-linear, even close to exponential growth". There is a category of industries that perfectly meets this requirement: the Pan-Moore's Law industry.

Moore's law originated in the semiconductor field, which means that the number of transistors on an integrated circuit will double every 18 months, and the performance will also double. The reason for the formation is the atomic level process, which will bring about a significant increase in efficiency. Functional improvements, reduced size, and the intuitive feeling of Moore's Law in the past 50 years is that mobile phones represent everything.

And by giving full play to Moore's Law, it is possible to achieve the surpassing of latecomers with better performance. For example, smart phones replace feature phones.

In the era of feature phones, mobile games lack masterpieces, and user needs are difficult to meet; and in the era of smart phones, mobile games are already users' favorites. Behind this is the chip at work. Feature machine chips are mostly hard-coded with specific functions before they leave the factory. Even if the computing power increases, they cannot perform more and more complex tasks. But in the era of smart phones, general-purpose CPUs can continue to expand the functional boundaries with the growth of Moore's Law, and software developers can therefore develop different software ecosystems.

One is the lameness in the application of Moore's Law, and the other is to squeeze Moore's Law dry. This is the industry code for the rise of smart phones: to outperform traditional giants with faster exponential growth.

Traditional giants have strong technology, capital and talents, but when faced with innovation, new technologies and new markets will form internal conflicts with the original inherent organizational structure, management mode, product marketing thinking, etc., while new technologies and new markets leave behind The time window is also very limited. Under the attack of internal and external conditions, it is easy to fall into the dilemma of being unable to destroy one's life.

Nokia is a negative teaching material. When Apple first came out, Nokia was not short of money or people. With the largest R&D resources, R&D expenses in 2010 were more than 4 times that of Apple. Technically, it is not backward, but in the face of the impact of Apple and Google, the internal innovation is slow, and finally the industry overlord has become a youthful memory.

Bill Gates once joked with the boss of General Motors that if the automobile industry can develop like the computer field, then today, a car can be bought for only $25, and a liter of gasoline can run 400 kilometers.

This slightly ironic joke, but pointed out the typical characteristics of fuel vehicles: stable as a dog.

The fuel vehicle industry has three characteristics: the core technology is based on progressive innovation, highly dependent on basic scientific research, and the supply chain is highly consolidated. This has also created a very high industry barrier for traditional car companies. In the past 100 years, few new companies have emerged in this industry.

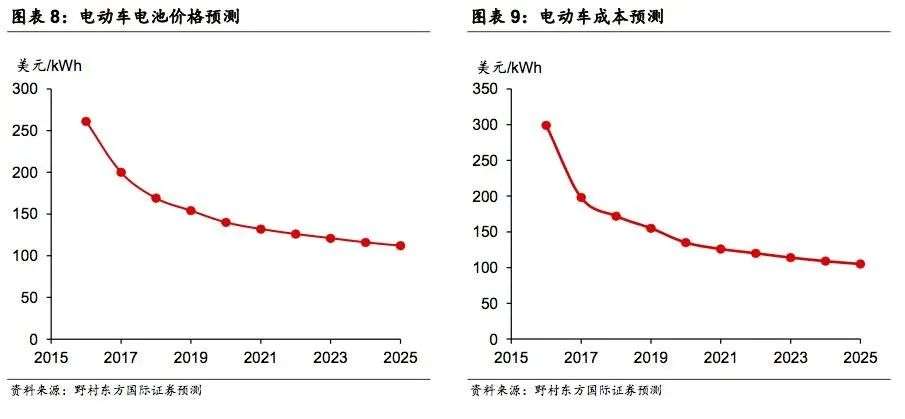

However, the emergence of electric vehicles is making "cars", the most stable industry in the past, gradually move closer to Pan-Moore's Law. An important driving force is the unique cost structure of electric vehicles.

For a pure electric vehicle, the power system (battery + electronic control, 40%) + automotive electronics (22%) account for more than 60%, and these two have strong Pan-Moore's law characteristics: the core of the power system is the battery. The cost performance of batteries can be quickly improved through the discovery of new materials and the application of new processes. For example, the price of Ningde era products dropped from 2.3 yuan/Wh in 2015 to 1.2 yuan/Wh in 2018, a drop of 50%.

