New battery technologies are coming out frequently. Who is the "big killer"?

The continued expansion of the scale of electric vehicles has prompted continuous breakthroughs in power battery technology.

Recently, South Korean media ETNews reported that LG Chem plans to mass-produce an ultra-high nickel NCMA battery in the second quarter of next year. In the second half of next year, this battery will be mounted on the Tesla Model Y produced by the Shanghai Super Factory.

Ultra-high nickel NCMA batteries will be produced by LG Energy, a wholly-owned subsidiary of LG Chem. According to ETNews reports, the nickel content in NCMA battery cathode materials can be increased to 90%, and the cobalt content can be reduced to less than 5%.

The biggest advantage of multi-element lithium batteries is high endurance. ETNews reported that NCMA batteries can provide a battery life of no less than 600 kilometers on a single charge, which is significantly higher than the current mainstream 500 kilometers endurance in the market.

Combined with a Reuters report earlier this month, LG Chem plans to more than double China's battery production capacity next year, and this part of the increased production of batteries will be shipped to Tesla's factories in Germany and the United States. With the "big battery consumer" Tesla, LG Chem intends to grab a larger market share.

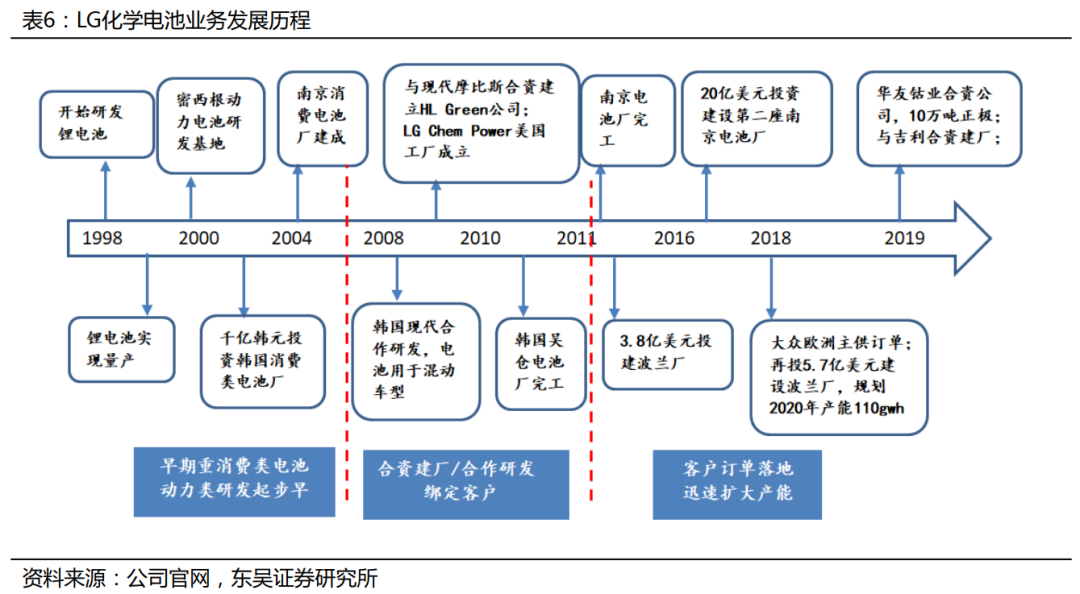

The development history of LG Chem’s battery business; Source: Soochow Securities Research Institute

However, competition for power batteries has always been fierce. LG Chem's "old enemy" Ningde era is also secretly making efforts.

On December 14, Future Auto Daily (ID: auto-time) learned exclusively from SAIC’s executives close to Zhiji Automobile that Zhiji Automobile is jointly developing the technology of "silicon-doped lithium battery cell" with CATL. Both parties will share technology patents and research and development. And mass-produce power batteries equipped with this technology.

Liu Tao, deputy leader of the Zhiji Automobile preparation group, told Future Automobile Daily that this battery can achieve a maximum range of about 1,000 kilometers and 200,000 kilometers of zero attenuation. However, "because of cost reasons, products with a battery life of about 1,000 kilometers will be introduced to the market in the next five years."

Relying on the time difference of about 5 years, how much dividend can LG Chem grab?

