Trees can’t grow into the sky, neither can NIO, Xiaopeng and Ideal

In 2020, please be nice to new energy car companies. Because this year, all investors who made heavy bets on this track have made a lot of money:

◆The total leader Tesla (NASDAQ: TSLA) has increased five times a year, with a market value of more than RMB 3 trillion;

◇ BYD (SZ:002594/HK:01211), which has been tepid in the past 10 years, directly soared 4 times.

And the bigger winners belong to the new forces of Chinese car making:

◆Nio (NYSE:NIO), once burned to the point of unconsciousness and nearly bankruptcy; after finalizing the financing, it became enchanting, and its market value rose 35 times from its lowest point to nearly 400 billion yuan, bringing GM, Volkswagen, BMW and Ford's centuries-old shops have left behind.

◇Xiaopeng Motors (NYSE: XPEV) and Ideal Motors (NASDAQ: LI) have both been on the market for more than 4 months. The share price has doubled and the market value has surpassed GAC (SH: 601238) and is close to Geely (HK: 00175) ...

Figure 1: Unrivaled new force in car building

Although it must be pointed out that the high valuation of the new car-building forces collectively benefits all stakeholders: no matter whether it is an investor in the primary market or as an employee of a company with original shares, no one will dislike it. High valuation, high valuation means the rapid expansion of real money in hand, the secondary market is willing to drum up new energy, and the primary market will naturally go smoothly.

But this also creates a paradox: from the perspective of market value, the new Chinese car-making forces represented by Weilai, Xiaopeng and Ideal have completed the century-old road of overseas traditional giants in four or five years. Is it a horror or a surprise.

Based on this magical paradox, a new realistic proposition was born: trees cannot grow to the sky, can Weilai, Xiaopeng and ideals?

01 a math problem

In terms of performance alone, the new car-making forces at this moment are still quite shame.

Data show that in the first 10 months of this year, the cumulative delivery of Weilai Automobile reached 31,400, an increase of 111.4% year-on-year, while Ideal Automobile and Xiaopeng Automobile were 21,900 and 17,100 respectively. In the first three quarters of the 20th century, the traditional car-making power SAIC had sold 3.6132 million vehicles. The gap between the two shipments is hundreds of times.

Figure 2: Sales of new car manufacturers (market value statistics as of November 9). Source: Sino-Singapore Jingwei

Obviously, this kind of performance is really not excellent.

For any car company, the annual sales volume of more than 100,000 vehicles will have an initial scale effect, and it can break even; and even more cruel, as an electric car company in the start-up market, the crazy investment in the early stage makes the threshold for this scale effect faster. Promote.

Tesla's total sales so far this year are 316,820 vehicles, but such a sales volume that arrogantly dominates the crowd, the net profit margin in the first half of the year was only 2.72%. Others, such as Weilai, have sold around 30,000 vehicles, and the net profit margin is even more terrible.

The profits are owed, and the income is pitifully small. If you want to rely on performance to support the valuation of 100 billion yuan, it is really hard to get it. Constrained by the skinny reality, if you want to do a good job in market value management, you must separate performance and valuation. The popular view of using A shares is: "No longer be dragged down by performance."

As long as investors in the market no longer care about actual performance, but pay for the possible future imagination, then no matter how much the loss is at the moment, whether the business model is feasible is no longer a meaningful question.

This constitutes a very simple math problem:

The market value of NIO, which has only sold more than 30,000 vehicles so far this year, is close to 400 billion yuan, and the ideal market value of more than 20,000 vehicles is also close to 200 billion yuan.

Every car sold by the new car-making forces is equivalent to a market value of 10 million. In contrast, SAIC Motor produced 3.61 million vehicles in the first three quarters, with a market value of 313.7 billion yuan, and each vehicle produced has a market value of around 80,000.

in particular:

[1] Sell one and lose one

At this moment, the puzzle of "selling liquor is not as fast as pouring liquor," which once appeared in A-share liquor stocks, reappears in the new car-making forces:

For the new car-making forces, the value of selling a car can be up to several hundred thousand, but if every car sold can be exchanged for more than 10 million market value, such a 1:20 rate of return is the most funny but the most rational. the choices are: the car give away to consumers, but to enhance the valuation is the fastest.

To be honest, the idea of sending out car compensation has not been tried by new car-building forces. In fact, it is already a basic operation.

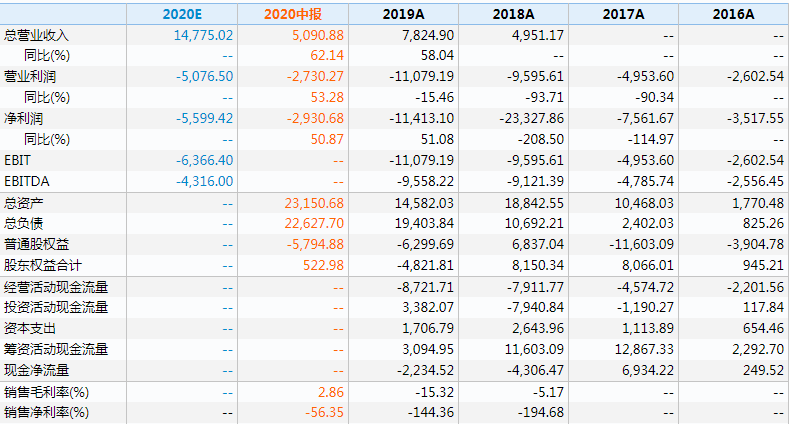

Take Wei as an example: every time a consumer buys a new energy vehicle, the state will give new energy vehicle consumers a tax exemption + subsidy, but even so, in 2018 and 2019, the net interest rate of Weilai's car sales will always remain at -100% The above are -194% and -144%, respectively. Fortunately, this year's hardware construction capital expenditures press the pause button, and the increase in sales brings the net profit margin to about -56%.