The second-largest automotive electronics in terms of cost include LEDs, IGBTs, etc. These electronic components themselves follow Moore's Law. Therefore, in terms of the cost of electric vehicles, an interesting "twin cost curve" has been formed: the vehicle cost curve and the battery cost reduction curve are almost the same, and non-linear reduction can also be achieved.

The cost-effective improvement of traditional car companies mainly comes from efficiency conversion, which follows the law of energy conversion, and even a 1% increase is very slow. However, electric vehicles are different: through new cost structures and energy sources, electric vehicles not only switch the track, but also use nonlinear speed to challenge the slow linear development of traditional tracks.

This is also the biggest opportunity for Musk when he starts a business to choose the track, and it is also the confidence he insists on when encountering difficulties. And SolarCity, another photovoltaic company under Musk, also conforms to this law. Its leading product BIPV is now the largest solar power company in the United States due to a 40% drop in cost.

Although the cost of new energy electric vehicles is high, the cost of use is low. The so-called buy is expensive and use is cheap. Under the development trend of the index, according to industry forecasts, the price of the whole vehicle is expected to be equal to that of traditional fuel vehicles around 2023. At that time, it was cheap to use, and cheap to buy, it really fragrant to the end.

Therefore, to challenge the traditional giants, the first priority is to create a track that can develop nonlinearly. If you have difficulties, you must go up. If there are no difficulties, you must go up.

Leader: Must be super capable

Every old giant fell because of the rise of a very capable new giant. For example, when Apple replaced Nokia, it was at the peak of Steve Jobs. Jobs's picky and meticulous products cannot be copied. And Google, which organizes the Android camp, is also rich, technical and ambitious.

Therefore, there must be a leading enterprise to become the driving force behind Nokia.

After the advent of the affordable Model 3, a consensus has gradually formed around Tesla. Through the closed-loop business ecosystem of software and hardware, Tesla is becoming the "iPhone on wheels".

The secret of the success of fuel car companies is to polish the engine, transmission system and other mechanical subsystems into sophisticated crafts, and establish a sufficiently high technical barrier. But the motor drive is a real blow to the fuel engine. The performance version of Tesla ModelS can accelerate to 2.3 seconds per 100 kilometers. This level has been flat or even surpassed the top luxury cars such as Bugatti Chiron, Ferrari F12tdf, and Lamborghini Aventador. .

What's more, electric vehicles have simple structure and are much less difficult to manufacture than fuel vehicles. To make an image metaphor, fuel vehicles are like the variable-speed bicycles we ride. They use large gears at low speeds, and they need to be changed to smaller ones after reaching a certain speed. gear. It takes time to shift gears from time to time, but an electric bike is equivalent to a bicycle with a constant gear. If you want to accelerate, you can pedal faster without shifting gears [13].

On the other hand, the success of the iPhone involves technological innovation and design subversion, but the most important thing is the ecological construction-Apple can extract more than 10 billion US dollars from the app store in a year, which is equivalent to Xiaomi’s 6 years profit.

Simple working principle diagram of electric car

Tesla's software revenue is generated by three businesses, namely, the Internet of Vehicles function, online system upgrade (OTA) and fully automated driving (FSD). Taking OTA as an example, Model 3 owners only need to pay US$3,000 to increase the car's acceleration performance from 4.6s to 4.1s. As long as you pay enough money, you can show your speed at will.