In 2030, the cost of high nickel batteries may be lower than lithium iron phosphate

Right now, the power battery is still in the stage of betting on the technical route. Lithium iron phosphate batteries and multi-element lithium batteries are currently two mainstream new energy power batteries.

Compared with multi-element lithium batteries, lithium iron phosphate batteries do not contain precious metals such as cobalt and nickel, and have two major advantages on the cost side-low raw materials and cheap processing. From 2014 to 2019, the cost of lithium iron phosphate batteries in China has dropped by about 60%-70%; in 2020, the price of lithium iron phosphate battery packs will be about 15% cheaper than ternary lithium batteries.

However, compared with lithium iron phosphate batteries, multi-element lithium batteries have the advantages of higher energy density and long cruising range. Since the state adopted a precise subsidy support policy in December 2016, shipments of ternary lithium batteries have increased significantly. From 2018 to the first half of 2020, China's ternary lithium battery market share continued to rise, from 54% to 72%, while the proportion of installed lithium iron phosphate batteries fell from 37% to 27%.

In the long run, high nickel and low cobalt are the future development trends. With the increase in the proportion of high-nickel batteries, the cost of battery pack materials per GWh battery has dropped, especially the degree of dependence on cobalt sulfate, which accounts for a relatively high cost. At present, the ternary lithium battery has developed from the earliest NCM111 to NCM523 (5 series), NCM622 (6 series), NCM712 (7 series), NCM811 (8 series), etc., and the proportion of nickel content has increased.

Bai Houshan, chairman of Rongbai Technology, predicts that by 2030, the cost of high nickel batteries will be equivalent to or even lower than that of lithium iron phosphate batteries. According to the research and development process of the head OEM, it is estimated that by 2025, the average price of power batteries will drop below $100/kWh, and the total cost of ownership of pure electric vehicles will be basically the same as that of traditional fuel vehicles.

West China Securities believes that the multi-material system provides the most mature technical route for electric vehicles in the short and medium term. Huatai Securities analyzed that the future development direction of global lithium battery giants will still be high energy density, and the current feasible route under the multi-business lithium ion system is to increase nickel content. Previously, based on safety considerations, overseas battery giants such as LG Chem and SKI were more cautious in implementing the high-nickel route. This time LG Chem is about to mass produce high-nickel multi-element batteries, indicating that its technology accumulation has reached a certain level.

However, high nickel batteries also have certain safety risks. Because the higher the nickel ratio, the worse the thermal stability of the battery cathode material. Moreover, the high nickel battery will produce gas when charging, which will cause the battery to swell, and there will be safety risks in the case of high temperature and external impact. In this regard, LG Chem will balance the instability caused by high nickel by introducing aluminum.

Challenge the supremacy of Ningde era

For the Ningde era, which is actively promoting the mass production of high-nickel ternary batteries, after the "power battery whitelist" was released, LG Chem became the first strong enemy to enter the market.

Since entering the Tesla China supply chain last year, LG Chem has made great strides in the field of power batteries. The company's financial report shows that in the first three quarters of this year, the installed capacity of LG Chemical power batteries increased by 110% year-on-year to nearly 20GWh, of which domestic Tesla contributed about 4.7GWh demand.