Figure 3: NIO's financial summary for the past few years. Source: Wind Financial Terminal

In other words, looking back at the history of NIO’s car manufacturing so far, the average level of loss has truly reached the point of selling a car and losing a car in the literal sense: sharing the past 3 years equally, every 100 million in revenue represents With a loss of nearly 100 million, every sale of one represents another loss.

On the one hand, Weilai explained that such a large-scale loss was because the scale effect had not yet arrived; on the other hand, many unimaginable operations were also important reasons.

Let’s take a look at the loss-making spree launched by Wei Lai over the years-for example, in August 2019, it announced the opening of the "lifetime free battery replacement" service for all ES8 and ES6 first owners.

You know, as early as 2013, Tesla introduced a battery swap mode. After that, Tesla abandoned battery swap and focused on the development of fast charging technology. The biggest reason was cost.

Tesla for electric service pricing, even more than gasoline plus car oil more expensive, basically in between 60-80 dollars for electricity ,, amazing high cost of Tesla eventually give up.

Rather for comparison, NIO not only provides life-long free battery replacement services to old car owners, in addition, NIO users who choose the battery swap mode can also subtract 70,000 yuan from the subsidized price. Buy NIO electric cars.

It is conceivable that this kind of free replacement mode will lose money all the way, and the diseconomies of scale have further increased the bicycle losses of the new car-building forces.

This speed of reduction and loss + loss, even if there are wealthy financial owners such as Tencent and Ningde era, Weilai cannot support it. Finally, on August 20 this year, this new car-making force finally announced that it would adjust the rights and interests of users with a deposit of 20,000 yuan for free power exchange. The free power exchange will be suspended on October 12, 2020.

[2] Use losses to earn valuation

Of course, as an optimistic investor, you can say that this is "eating sugar cane, one section is sweeter than one section", just as you said it is "the Chinese version of Tesla", the future is not here, who can What about falsification?

However, even so, the reasons behind the weird behavior of "giving away for nothing" of new car manufacturers are still obvious-this stems from the current crazy market's pricing model for new energy car companies:

Different from the cyclical image of traditional cars, the market is full of imagination for the bright future of new energy car companies. The calculation behind this is that although the current sales performance of new car manufacturers is not good, the logic of long-term track and high growth has not been broken. The current loss is not important, and the most important thing is to be able to make the trend of sales growth.

(Investors here will retort that this is not the case for an ideal car. It achieved profitability before it went public. But if you understand the history and cost of the extended range technology, you understand that this model should have been classified as a traditional car company. If so, You might as well compare the pricing of 7-seat SUVs of local traditional car companies to understand why the ideal ONE with limited sales and priced at 319,800 per vehicle is profitable.)

Therefore, it is the best choice to sell the most cars with the least cost and make the best growth curve.

Every time a car is shipped, the valuation of new car manufacturers like Weilai and Xiaopeng will increase by 10 million. Losing money spree is only a 100% loss in performance, but it can earn 2000% in market value. This math problem has long been clear in the market value management tactics of the new forces.

02 a literary question

For the new forces of car-making, once sales soar, subsequent probabilistic problems will inevitably increase. At this time, where mathematics and psychology are beyond the reach, the necessity of learning to choose words and make sentences is greatly highlighted.

Like many predecessors of the new economy, the new carmakers are also very keen to use new words to change the narrative. The mysterious use of words makes investors believe that this company represents the future of new energy and mankind even if the product line has Defects are often recalled. As long as you represent the future of mankind, your valuation leverage is 1:20.

For example, renting a battery is called Battery as a service (BaaS), which is nothing new in Chinese; ideally, adding an extended program name to a hybrid car to mix into the new energy phalanx is just the Chinese language of the new car-building forces. An episode of literature.

So far, the case that has contributed the most to Chinese language and literature comes from Tesla and Ideal: After the vehicle has broken axles, Tesla claimed that it was Chinese users "abusing" the vehicle, not a quality problem; the ideal car was breaking After an axle accident, an attempt was made to define a vehicle recall as a "hardware upgrade."

In the face of life-threatening accidents, the incredible brain circuits of the new forces are creepy.

Figure 3: Ideal ONE collision accident leads to broken shaft. Source: Network

Fortunately, in addition to the earning fanatical investor fans, there are also calm regulators in the market: the State Administration for Market Supervision announced the recall information on the website of November 6th. From now on, the production date of the recall is November 2019. Ideal ONE electric vehicles from 14th to June 1st, 2020, totaling 10469 vehicles.

03The tree will not grow to the sky

The new car-building forces that "build only cars and make words and strike out" have written notes on new mathematics and new literature in their current market value management tactics, all for the 1:20 market value growth lever.

But the tree cannot grow to the sky, and of course neither can Weilai, Xiaopeng and Ideal.

For investors who have been floating in the multicolored bubble of money-making effect for almost a year, not only 2020, but also 2021 will be better for these new energy car companies-because they are likely to be more sad:

The literary illusion of word-making in 2020 has been punctured; and by 2021, as the profit growth of Tesla and BYD, the leaders with real performance, consolidate, the valuation model of electric car companies is bound to gradually From the PS (market-to-sales ratio) model with a return rate of 1:20 to the PE (price-earnings ratio), no matter how good the story is (the country’s industry will clear the way, backed by BTAM funders), someone will pay the bill.

In all fairness, in a wave of bull market, it is impossible to tell who is swimming naked . But if we still cannot see who will pay for this banquet, perhaps we should clearly realize that we are the one who pays.

Comments

Post a Comment