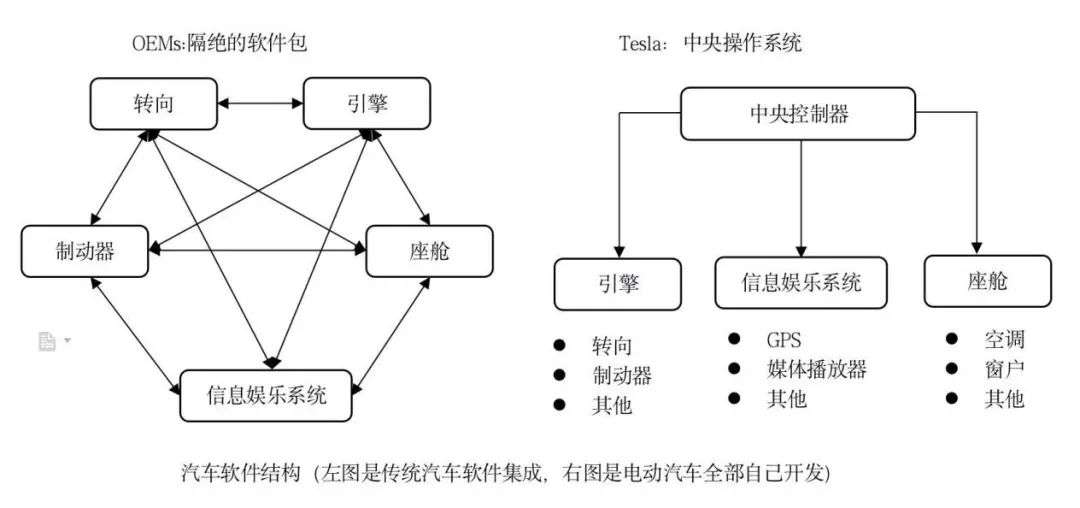

The net profit of Tesla's auto manufacturing business is only 2% per year, and software will obviously be the main source of income under the effect of scale in the future. But since the software is so important, can't it be done by a fuel car?

The answer is to do, but not good at it.

In fact, software has always been the weakness of traditional car factories. In the era of fuel vehicles, automakers do not need to develop their own software, just put the products of various suppliers together like a puzzle. But this will bring two potential problems, one is the program loopholes caused by the incompatibility of software modules, and the cost of coordination is high; the other is the slow software update speed.

It takes about three years for a car from design finalization to final delivery[11]. During this period, all parts and components are not allowed to change the design because of safety and coordination considerations.

Volkswagen, the overlord of fuel vehicles, has suffered from software losses: its electrified platform MEB was once regarded as a killer to Tesla, but the first model ID.3 happened to be delayed in delivery due to software problems. In the end, the delivery time was delayed again and again, from the end of 2019 to September 2020, a delay of nearly a year.

The ID.3 already produced is backlogged in the German parking lot

The same thing that cannot be ignored is the impact of business transformation on the company’s internal management. Fuel car companies often have dozens of hundreds of years of history, are intertwined internally, and have deep binding of interests with suppliers, and changes in a certain production and R&D link. It probably means the redistribution of the benefit chain, and the difficulty can be imagined.

The former CEO Jorma Ollila, who led Nokia to the top, recalled in his autobiography the scene when the iPhone came out: He called 12 executives to talk and asked them what they thought of the iPhone. Two of them believe that the iPhone does not pose a serious threat, and the other 10 believe that the iPhone cannot be underestimated.

However, Nokia’s performance-centric management system restricts the U-turn of this big ship. Compared with changes in the external environment, executives are more worried about not achieving their quarterly goals. This mentality is transmitted to the middle level, making bonuses linked to sales data. Further hinder the company's transformation.

Ollila reflected in the book and said: We all know the problem, but deep down we can't face reality. The company's large-scale plans are still going on. When we should focus on the long-term prospects, we only reviewed the sales forecast for the next quarter.

Ecology: forming new interest groups

When Google entered the mobile operating system in 2005, an important measure was to open source and absorb more power. Around the same time, China Mobile developed its own operating system, but it was ignored by other operators because it integrated 139 mailboxes and other mobile characteristic products. The rapid popularity of closed-loop Apple is also inseparable from the rich Chinese electronics supply chain and global application developers behind it.

It is Apple and Android that replace Nokia, but it is a batch of industry chain enterprises that stepped on Nokia's corpse. Fuel vehicles and mobile phones also have a very similar point in the supply chain: the closed mode under a highly specialized system of division of labor.

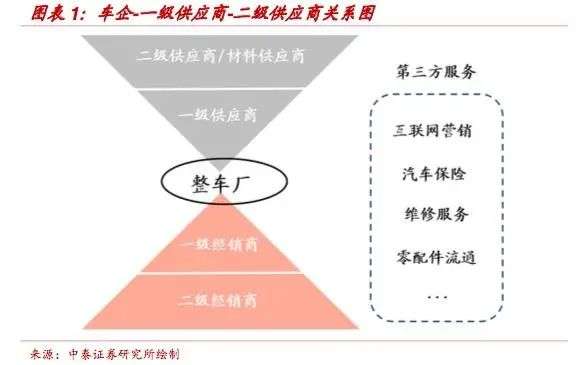

In the automotive industry system, OEMs play more of the role of "system integrators". The first and second-tier suppliers below strictly follow the division of labor and specialization. For example, in the automotive electronics field, Bosch, Delphi , and mainland China The division is complete. In the process of automobile R&D and production, most value-added activities take place at the first and lower-level suppliers, and about 70% of the cost of automobiles comes from suppliers [5].

