Xiaopeng soared 23%, NIO entered the top ten of China Concept Stock

- Get link

- X

- Other Apps

Citigroup is optimistic about the new energy automobile industry, and raised the target price of Weilai to US$46.4, and initially rated Xiaopeng Motors as BUY; Ali released its financial report today and expects the growth of annual active users to further slow down; Shells joined Double Eleven to start the "11.11 New House Festival" ".

The three major U.S. stock indexes closed up on Wednesday. The Nasdaq rose nearly 4%, thanks to the surge of large technology stocks, but the results of the U.S. general election are still stalemate.

As of the close, the Dow rose 367.63 points to 27847.66 points, an increase of 1.34%, and once rose more than 800 points during the session; the Nasdaq rose 430.21 points to 11590.78 points, an increase of 3.85%; the S&P 500 index rose 74.28 points to 3,443.44 Points, an increase of 2.2%.

China concept stocks rose collectively on Wednesday, following the rise of US stocks, of which 160 China concept stocks rose and 114 fell.

The specific performance is as follows:

Among the large Chinese concept stocks, the largest gains were: Pinduoduo rose 12.83% to US$110.26; JD.com rose 8.01% to US$89.31; Bilibili rose 7.93% to US$48.16; New Oriental rose 6.1% to report US$170.6.

New car-building forces soared collectively last night, hitting a record high in the intraday! As of the close, Xiaopeng rose 23.32% to US$27.39; Weilai rose 6.23% to US$37.71; Ideally it rose 5.24% to US$25.31.

Among other popular Chinese concept stocks, the largest gains were: Shell and Jinshan Cloud both rose more than 12%, closing at US$75.32 and US$35.07.

Focus review

Citi raises Weilai's target price to US$46.4

Citigroup raised the target price of NIO by 40% to US$46.4 from the previous US$33.2. The bank said that its optimism about NIO is mainly based on the following factors: (1) Benefit from the strong backlog of orders and high profit margin visibility; (2) The processing gross profit margin in the third quarter is expected to reach 13-16%, and the fourth quarter is expected To further reach the level of 22-25%; (3) The market share continues to increase; (4) Battery costs continue to decrease; (5) It is expected to benefit from the tailwind of export-related policies.

Wei Lai squeezed into the top 10 in China Approximate Stock Market Value!

Bloomberg data shows that the latest market value of NIO is 47.88 billion U.S. dollars, which has surpassed Baidu ’s 45.7 billion U.S. dollars and squeezed into the top 10 overseas Chinese stock markets.

The search scope of this ranking covers sub-sectors such as Internet media and services, technology, and semiconductor manufacturing. The company is located in mainland China or Taiwan listed companies in the US and Hong Kong stocks.

Citi is optimistic about the new energy automobile industry, and initially rated Xiaopeng Motors as BUY

Citigroup initially rated Xiaopeng Motors as BUY, and initially rated Ideal Auto as Neutral, because it is bullish on the new energy vehicle (NEV) industry. Citi analyst Jeff Chung wrote in the report that after three and a half years of automotive industry downturn, the 5-year replacement cycle of passenger cars in China is expected to continue. Citigroup has set a target price of Xiaopeng Motors at US$34.70; its market share is expected to double by 2022, accounting for 6% of China's pure electric vehicle (BEV) sales. Citigroup has set a target price for the ideal car at $27.10.

Ali released its financial report today and expects annual active user growth to slow further

