The new energy on the tuyere, are you in the car?

- Get link

- X

- Other Apps

How new energy vehicles lead the market and become a rich myth

Since the beginning of this year, the new car-making forces in the new energy sector have always been the king of topics. Tesla, ideals, the future, Xiaopeng and other "sing it, I will appear on the stage", fighting for battery life, intelligence, and high-end, and the momentum is rising. After a wave, the corresponding stock price has also been advancing all the way, constantly staged "amazing" market.

It can be seen from the above figure that the growth rate of new car-making forces has more than doubled at every turn, compared to traditional cars, which have basically not increased or even declined. The "new and old" forces are in sharp contrast!

Last year, Weilai Automobile CEO Li Bin was hailed as the "worst person in 2019." Looking back at the moment, the stock price has doubled 9 times a year, and the market value surpasses GM and Ferrari. If you buy Weilai’s stock earlier, you may have earned enough money to buy a car;

Both Xiaopeng and Ideal Car have been on the market for 3 months, and their market value has doubled, even surpassing FAW, and keeping up with Geely;

Xiaopeng Motors released its third-quarter financial report last night, exceeding expected revenue of 1.99 billion yuan, a 9% increase before the market. The fourth-quarter revenue is expected to be approximately 2.2 billion yuan.

The market value of Tesla, the leader in electric vehicles, has soared from less than 80 billion U.S. dollars to nearly 400 billion U.S. dollars, surpassing Toyota, the world's largest car salesperson, and all of the global traditional car brands are all at once.. .

The market value of the above few new car manufacturers alone has increased by more than 500 billion US dollars this year, which is more than half of the total market value of other mainstream traditional car companies...

1. Why can new energy vehicles lead the market and become a rich myth?

Favorable policies, the industry may usher in an inflection point

On the evening of November 2nd, the State Council issued a blockbuster document: The 15-year blueprint for a "automobile power" "New Energy Automobile Industry Development Plan (2021-2035)", revealing three grand visions:

• 1) Strive for pure electric vehicles to become the mainstream by 2035;

• 2) New energy vehicles will account for about 25% of sales in

2025 ; • 3) Electricity consumption of pure electric passenger vehicles will drop to 12 kWh per 100 kilometers in 2025.

I fully demonstrated the country's new energy vast space and long-term commitment to the development of the automobile industry, the new energy automobile industry chain and form the subject of a long-term positive.

The policy warm wind is blowing, and the new energy vehicle sector is surging to meet: Ideal cars once rose by 15%, and closed up by 13.44%; Weilai once rose by more than 14%, and closed up by nearly 9%, Xiaopeng Motors rose by 7%, and the new The energy industry chain is "rising."

Sales are rising steadily, the data is quite eye-catching

2020 has entered the fourth quarter, and major auto companies are sprinting at full capacity. New car-building forces Weilai, Ideal, and Xiaopeng have all announced delivery data for October, which can be described as a rainbow of momentum:

• NIO delivered 5,055 units in October, a year-on-year increase of 100.1%. The monthly delivery data set a new high and exceeded 5,000 units for the first time. 31,430 vehicles have been delivered year-to-date, a year-on-year increase of 111.4%;

• Ideal delivered 3,692 Ideal ONEs in October, an increase of 5.3% from the previous month, while only 28 delivered during the same period last year, setting a new monthly delivery record for three consecutive months, and this year's cumulative delivery reached 21,852;

• Xiaopeng delivered 3,040 units in October, a year-on-year increase of 199.5 percent, and delivered 17,117 units year-to-date, reaching more than 3,000 units for two consecutive months.

In addition to the continued strong delivery volume, each car company has different bright spots. Weilai delivered 883 new models of EC6, a faster climb than September’s 16; Ideal October’s new orders hit a record high, becoming the first new energy brand to break 10,000; Xiaopeng’s P7 exceeded 3,000 for two consecutive months +.

It can be said that the new energy sector has gathered many favorable factors such as the time and place and the harmony of people, and this counter-trend rise is also the general trend.

2. Is it too late to get on the bus now?

New energy is at the cusp of the storm, and its high expectations, high growth and high valuation momentum make people hesitate. Do we still have a chance to get on this express train of new energy?