Under this multi-level and strict hierarchical supply chain system, the parts industry chain is extremely long, which poses greater challenges to inventory, logistics, and dealer management [6]. The result is:

1. The excess profits in the upstream of the automobile are obtained by the system subcontractor.

2. The supply chain price system is stable, each occupying the top of the mountain and its own king, it is difficult for newcomers to get the opportunity to enter [4].

In the era of feature phones, the supply chain pattern of the mobile phone industry is roughly the same. The most far-reaching significance of the emergence of Apple to the industry lies in reshaping the supply chain by relying on "independent design + vertical procurement system".

In addition to the iOS system and chips, other parts of the iPhone adopt a global procurement model. After the entire production is outsourced, more parts are split, allowing hundreds of suppliers to directly enter Apple's procurement system.

Apple’s direct procurement has broken the dilemma of Chinese electronics manufacturers’ difficulty in entering the Apple system in the era of closed procurement in the mobile phone industry, and has given Chinese manufacturing an important opportunity. Since 2012, Apple’s Chinese suppliers have more than doubled, and Luxshare Precision , Desay Battery , Anjie Technology and other ten-fold stocks have been tenfold.

To say that Tesla is the "iPhone on wheels" also lies in Tesla's reshaping of the supply chain:

1. The product SKU is less. Tesla currently only has four mass-produced models (Model X, Model S, Model 3, Model Y), which allows the company to make a hole and focus more on R&D resources to build products.

2. Direct sales model. In addition to the traditional 4S store channel business, while firmly controlling consumers in their own hands, it also frees up more profit margins for new supply chain manufacturers.

3. Supply chain vertical procurement. The number of electric vehicle parts and fuel vehicles has been reduced by one-third, breaking the traditional car multi-tier supplier matching model [6], and taking back the right to speak.

Tesla's three-pronged axe allows its entire supply chain system to bypass fuel vehicles and start anew. Currently, Tesla's localization progress has reached 70%-80%. In the industry chain, a large number of excellent supply chain companies such as CATL, Sanhua Intelligent Control, and Tuopu Group have also emerged.

With the help of the Chinese circle of friends, the production capacity is increased quickly, and the product iteration is fast. The two-pronged approach of quantity and quality, the market will naturally grab faster. From January to July 2020, Tesla's global sales of 212,000 vehicles, of which China, which has been mass produced for less than one year, contributed as much as 30%. No wonder some people say that it is groups of Chinese companies, groups of consumers, and policies that have cheered Tesla.

Of course, Musk is also very generous. In an interview, he praised the Chinese as "smart" and "hard-working". This is very true. If it weren't for these workers on the other side of the ocean, would Musk have a net worth close to 100 billion US dollars?

Waiting: a decisive battle with three moats

In June 2018, Tesla achieved a production capacity of 7,000 vehicles per week. Musk was overjoyed and immediately tweeted to show off. Steven Armstra (Steven Armstong), chairman of Ford Europe and the Middle East, immediately forwarded and publicly mocked "7000 cars, about 4 hours-Ford."

An embarrassing reality is that traditional car companies simply do not look down on Tesla's production capacity.

Two people tear up Twitter screenshots

Compared with mobile phones, the replacement cycle of automobiles in 5-8 years is longer, and the industry naturally has three major industrial moats: manufacturing slowly increases in volume, products slowly iterates, and markets slowly penetrate. These three moats have given traditional fuel car manufacturers longer time than mobile phones to deal with this electrification war.

First, manufacturing is slowly increasing.

In 2020, as the leader of electric vehicles, Tesla's cumulative sales have just exceeded one million. This figure is about 10% of Toyota's annual sales. It is clear who is the thigh and who is the leg hair.

Besides quality, the quality control of automobiles is more difficult than that of mobile phones. For example, mobile phones have very few mechanical moving parts, and all parts cannot be moved when installed. But cars are different. There are a large number of moving parts, and a problem with a screw may cause a chain reaction. Therefore, any top OEM, the exclusive know-how accumulation is accumulated by stepping on countless pits, and it will never be spread.[16 ].

Closely related to quality control is also a complex supply chain-there is a joke in the industry that buys a Lexus back, flips the car cover, and finds that there is a Camry inside.