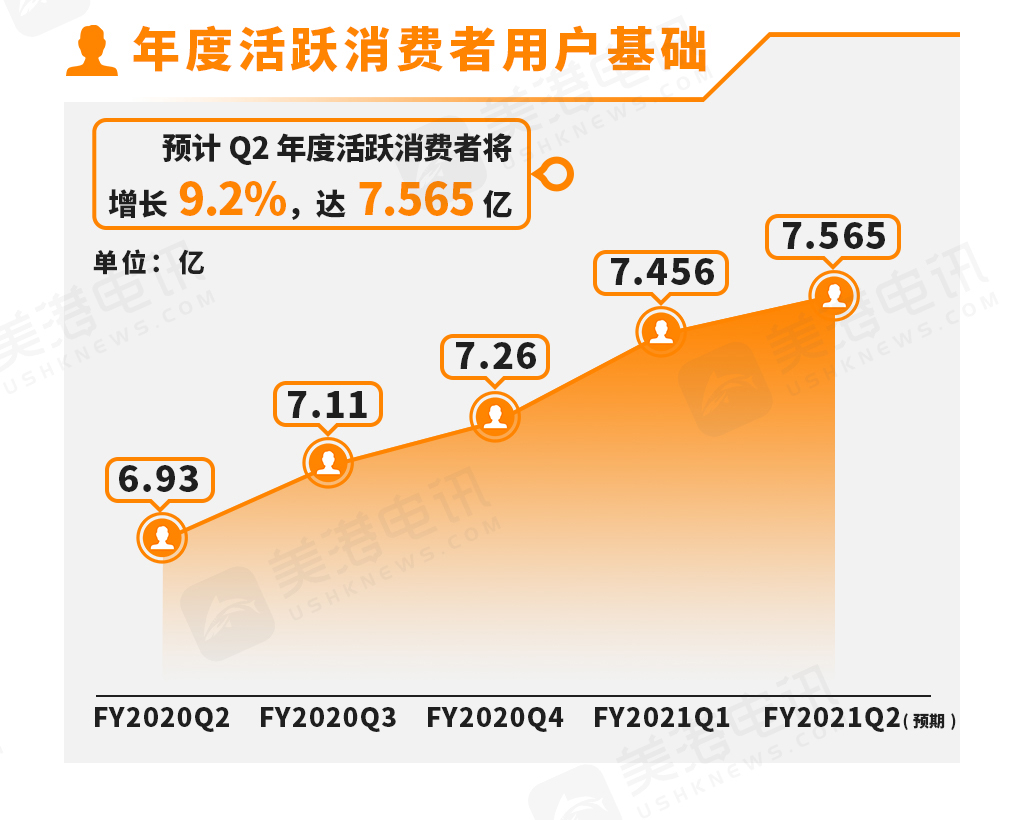

Alibaba will announce its 2021 fiscal year Q2 earnings report before the US stock market on November 5, 2020. In the past few years, the number of Alibaba’s domestic annual active consumers has steadily increased, but the growth rate has slowed. In fiscal year 2020, the annual active consumer growth rate dropped from 17% in Q1 to 11% in Q4. Although the epidemic has led to a boom in online retail, the growth rate of Q1 in fiscal 2021 slowed to 10.1%. Analysts expect a further slowdown to 9.2% in the Q2 fiscal quarter. Despite this, Ali’s annual number of active consumers is expected to reach a record 756.5 million.

Shell joins Double Eleven? Open "11.11 New House Festival"

Starting from November 5th, the "11.11 New House Festival" will be launched for Shell House Search. Shell has now covered more than 300 cities across the country. The "11.11 New House Festival" event is a joint venture with over 7,000 real estate developers from more than 100 well-known national brands including Evergrande, Vanke, Country Garden, R&F, China Resources, China Shipping, Poly, Sunac, Blu-ray, etc., covering more than 90% of the Sell mainstream real estate.

Barclays: upgrade Baidu to "overweight" rating, target price of 170 US dollars

Boosted by the growth of AI and marketing services, Barclays upgraded Baidu from "Flat with the market" to "Overweight" with a target price of US$170. The bank analyst Gregory Zhao said that starting from the second quarter, Baidu's marketing department has risen with the gradual recovery of the online advertising market.

Risk warning: The views of the authors or guests shown above all have their specific positions, and investment decisions must be based on independent thinking. Futu will endeavour but cannot guarantee the accuracy and reliability of the above content, and will not bear any loss or damage caused by any inaccuracies or omissions.

- Get link

- X

- Other Apps

Comments

Post a Comment