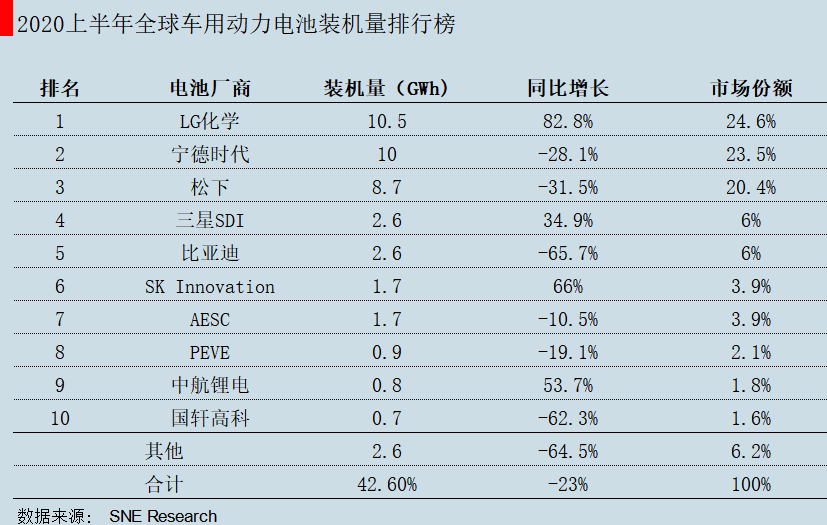

According to research data from SNE Research, as of the first three quarters of this year, LG Chem has become the world's largest battery manufacturer with installed capacity, surpassing the Ningde era, which has been at the top of the list for three years. The Korean power battery ace company predicts that the sales of power batteries will reach 40-45GWh in 2020, and the sales will double to 80-90GWh in 2021. Soochow Securities analysts also said that as the main supplier of the European electric vehicle market and an important supplier of domestic Tesla, LG Chem's shipments in 2021 will continue to grow by 80%-100%.

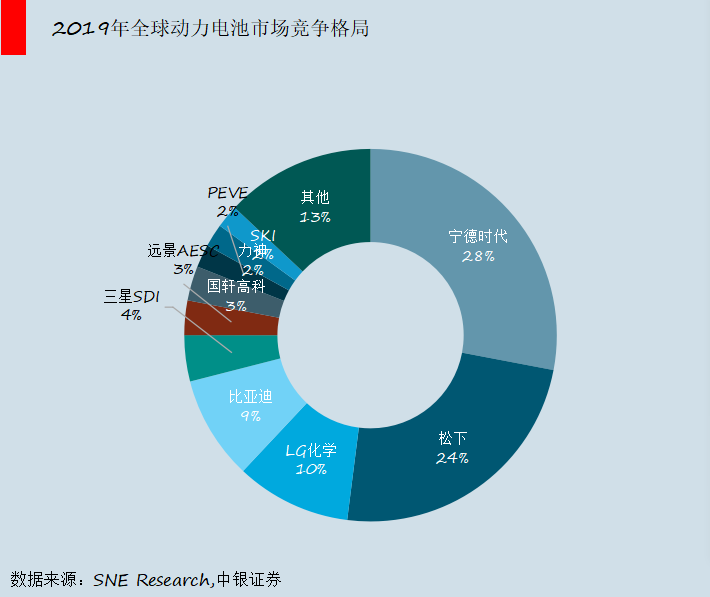

Image source: Yuanchuan Research Institute

Image source: Yuanchuan Research Institute

However, the related technologies of CATL did not win the favor of Tesla, a major battery customer. In the purchase agreement signed with Tesla at the beginning of this year, CATL only provided the latter with lithium iron phosphate batteries, not the ternary lithium battery it is best at.

In fact, as early as 2018, compared with the battery leader Panasonic at the time, Chinese companies have been behind at least 2-3 years in the technology and application of high nickel ternary system power batteries. "As time goes by, the gap continues to widen." A battery industry practitioner told Future Auto Daily (ID: auto-time).

At present, there are few companies in China that have the ability to mass-produce high-nickel materials and high-nickel batteries. In the four key materials upstream of the power battery industry (positive electrode materials, negative electrode materials, separators, electrolytes), Japanese and Korean companies occupy a leading position in technology, including more sophisticated high-nickel ternary materials and supporting additive materials.

The Ningde era did not sit still. Future Automobile Daily has exclusively learned that Zhiji Auto is working with CATL to jointly develop the "silicon-doped lithium battery cell" technology, and battery products equipped with this technology will have a cruising range of 1,000 kilometers.

In addition, compared with Panasonic and LG Chem, Chinese battery manufacturers have a more complete industrial chain and cost control capabilities. Ningde Times’ power battery raw material suppliers are 100% domestic, and they use the “multi-supplier” model to balance purchase prices.

However, the future war in the power battery field may be more complicated. Except for the Ningde era and LG Chem to be confronted with each other, new enemies are constantly entering the game. Tesla may send a delegation to Indonesia next month to investigate and consider building a battery factory there; Apple is studying "LFP" lithium iron phosphate batteries, and in the future Apple electric cars may use self-developed battery technology. After all, who can become the real king in the battery field?

Comments

Post a Comment