"Visible" incremental space

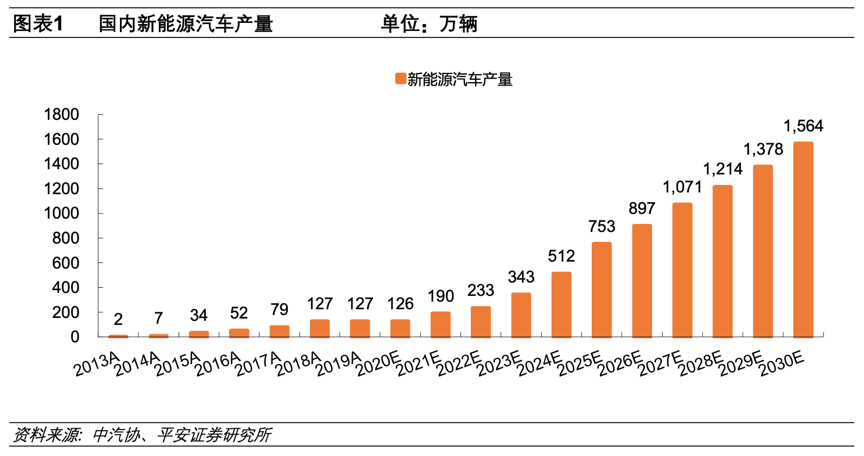

According to the "New Regulations", by 2025, the sales of new energy vehicles will account for 25% of the total vehicle sales that year, and the corresponding annual sales will exceed 7.5 million, and sales will exceed 15 million in 2030;

In terms of sales volume, the predicted sales volume in 2030 has more than 10 times the growth space compared to 2020, and the current penetration rate is only 5.38%. It can be said that new energy vehicles still have a very large incremental space. Obviously, this industry is still It is a promising blue ocean market, and the expectations are relatively certain.

"Inside and outside" parallel, the general trend

There is a warm air policy inside and a long-time advocate of clean energy plans outside the United States. The current US President Biden said in his campaign speech: (after taking office) stop subsidies to fossil energy and provide 400 billion US dollars for Research and development of clean energy technology. To achieve carbon-free power generation by 2035, and 100% clean energy economy by 2050.

Take a look at the strategy of the agency bosses

JP Morgan Chase: reiterated Xiaopeng Motors' "Buy" rating and raised the target price to $43

Analyst Nick Lai believes that the company will be the main beneficiary of the trend of smart electric vehicles in China in the next few years, and expects its penetration rate to triple from less than 5% in 2019 to 13% or more in 2025. .

Citi: Grant Ideal Car "Neutral" rating, target price of US$27

Analyst Jeff Chung gave Ideal Car a "Neutral" rating with a target price of US$27. The analyst believes that although the stock price has reflected most of its positive factors. However, the ideal car will be the main beneficiary of the increased demand for extended-range electric vehicles (EREV).

CITIC Securities: The trough of new energy vehicles has passed, it is recommended to seize the opportunity of high-quality targets in the global electrification supply chain

CITIC Securities pointed out that the industry has been recovering steadily in the later stage of the epidemic, the production and demand of new energy vehicles will continue to recover, and demand will gradually be released. The global new energy vehicle industry chain has entered a stage of rapid growth. It is recommended to continue to grasp the global electrification supply chain (especially It is an opportunity for high-quality targets in the Tesla supply chain.

In terms of macro trends, the new energy vehicle plan is undoubtedly an epoch-making reform. The resulting market is tens of trillions of dollars in scale. In view of the strong positive support from policy and performance, the market outlook may still be Continue to pay attention, but more is based on the layout of the dip.

Risk and disclaimer: The above content only represents the personal position and opinions of the author of this article. Before making any investment decision, investors should consider their own circumstances and consider the risks of investment products. If necessary, please consult professional investment advisors. This article does not constitute any investment advice, nor does it make any promises or guarantees.

This article comes from the information column of the Huashengtong APP, a Hong Kong-US stock trading platform under Sina Group.

- Get link

- X

- Other Apps

Comments

Post a Comment