This is a joke at Toyota. But it also reflects the high level of standardization of Toyota's supply chain management. It is not only promoted in the same model, but also has crossed different models, such as Lexus and Camry. Although they are representatives of high-end and mid-range models, many parts are common. Honda cars are similar, for example, Civic and CRV are two completely different models, but they use the same chassis [5].

A fuel vehicle has about 30,000 parts and components, and the supply chain is complicated beyond imagination. Poor management will also bring inventory risks. Therefore, a rule will be discovered. All the revolutions in production management in human history began with the automobile manufacturing industry, such as the Ford assembly line and Toyota's lean production.

In contrast, the number of parts required for electric vehicles is about 2/3 of that of traditional cars. The number is greatly simplified but still cannot be separated from the characteristics of the automotive supply chain: complex, sophisticated, and requires professional management skills. The management and reform of the industrial chain cannot be changed overnight.

In 2018, Musk, who advocated the robot revolution, jokes that Toyota's lean production management is slower than "grandmother using a walker", and tried to achieve 100% machine production on the production line. As a result, the production capacity did not increase after some toss. Reduction, frequent mistakes, made Musk a rare public apology.

Screenshot of Musk's apology

Second, the product slowly iterates

Internet innovation and manufacturing innovation are two different things.

A car is a typical product designed by genius and used by fools. Consumers are proficient in simple operations such as starting, accelerating, braking, etc. Behind each action is a complicated and sophisticated technical black box. Moreover, many of the skills in these technical black boxes are chain buckles, one chain after another, one trick is careless, and it is easy to lose all the games.

According to Internet thinking, any product can be iterated in small steps, quickly trial and error, first make a 60-point product, and then gradually iterate to 80 and 90 points. Building a car with this kind of thinking will affect reputation and brand, but will trigger a large-scale recall crisis and affect the survival of enterprises.

Building a car is not about developing apps, and user safety is not even a trifle. Mobile phones can be shut down and restarted when they crash. Car failures often crash and kill people.

Since it is so difficult to build a car, can it be outsourced directly to the foundry?

An embarrassing reality is: Foxconn, the king of mobile phones, does not have a mature large-scale professional car foundry in the world. Even if Wei came to JAC, and Xiaopeng was contracted by Haima, but these are automakers, not professional contract manufacturers.

Behind this involves another layer of industrial laws: cars and mobile phones are different, and assembly capabilities affect performance and ultimately determine car quality. This is one of the most important core capabilities of a car company.

In 2017, Tesla fell into "capacity hell". Musk was so worried that he slept directly in the tent on the construction site. Even the Wall Street Journal shouted that "it is not ashamed to find someone to produce a car as an OEM", but Musk didn't listen. Persistence is not paranoid, but the best choice after overall consideration. The foundry of Weilai and Xiaopeng is also more in order to solve the production qualification problems, and will still build their own factories in the later period.

The mobile phone industry will give birth to Foxconn, but the automotive industry is difficult.

Third, the market slowly penetrated.

Automobiles are not a winner-takes-all industry. Buying Mercedes-Benz is for identity, Toyota is for quality, BMW is for performance, and several major automobile groups have numerous product lines to meet the complex needs of users. For example, both are luxury cars, Ferrari and Maserati have different details. Sub-groups. Toyota sold 10.74 million vehicles worldwide in 2019, and even the best-selling Corolla has a global market share of less than 2%.

There is no winner-takes-all, and a living case of the slow penetration of the market is Tesla's addiction to price cuts after entering China.

Since the domestic version came out in 2019, Model 3 has been reduced in price five times, with a drop of 100,000 yuan. "The BMW 5 Series I bought a year ago became a Honda Accord a year later." For Tesla owners, it is never known which comes first tomorrow or the price cut. Even the best strategy for buying a car has turned into hesitation, because hesitation will lower the price.

Tesla's addiction to price cuts is true, and it's true that it's red eyes. In October of this year, Musk tweeted "Tesla is challenged." While Iron Man Alexander, Chinese players are using differentiated products to carve up the market. For example, BYD's popular electric car Han, Xiaopeng's P7, etc. have achieved good results through the creation of subdivided product capabilities.

Musk Twitter screenshot

In contrast, the strength of domestic Tesla's products does not have the strength to show off. In other words, the current Tesla is more like the original iPhone in 2007 than the iPhone 4 in 2010.

The current Tesla has learned to combine software and hardware, but has not yet learned how to make products. For example, plastic interiors, ghost brakes, unbearable noise, chaotic navigation, blind wipers, and functional upgrades are eager to see. The OTA game push is very positive.

On February 28, 2020, Tesla encountered the collective rights protection of domestic car owners. The chip that should have been equipped with autopilot 3.0 was reduced to version 2.5. This is Tesla's famous "fake door." Although Tesla's official post-event response was due to conditions in the supply chain during the epidemic, the "false feelings" in the configuration were undoubtedly hammered.

Despite the performance of Tesla, it has almost been born in the industry. Blocked by the three major moats of "manufacturer volume, product iteration, and market penetration", the Nokia moment of traditional car companies will not come as fast as Nokia. New forces are accelerating, and traditional car companies are also working hard to withstand it. The battle has already begun, but it will not end in a hurry.

Epilogue: Where are the Chinese giants?

Over the past 40 years, although the Chinese car market has developed rapidly, congestion has become a characteristic of the city. However, under the influence of factors such as joint venture policies and technology for the market, my country's auto companies have not broken through the three core components of fuel vehicles (engine, gearbox, and chassis), and they are still far from European and American companies. So Wang Xing said in Fanfou:

In all fairness, in the era of traditional fuel vehicles, Chinese companies have no reason to win.

History has no assumptions, nor can it pass through. However, new energy vehicles have renewed hope for China: the industry is at an early stage and the pattern is unstable. Pan-Moore's Law gives catch-ups a chance to comeback; my country sits on the world’s largest automobile consumer market, with the most complete industrial chain supporting facilities, and strong China’s industrial policy still has generous bonuses for engineers, and it has also invited the best players in the world to "copy homework."

Therefore, Wang Xing's second sentence is: In the coming era of smart electric vehicles, Chinese companies have no reason to lose.

China's auto industry has gone through a detour that has been criticized by hundreds of millions of onlookers. If the progress of this era cannot be grasped, there will be no second chance.

The full text is over. Thank you for your patience to read.

Reference materials:

[1] Dai Chang, Dong Xiaobin, Zhao Jixin, Industrial Securities, "Golden Decade Apple Chain, Red Gold Era Tesla"

[2] Silent contest: four handshake behind Tesla's entry into China

[3] Liu Jing, Yu Nengfei, Tian Renxiu, West China Securities, What is the core competitiveness of non-standard companies? 》

[4] Zhao Xiaoguang, "The Wave Breaker: Ten Years of Electronics Industry in the Eyes of Platinum Analysts"

[5] Liu Baohong, Procurement and Supply Chain Management: A Practitioner’s Perspective

[6] Deng Xue, Tianfeng Securities, "Model 3 Marks Tesla (TSLA.US) Entering "iPhone 4" Stage"

[7] Wu Xiaofei, Shi Jinman, Xu Weidong, Guotai Junan Securities, "The independent demand for new energy vehicles is accelerating formation"

[8] First Electric Network, 10% of the German auto industry will be laid off? The culprit is electric cars

[9] In No. 42 garage, Tesla shot Wang Bo, with a battery life of 339,000 yuan for 668 kilometers, why buy BBA?

[10] Xiong Li, Guosen Securities, software-defined cars ushered in the great era, network security and financial technology maintain high prosperity

[11] Wang Weijia "Dark Knowledge: How Machine Cognition Subverts Business and Society"

[12] Wu Jun, Top of the Wave

[13] Chen Jing; Yidian Encyclopedia | Why do electric cars start fast?

[14] Zeng Duohong, Soochow Securities, analysis of the power of new cars, the one who sinks in the big waves is gold, and the winner is the king.

[15] Bank of China Securities, morning meeting focus-20200727

[16] Stephen’s column, why is there no such foundry as Foxconn in the auto industry?

[17] Intelligent manufacturing ISTEC project center: Comparison of manufacturing in various countries: Germany relies on equipment, Japan relies on people, and the United States relies on data

[18] Photovoltaics: Deduction of Universal Moore's Law

[19] Zhang Heng, International Finance News, Li Bin and his Wei Lai

[20] Cui Yan, West China Securities, "Based on Industrial Reform, Welcome to the Golden Age"

- Get link

- X

- Other Apps

Comments

Post a Comment